Nanotech Security is undervalued, says Echelon Wealth Partners

Nanotech Security Corp (Nanotech Security Corp Stock Quote, Chart, News TSXV:NTS) is going to be worth the wait, says Echelon Wealth Partners analyst Gianluca Tucci, who expects EBITDA margins to start trending upwards as the company gets more contract wins and continues to scale up.

Nanotech Security Corp (Nanotech Security Corp Stock Quote, Chart, News TSXV:NTS) is going to be worth the wait, says Echelon Wealth Partners analyst Gianluca Tucci, who expects EBITDA margins to start trending upwards as the company gets more contract wins and continues to scale up.

Vancouver-based nano-optic tech company Nanotech Security released its third quarter fiscal 2019 financials last Thursday, reporting revenue of $1.9 million, a slight one per cent increase year-over-year, while adjusted EBITDA was $17,000 and gross margin for the quarter was 72 per cent versus 83 per cent a year prior.

The company is keeping on with its strategy of focusing on near-term revenue growth through commercializing its technology, according to CEO and president Troy Bullock.

“We are seeing the results of our product-based sales strategies that we implemented at the beginning of the year,” said Bullock in the quarterly press release. “Our brand protection products are gaining traction, with corresponding growth in our sales pipeline, and we’ve also been able to expand our optical thin film sales. These developments, coupled with the advancement of our contract services, give us confidence that our growth strategy is sound.”

The quarterly results were in line with analysts’ expectations, with the revenue and adjusted EBITDA consensus estimates coming in at $1.9 million and $0.0 million, respectively. Tucci was also expecting $1.9 million and $0.0 million. On EPS, Nanotech delivered negative $0.01 per share which equalled the expectations from both the Street and Tucci. The analyst noted that the Q3 represented NTS’ ninth adjusted EBITDA-positive quarter in a row.

Nanotech Security is diversifying, Echelon Wealth says…

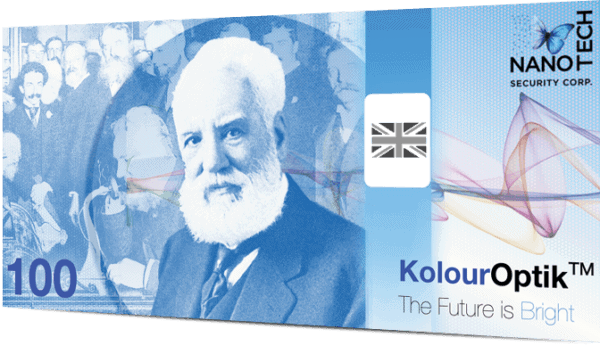

“While we continue to view F2019 as a transition year in its sales and marketing efforts, we note progress has been made in diversifying from banknotes and in particular, to the commercial market where NTS recently booked its first sales – we note the commercial market also provides recurring revenue and with the launch of NTS’ first two products in April, we expect early modest traction to grow in this vertical into the new year. We believe NTS has more than ample cash to continue developing new products for the commercial and banknote markets and believe at current levels, the risk/reward is appealing and worth the patience,” wrote Tucci in an update to clients.

Tucci noted that Nanotech’s management has reiterated its fiscal 2019 guidance, calling for revenue between $7.4 million and $8.3 million and an adjusted EBITDA loss of up to $1.0 million, which is being attributed to potential declining revenue and increased spend on sales efforts and product offerings. Management predicts that it will continue to generate most of its fiscal 2019 revenue from development contracts with a single customer.

Tucci argues that NTS is currently trading at 2.6x his calendar 2019 EV/Revenue estimates versus its Security comparables at an average of 4.8x and its SaaS comparables at an average of 9.4x.

Tucci is sticking with his 2019 forecast, calling for revenue and adjusted EBITDA of $7.8 million and $0.3 million, respectively. The analyst is also reaffirming his “Speculative Buy” rating and $0.80 target, which represents a projected 12-month return of 84 per cent at the time of publication.

Nanotech announced on August 1 a new order for its colour-shifting Optical Thin Film for a long-term customer, an expansion of its business that Tucci calls significant as it demonstrates that NTS’ commercialization strategy is working.