A new strategic alliance is a boon for cleantech newcomer Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN), according to Beacon Securities analyst Ahmad Shaath, who provided an update to clients on Wednesday, reiterating his “Buy” recommendation and $0.50 price target.

A new strategic alliance is a boon for cleantech newcomer Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN), according to Beacon Securities analyst Ahmad Shaath, who provided an update to clients on Wednesday, reiterating his “Buy” recommendation and $0.50 price target.

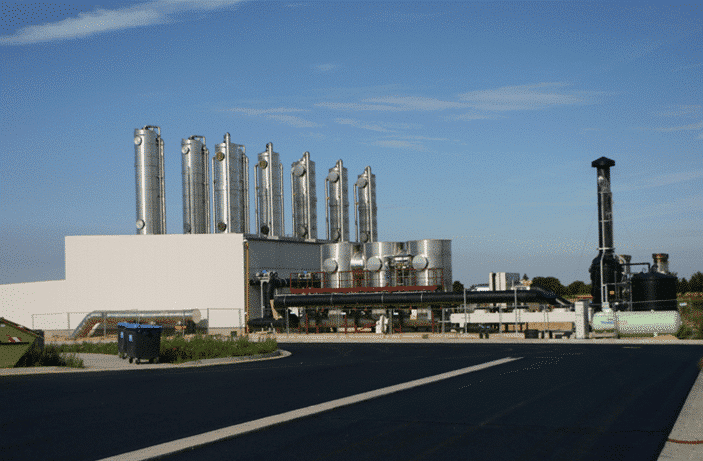

Vancouver-based Greenlane, which is a global provider of biogas upgrading systems, on Tuesday announced it has entered into an alliance with four companies —AB Energy and Entsorga from Italy, Eisenmann Corporation from the US and Tietjen from Germany, all connecting as members of the Integrated Biogas Alliance (IBA).

“We are honoured to bring the advanced, reliable biogas upgrading technology part of this platform solution in a way that is integrated both technically and commercially with the other technologies required for complete greenfield projects,” said Brad Douville, President & CEO of Greenlane, in a statement.

The new platform aims at providing fully-integrated waste-to-renewable energy solutions, with each alliance member bringing a unique component to the system.

Greenlane management says the alliance will “lower the inherent risks facing developers, investors and engineering, procurement and construction firms in developing biogas plants.”

Shaath likes the arrangement, saying that it should fast-track the development of new projects and potentially make the alliance “a go-to, one-stop Market Cap shop for waste-to-RNG projects.”

In particular, Shaath likes the inclusion of Eisenmann, which should help in Greenfield Projects.

“We are very encouraged by this alliance and the caliber of partners that Greenlane has partnered with. We are especially optimistic about the growth in relationship with Eisenmann, which in our view should result in more project opportunities for GRN, at an earlier stage of development as well,” said Shaath.

“Therefore, GRN will have the opportunity to be part of new opportunities at an earlier stage of development, allowing them to provide a better solution and ultimately improving their chances of winning bids,” Shaath added.

Shaath thinks Greenlane will generate fiscal 2019 revenue of $10.9 million and adjusted EBITDA of negative $1.4 million (excluding pre-public company revenues and EBITDA) and fiscal 2020 revenue of $25.0 million and adjusted EBITDA of negative $0.3 million. His $0.50 target represents a projected 12-month return of 122 per cent at the time of publication.

On November 27, Greenlane announced its interim financial results for its third quarter ended September 30, 2019, the company’s first full quarter since its qualifying transaction on June 3.

Greenlane generated $5.0 million in revenue, gross profit of $1.3 million or 26 per cent of revenue and an adjusted EBITDA loss of $0.9 million. Over the quarter, Greenlane secured a $2.7-million biogas upgrading contract with the Metropolitan Wastewater Management Commission in Lane County, Oregon, and saw its sales pipeline increase in value to $660 million, up 47 per cent from January 1, 2019.

“We have made tremendous strides since launching as a public company, including posting our first full quarter of revenue,” said Brad Douville, President and CEO, in a press release.

“We continue to see an acceleration of activity in the RNG industry through various announcements and declarations with respect to new RNG volume commitments made by major gas utilities, developments related to easing access to gas distribution networks and new project development activity. This is encouraging for us as evidence that the RNG market is positioning for rapid growth from what is still a low base,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment