Nanotech Security (Nanotech Security Stock Quote, Chart, News TSXV:NTS) delivered quarterly results which were as expected but the stock is still a wait-and-see proposition, according to Echelon Wealth Partners analyst Gianluca Tucci, who in an update to clients on Thursday kept his “Hold” rating and $0.45 per share price target.

Nanotech Security (Nanotech Security Stock Quote, Chart, News TSXV:NTS) delivered quarterly results which were as expected but the stock is still a wait-and-see proposition, according to Echelon Wealth Partners analyst Gianluca Tucci, who in an update to clients on Thursday kept his “Hold” rating and $0.45 per share price target.

Vancouver-based Nanotech, which is in the authentication and brand enhancement industry, released its first quarter fiscal 2020 results on Thursday, registering $1.5 million in revenue, compared to $1.5 million as well a year earlier, and an adjusted EBITDA loss of $0.3 million, compared to a $0.1 million gain during 2019’s Q1.

The company saw eight customer product orders delivered in the quarter, compared to 14 for the full 2019 year, while gross margin for the Q1 ended at 79 per cent versus 76 per cent a year earlier.

NTS is in the middle of a strategic shift toward product sales, which CEO Troy Bullock said, now 12 months into the commercialization strategy, is seeing encouraging signs from the brand protection and banknote markets.

“Looking ahead to the rest of the year, we plan to continue to increase our sales and marketing efforts to broaden our geographic reach into Europe, release new products, and develop and leverage partner relationships. While it may take some time for these efforts to generate meaningful sales, we are seeing growth in our sales pipeline and our technology continues to generate interest from potential customers in our key markets,” said Bullock in a press release.

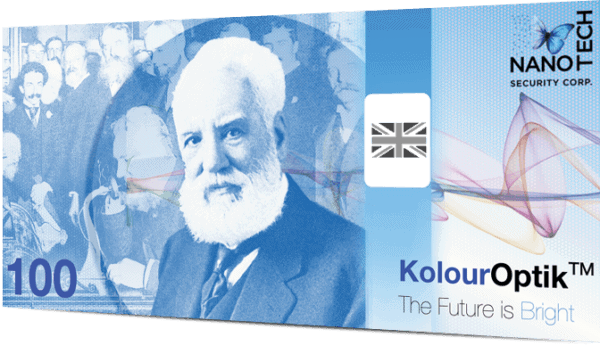

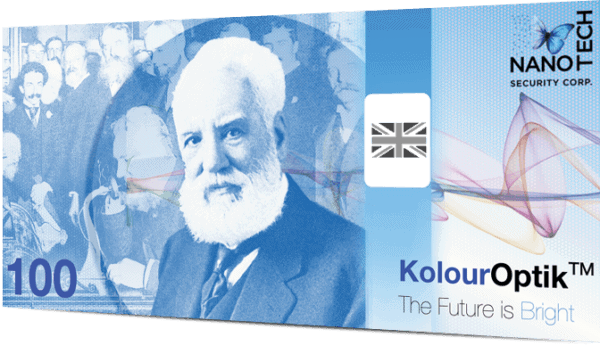

NTS’ commercialization initiatives include the creation of a salesforce to accelerate the sales process and diversity its customer base, hopefully ending up with a more traditional sales pipeline. The company aims to brand its unbranded products such as Optical Thin Film (OTF) along with a new version of its branded banknote product M2.

The company has also launched a new line of products under its KolourOptik technology. Tucci said the quarter came in line with his expectations, where he had called for $1.5 million in revenue and an EBITDA loss of $0.3 million. The 79.2 per cent gross margin was better than his 73.0 per cent estimate. The analyst calculates that NTS ended the quarter with cash and equivalents of $9.5 million, enough for a comfortable margin of safety, he says, although he is waiting for further visibility concerning the company’s commercial revenue growth and diversification efforts.

“Management expects that adjusted EBITDA losses will continue as the Company continues to invest in sales and marketing activities to drive future revenue growth. We are encouraged with signs of early growth from the products and services business,” Tucci wrote.

“We continue to view F2020 as a transition period in its sales & marketing efforts, we note progress has been made in diversifying from banknotes and in particular, to the commercial market where NTS has shown evidence of early progress. We believe NTS has a comfortable cash balance to continue developing new products for the commercial and banknote markets,” he wrote.

Tucci thinks that NTS will deliver fiscal 2020 revenue of $6.0 million and adjusted EBITDA of negative $0.8 million. His $0.45 target represented at press time a projected return of 23 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment