Impressive clinical data has come in from medical technology company Sernova (Sernova Stock Quote, Chart, News, Analysts, Financials TSXV:SVA), according to Leede Jones Gable analyst Douglas Loe, who delivered an update to clients on the company on Monday. Loe maintained his “Speculative Buy” rating while increasing his target price from $1.00 to $2.50 per share, calling Sernova’s Cell Pouch a substantial advance in cell transplantation technology.

Impressive clinical data has come in from medical technology company Sernova (Sernova Stock Quote, Chart, News, Analysts, Financials TSXV:SVA), according to Leede Jones Gable analyst Douglas Loe, who delivered an update to clients on the company on Monday. Loe maintained his “Speculative Buy” rating while increasing his target price from $1.00 to $2.50 per share, calling Sernova’s Cell Pouch a substantial advance in cell transplantation technology.

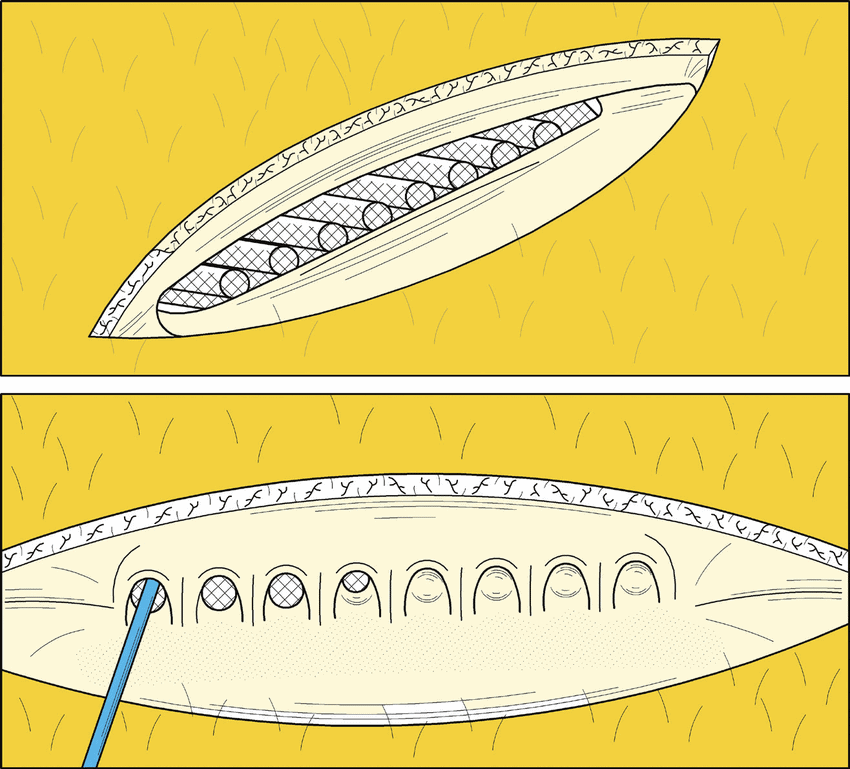

London, Ontario, regenerative medicine therapeutics company Sernova, along with clinical collaborators at the University of Chicago, announced on Friday preliminary safety and efficacy data at the 2021 American Society of Transplant Surgeons (ASTS) Winter Symposium. The interim update was on a seven-patient Phase 1 islet cell transplantation study exploring the utility of Sernova’s flagship implantable cell reservoir device Cell Pouch, with follow-up performance for three of the initially-enrolled subjects now available for review.

The company said the study, which involved patients with type 1 diabetes with severe hypoglycemic unawareness episodes and no glucose-stimulated C-peptide circulating in their bloodstream, found that in addition to confirming the ongoing safety and tolerability of the technology, Cell Pouch transplants with insulin-producing cells “continue to show persistent islet function and clinically meaningful improvement in measures of glucose control.”

Principal clinical investigator Dr. Piotr Witkowski of the University of Chicago said in his presentation that the first transplanted patients who are furthest along in the study and who have receive a second islet transplant are showing “defined clinical benefit” involving “a clinically meaningful reduction in daily injectable insulin requirement.”

Sernova’s share price has vaulted ahead since the news, gaining 65 per cent in value on Friday alone.

Loe said while his Cell Pouch-based revenue and EBITDA forecasts had already assumed positive clinical and future commercial performance for the device, the results nonetheless reflect impressive and durable performance from Cell Pouch in the Phase 1 testing.

“Sernova’s new interim Phase I Cell Pouch data further reduces development risk for the device, and not just in type I diabetes for which new data directly applies (the firm is also targeting hemophilia A (endothelial cell production of Factor VIII), and thyroid disease (cellular production of thyroxine and its precursors)),” Loe wrote.

“Accordingly, we are reducing the discount rate embedded in our NPV and discounted EBITDA/EPS-based valuation methodologies from 40 per cent to 30 per cent and we are simultaneously rolling forward our NPV valuation period and thus eliminating one discounting period (F2020) in the process,” Loe said.

Loe said to expect new updates on Cell Pouch’s clinical performance in upcoming quarters.

“Recall that Sernova provided a clinical update on this trial back in Nov/20 that was qualitatively similar to the update provided by the University of Chicago at the ASTS meeting, though clearly with the recent update demonstrating Cell Pouch performance over longer-term follow-up and from one additional subject. The trial is still ongoing and we expect longer-term follow-up out to one-year for all seven patients that are either enrolled or soon-to-be-enrolled in the trial, and for interim updates to be provided periodically during F2021,” Loe wrote.

The analyst said it will be important for Cell Pouch to demonstrate sustainable islet cell function for over one year for the device to be seen as “a plausible component” for regenerative medicine intervention in type 1 diabetes patients, which will make further results like those just provided important to his investment thesis on the company and stock.

Loe said it appears islet-based regenerative medicine alternatives can give disease-reversing results that other therapies cannot. “In addition to insulin of course, there are multiple small-molecule drugs and biologics that are relevant to the diabetes pharmacopeia — among them, various glucagon-like peptide 1 (GLP-1) analogs like Novo Nordisk’s Victoza or Ozempic, or AstraZeneca’s Bydureon/Byetta, to name a few — but it has long been desirable to more substantially reduce the pharmacologic burden of diabetic patients with regenerative alternatives that mitigate, or ideally eliminate, insulin dependency to stabilize disease,” Loe said.

For Sernova, the analyst’s forecast calls for zero revenue in fiscal 2021, $393,000 in fiscal 2022, $10.7 million in fiscal 2023 and $37 million in fiscal 2024 and hitting $57.8 million by fiscal 2025. Loe said the valuation gap between Sernova and its peers should narrow as Cell Pouch hits new clinical milestones on type 1 diabetes and other indications. At the time of publication, Loe’s new $2.50 target represented a projected 12-month return of 100 per cent.

Of his ASTS meeting presentation, Dr. Witkowski said in a press release, “While we continue to validate the therapeutic potential of Sernova’s Cell Pouch with islets for type 1 diabetes, we also continue to optimize conditions within the designed clinical protocol towards a therapy to provide to diabetic patients, as we observe ongoing safety and efficacy measures in our trial patients. I am excited to be part of this evolution in patient treatment as we advance the Cell Pouch cell therapy approach towards a functional cure for diabetes.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment