Canadian fintech company Mogo Inc (Mogo Inc Stock Quote, Charts, News, Analysts, Financials TSX:MOGO) is shifting focus to profitable growth, according to Eight Capital analyst Adhir Kadve. In a Friday report to clients, Kadve maintained a “Buy” rating on the stock, saying investors should climb aborad before shares re-rate higher.

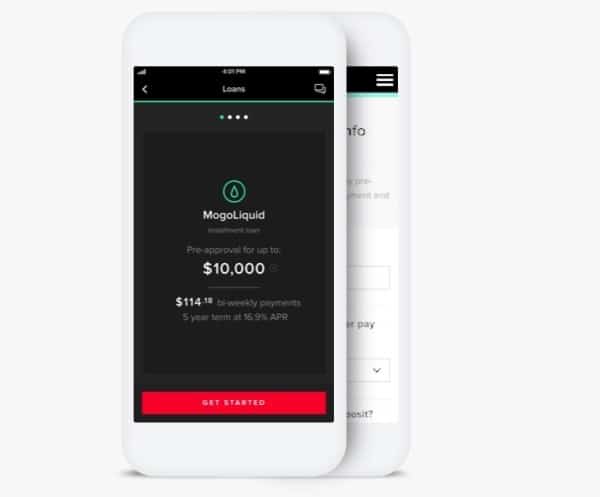

Vancouver-based Mogo, which has a next-gen digital ecosystem for non-bank financial products such as online lending, credit scores, prepaid credit cards and mortgage brokering, announced on Thursday its second quarter 2023 financials.

Revenue at $16.0 million was down seven per cent year-over-year and adjusted EBITDA of $1.8 million compared to a loss of $4.1 million a year earlier. The company said the lower topline was due to Mogo dropping some of its unprofitable products.

“We have made excellent progress to date, highlighted by a significant year-over-year improvement in Adjusted EBITDA,” said Founder and CEO David Feller in a statement. “At the same time, we have our sights on future growth as we emerge from this period, with each of the three core pillars – Wealth, Payments, and Lending – expected to be profitable growth drivers for the business. In each of these areas, we believe we have differentiated products that can win share in large addressable markets.”

Operationally, Mogo has a 34 per cent ownership in Coinsquare, which recently combined with WonderFi and CoinSmart Financial, with Mogo now owning 14 per cent of the combined entity, going by the name WonderFi.

With the quarterly financials, Mogo also announced a 3:1 share consolidation, with shares to start trading on the TSX and Nasdaq on a post-consolidation basis starting on Monday, August 14.

The Q2 results were a beat of estimates, where the topline of $16.0 million compared to the Eight Capital call at $15.4 million and the consensus estimate at $15.1 million. Adjusted EBITDA at $1.8 million was also a bit better than both Eight Capital and the Street at $1.5 million.

Kadve said there are early signs of organic growth returning to Mogo’s lending, MogoWealth and Payments businesses. Kadve also noted the expansion in Mogo’s user base which grew by 25,000 quarter-on-quarter to sit at 2.04 million, up two per cent year-over-year.

“The company continues to streamline its operations and strategically decrease OpEx, which has resulted in a significant increase in profitability,” Kadve wrote.

“With a narrow focus on a core set of products, including Lending, Wealth management, and Payments businesses, all of which are showing early signs of organic growth, Mogo has an ultimate goal to reach a ‘Rule of 40’ financial profile by H2 of 2024. We continue to believe that as Mogo executes on delivering this financial profile, shares should see a significant re-rate opportunity,” he said.

With the update, Kadve reiterated a $9.00 target price, which at press time represented a projected return of 194 per cent.

Share

Share Tweet

Tweet Share

Share

Comment