Mixed results from the company’s recent quarterly results aren’t moving the needle for David Kideckel on Auxly Cannabis Group (Auxly Cannabis Group Stock Quote, Chart, News TSXV:XLY).

Mixed results from the company’s recent quarterly results aren’t moving the needle for David Kideckel on Auxly Cannabis Group (Auxly Cannabis Group Stock Quote, Chart, News TSXV:XLY).

In an update to clients on Sunday, the AltaCorp Capital analyst kept his “Sector Perform” rating but dropped his one-year target from $0.85 to $0.45 per share, reflecting at the time of publication a projected return of 25 per cent.

Toronto-based consumer packaged goods company Auxly Cannabis reported its fourth quarter and full-year 2019 financials on April 29, featuring $8.4 million in revenues for the year and an adjusted EBITDA loss of $31.2 million.

The company ended the year with cash and equivalents of $44 million and $95 million in debt.

CEO Hugo Alves called 2019 a pivotal year for Auxly, pointing to the $123-million investment from UK-based tobacco company Imperial Brands and the launch of its Cannabis 2.0 product line, which are now in all Canadian provinces and 90 per cent of cannabis stores across the country, the company having shipped more than 1.2 million units to date.

“Whereas 2019 was a year of building infrastructure, know-how and capacity, 2020 will be Auxly’s first year of commercial operations. We will continue to focus on our vision of being a global leader in branded cannabis products and constantly strive to better understand and delight our consumers and deliver on our consumer promise of quality, safety and efficacy,” Alves wrote.

In the quarter, Auxly had $3.2 million in revenue and an adjusted EBITDA loss of $5.1 million, whereas Kideckel was calling for $1.0 million and an $8.1 million adjusted EBITDA loss.

For its Cannabis 2.0 products, the Q4 saw $1.4 million in sales, and sales from research contracts and others resulted in revenue of $1.9 million.

Kideckel said Auxly’s right-out-of-the-gate derivatives sales herald good things to come.

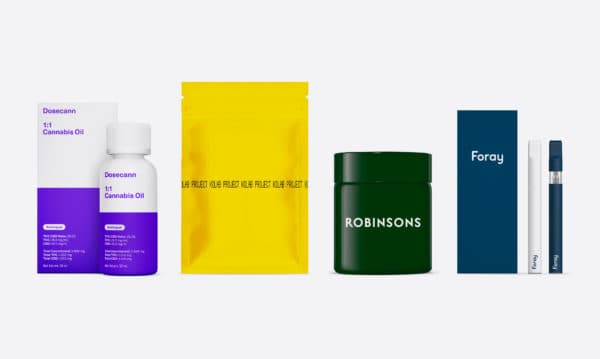

“In our view, the Company’s early launching of cannabis derivative products indicate its strong manufacturing capabilities and may grant Auxly with an early-mover advantage in that market. We believe that the introduction of cannabis derivatives into the Canadian market will lead to meaningful revenue growth and improvement in profitability for the cannabis sector over the medium to long-term. We believe that Auxly can seize that market opportunity due to its strong balance sheet, its strategic partnership with Imperial Brands, and its diversified collection of products and brands (Foray, Kolab, Dosecann),” Kideckel wrote.

At the same time, the analyst says the near-term outlook in the cannabis space has a number of headwinds, including competitive pressures and regulatory factors and the bottleneck for growth stemming from the slow roll-out of retail across the country, with the COVID-19 crisis adding more uncertainty to the mix.

In Auxly’s case, Kideckel also pointed to a lack of visibility concerning the company’s Latin American operations (specifically, its early 2019 acquisition Inverell, a Uruguay hemp operation), which have caused the analyst to remove its LATAM business from his forecast.

Kideckel is now calling for fiscal 2020 revenue and adjusted EBITDA of $36.8 million and negative $22.5 million, respectively, and fiscal 2021 revenue and adjusted EBITDA of $67.0 million and $3.3 million, respectively.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment