Shares of fintech name Mogo (Mogo Stock Quote, Chart, News TSX:MOGO) have been halved in recent weeks but the stock should rally big time over the next 12 months.

Shares of fintech name Mogo (Mogo Stock Quote, Chart, News TSX:MOGO) have been halved in recent weeks but the stock should rally big time over the next 12 months.

So says Nikhil Thadani of Mackie Research Capital, who reviewed Mogo’s latest quarterly results in an update to clients on Monday.

Vancouver-headquartered Mogo is a mobile-first digital banking business with a range of new products including mortgages, prepaid Visa cards, ID protection and cryptocurrency buying and selling. Mogo released its fourth quarter and full year ended December 31, 2019, financials last Friday, showing fourth quarter revenue up two per cent year-over-year to $15.0 million.

The company had an adjusted net loss for the Q4 of $5.2 million and ended the term with $10.4 million in cash and $20.8 million in its investment profile.

For 2019, Mogo said its revenue grew by six per cent, its adjusted EBITDA grew by 73 per cent and its active members finished at 976,000, up 29 per cent year-over-year (by February 2020, Mogo hit one million members).

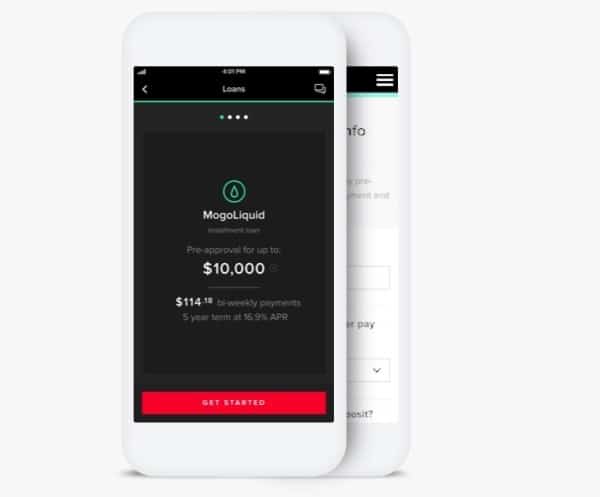

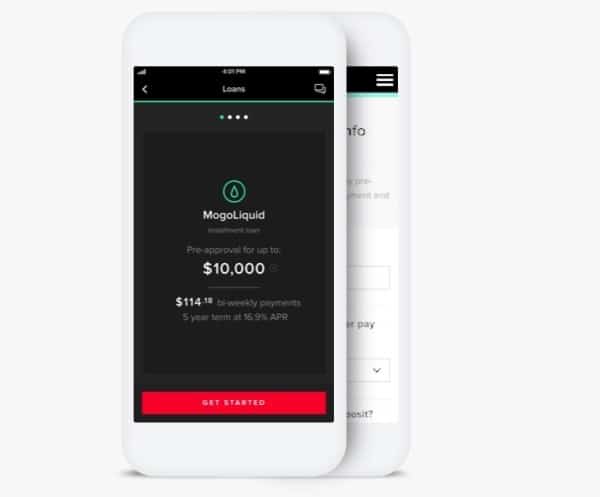

In its commentary on the quarter and year, management spoke of the company’s transition to a capital-light model versus on balance sheet lending, shown through the recent $31.5-million sale of its MogoLiquid portfolio.

On the COVID-19 crisis, Mogo said it is taking a number of steps in response to help its members manage, including financial relief, financial coaching, ID fraud protection and, with respect to the company’s business, cost reduction initiatives, aiming to reduce cash expenses in the second quarter 2020 by $5.0 million.

“We will continue to support our existing loan customers through this challenging period while directing new originations to our lending partners, which will allow us to continue to monetize our digital lending platform,” said President and CFO Greg Fuller in the press release.

The quarterly numbers came in mixed compared to Thadani’s forecast, where the analyst was calling for $16.5 million in revenue compared to Mogo’s $15.0 million and $1.1 million in adjusted EBITDA compared to Mogo’s $1.5 million.

The analyst said management’s steps to address its business vis a vis COVID-19 should help it navigate through the challenging times, although he is still calling for about a 25 per cent decline in revenue for Q2 and Q3, based on a Q4/19 baseline of about $12 million.

“We expect an increase in loan provisions (~$2 million) in Q1/20 for recent disruptions. Future impact on charge offs is unknown — loan defaults could be a risk,” Thadani wrote.

“We suspect Mogo could generate modest cash in Q2 as new balance sheet loan originations are paused, barring additional large shocks.”

“During this period of unprecedented public health & economic challenges, Mogo is taking steps to help its customers and enhance its value proposition, even though Mogo will incur costs for these steps,” he said.

With the update, Thadani is maintaining his “Speculative Buy” rating and $4.00 target, which at press time represented a projected 12-month return of 172 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment