Medicenna Therapeutics has an upside of 187 per cent, Mackie says

After recent news from clinical-stage biotech company Medicenna Therapeutics (Medicenna Therapeutics Stock Quote, Chart, News TSX:MDNA), Mackie Research Capital Corporation analyst André Uddin made some adjustments to his model.

After recent news from clinical-stage biotech company Medicenna Therapeutics (Medicenna Therapeutics Stock Quote, Chart, News TSX:MDNA), Mackie Research Capital Corporation analyst André Uddin made some adjustments to his model.

But in a client update on October 17 the analyst has nevertheless maintained his “Speculative Buy” rating and $3.30 target price, saying there should be significant upside to his market cap and target price should monetization opportunities present themselves to MDNA on its pre-clinical assets.

Oncology-focused immunotherapy company Medicenna on Thursday announced the closing of a previously announced equity financing round of 692,307 units for proceeds of C$6.9 million, intended for use in funding preparations for upcoming meetings with regulatory agencies for lead candidate MDNA55 as well as the further development of MDNA19, a pre-clinical IL-2 candidate.

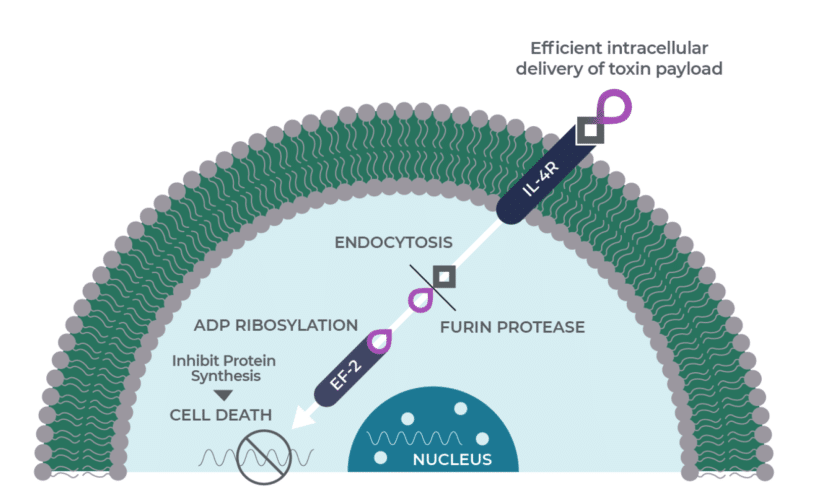

Medicenna’s MDNA55 has now completed enrolling patients in a Phase 2b clinical trial for treating recurrent glioblastoma (rGBM). So far, MDNA55 has been studied in five clinical trials involving 132 patients including 112 adults with rGBM and has obtained Fast-Track and Orphan Drug status from the US Food and Drug Administration and the European Medicines Agency.

Uddin says that MDNA55 has been delivering “very decent results” in a Phase 2b trial and has a high probability of hitting the trial’s primary endpoint.

“In terms of survival data, available data shows that the first 12 evaluable patients on the high-dose cohort had a medium overall survival (mOS) of 16.7 months – meaningfully longer than mOS (11.8 months) in the low-dose cohort – a dose-dependent increase. In all 33 evaluable patients on both low and high doses, MDNA55 responders had an mOS of 16.1 months – longer than 8.3 months of non-responders and 6 to 9 months of current standard of care for rGBM (Avastin, Lomustine and Temodar). Additionally, the results based on the 33 subjects support MDNA55’s anti-IL-4R mechanism – subjects with high IL-4R expression had an mOS of 15.2 months, almost 2x the mOS (8.5 months) of subjects with low IL-4R expression,” writes Uddin.

In terms of timelines, the analyst says that most of the remaining Phase 2b data should come out by the fourth quarter of this year, with final data expected during the second quarter 2020. Uddin points out that Medicenna expects to have an end-of-Phase 2 meeting with the FDA during Q1 of next year from which the company should find out if full results of the Phase 2b trial are sufficient to support a BLA filing. Uddin is calling the event an important near-term catalyst.

Due to the equity financing, Uddin is revising his bottom line estimates. The analyst is now calling for fiscal 2020 revenue and fully diluted EPS of $0.0 million and negative $0.42 per share and for fiscal 2021 revenue and fully diluted EPS of $0.0 million and negative $0.46 per share.

On his valuation —which stems from a two-stage probability-adjusted discount cash flow methodology— Uddin says investors should note that his target price does not include potential monetization opportunities of MDNA’s pre-clinical assets – as those deals should represent significant upside potential to MDNA’s current market cap and to his target price. Uddin’s target represents a projected return of 187 per cent at press time.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.