Oncolytics Biotech has massive upside, says Echelon analyst Loe

The start of a Phase 2 trial is a key step for Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart, News TSX:ONC), says Echelon Wealth Partners analyst Douglas Loe, who updated clients on the company on Tuesday, keeping his “Speculative Buy” rating and $11.00 target price.

The start of a Phase 2 trial is a key step for Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart, News TSX:ONC), says Echelon Wealth Partners analyst Douglas Loe, who updated clients on the company on Tuesday, keeping his “Speculative Buy” rating and $11.00 target price.

ONC is an Calgary-based cancer biologics developer with oncolytic reovirus formulation Reolysin currently active in clinical studies, including lead programs in metastatic breast cancer and first-line advanced pancreatic cancer.

Oncolytics on Tuesday announced on Tuesday that the first patient has been dosed in its 48-patient

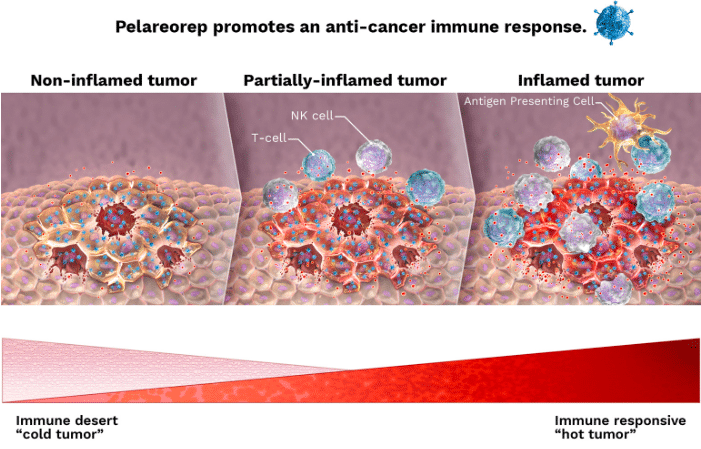

three-arm Phase 2 BRACELET-1 study of pelareorep-based combination therapies in metastatic breast cancer. ONC said in its press release that the study aims to support prior results of a successful Phase 2 trial which showed a “near doubling” of overall survival with pelareorep treatment.

“The ability of pelareorep-induced immune responses to enhance anti- PD-L1 therapy will also be evaluated through the inclusion of the paclitaxel-pelareorep-avelumab combination therapy cohort. Importantly, the trial also aims to validate peripheral T cell clonality as a biomarker of pelareorep response in HR+/HER2- mBC, which may aid in future registrational trial study design and patient selection,” the press release read.

On the new announcement, Loe said the start of the new trial doesn’t materially move the needle on his valuation for ONC but it does sharpen the sight lines on when data from the study might become available and thus when a pivotal Phase 3 trial might begin, with Loe estimating the first half of 2021.

“We consider commencement of a Phase II clinical trial to be more of a logistical milestone, since such events do not on their own mitigate development risk for clinical-stage assets, at least not until relevant data are generated,” Loe said.

“On the milestone watch, we continue to separately focus on pelareorep performance in ongoing advanced pancreatic cancer testing, for which final tumor response/survival data from a 40-patient Phase II partnered (with Northwestern University) trial testing pelareorep in combination with Merck’s anti-PF1 mAb pembrolizumab/Keytruda are expected near end-of-F2020,” Loe wrote.

“Oncolytics provided an encouraging, if not yet definitive, update from a separate 73-patient partnered (in this case, with Ohio State University) Phase II advanced pancreatic cancer trial at a recent ASCO meeting in Jan/20, showing that expression of the biomarker CEACAM6 correlated reasonably well with survival,” Loe said.

Loe’s $11.00 target, which is based on net present value with a 40 per cent discount rate and multiples of his fiscal 2024 EBITDA/EPS projections, represented at press time a projected 12-month return of 312 per cent. His forecast for ONC calls for royalty revenue for pelareorep in 2023 and 2024 of $16.8 million and $82.9 million, respectively, and for EBITDA in 2023 and 2024 of negative $5.7 million and 61.5 million, respectively.

Oncolytics Biotech’s share price saw a spike this past December which skews it year-to-date return, currently registering at negative 55 per cent. For the past 12 months, ONC has returned 22 per cent.