Oncolytics Biotech is “dramatically undervalued”, says Echelon Wealth

Alberta-based biologics developer Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart, News TSX:ONC) has a clear roster of clinical milestones ahead for its flagship virus formulation, according to Echelon Wealth Partners analyst Doug Loe, who reviewed the company’s quarterly results and general state of affairs in an update to clients on Friday.

Alberta-based biologics developer Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart, News TSX:ONC) has a clear roster of clinical milestones ahead for its flagship virus formulation, according to Echelon Wealth Partners analyst Doug Loe, who reviewed the company’s quarterly results and general state of affairs in an update to clients on Friday.

With the update, Loe maintained his “Speculative Buy” rating and $11.00 target, which at press time represented a projected 12-month return of 197 per cent.

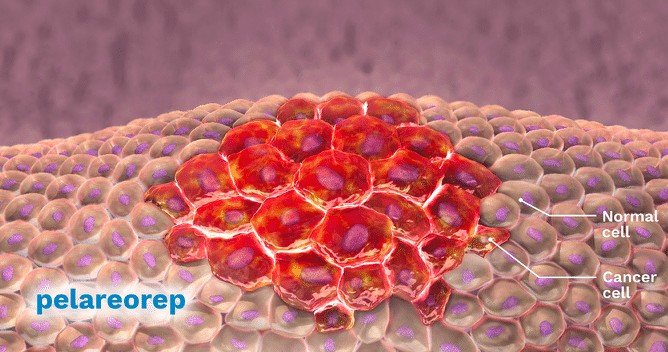

Oncolytics, which has oncolytic reovirus formulation Reolysin (pelareorep) active in several clinical studies including lead programs in metastatic breast cancer and first-line advanced pancreatic cancer, reported its fourth quarter and full-year 2019 results last Thursday. ONC reported year-end revenue of $0.0 million and an operating income loss of $20.8 million.

On the year that was, CEO and president Matt Coffey said ONC delivered on its strategy to engage pharma companies including Pfizer, Roche, Merck, EMD Serono and BMS to support four of ONC’s five ongoing clinical studies combining pelareorep with checkpoint inhibitors.

“While we continue to focus on demonstrating the effectiveness of pelareorep in patients with metastatic breast cancer, parallel efforts by large pharma seek to use pelareorep to enhance the efficacy and broaden the application of their immune checkpoint inhibitors,” said Coffey in a press release.

“Indeed, we are hopeful that our biomarker strategy, along with our distinct competitive advantages of intravenous delivery and excellent safety profile, makes pelareorep an attractive therapy to boost the range and potency of checkpoint inhibitors commercialized by multiple large pharma companies.”

Loe said the fiscal quarter arrived in line with his expectations, saying that his model on ONC currently ascribes value to pelareorep’s potential with respect to metastatic breast cancer and pancreatic cancer, while other model-altering data could arrive in the next year or two for pelarerep’s potential in multiple myeloma for which ONC has a few partnered and independently-funded Phase 2 studies.

“With ONC up 388 per cent since the end-of-FQ319 (and was up 709 per cent during FQ419 alone, before a more recent price recalibration) and with abundant pelareorep clinical milestones on the horizon that we predict will be positive to ONC’s clinical risk profile, we are maintaining our Speculative BUY rating and one-year price target of $11.00 on ONC, with our valuation still based on NPV (40 per cent discount rate, for which we have a downward bias if/when pelareorep advances into formal Phase III testing, probably in metastatic breast cancer initially) and multiples of our F2024 EBITDA/fd EPS forecasts,” wrote Loe.

“Our EV calculation incorporates newly-reported FQ419 balance sheet data (cash of $14.1 million, no debt) and fd S/O of 36.1 million,” he wrote.

Loe says that even at its current share price levels, ONC is still “dramatically undervalued” compared to its oncolytic virus development peers, pointing to a number of examples including Amgen’s/BioVex’s herpes virus-based Imlygic (innovator BioVex’s was acquired by Amgen in Q1 2011 for US$1 billion) and Merck’s/Viralytics’ coxsackievirus A1-based Catavak (acquisition value of US$394 million established in Q1 2018, exclusively for melanoma based on Catavak’s underlying virology. Those numbers compare to ONC’s current enterprise value of $84 million, Loe says. (All figures in Cdn

dollars except where noted otherwise.)

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.