DHX Media price target cut at Echelon Wealth

A DHX Media (DHX Media Stock Quote, Chart TSX:DHX) price target cut comes with a silver lining from Echelon Wealth Partners analyst Rob Goff.

A DHX Media (DHX Media Stock Quote, Chart TSX:DHX) price target cut comes with a silver lining from Echelon Wealth Partners analyst Rob Goff.

Heightened competition in the streaming market is increasing the value of content, which bodes well for children and family entertainment company DHX Media , according to Goff, who likes DHX’s ongoing shift in focus towards premium production.

In an update to clients on Tuesday, Goff maintained his “Buy” recommendation but reduced his target price from $3.25 to $2.50.

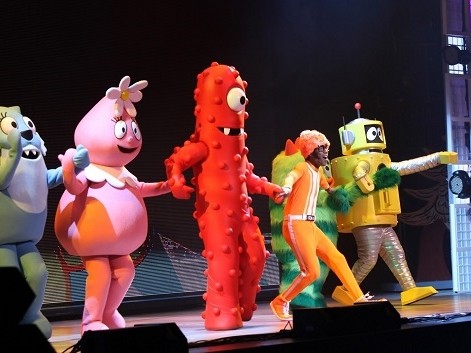

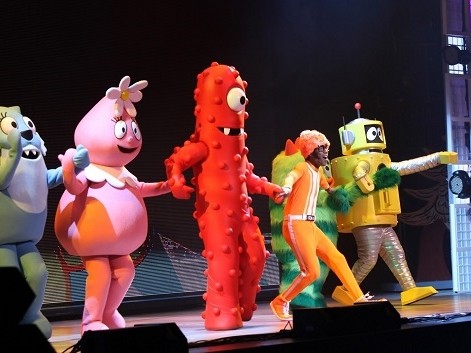

Halifax’s DHX Media, whose library includes a large stake in the Peanuts catalogue along with kids TV favourites Strawberry Shortcake, Teletubbies, Caillou and the WildBrain platform, has seen its share price on a slide since last December, losing half of its value in the process.

The company is in a transition period both in terms of focus and management, where past-president and CEO of Marvel Enterprises Eric Ellenbogen has just taken the helm.

“In addition to its library and leading animation studios, DHX Media has built a truly unique asset in WildBrain – one of the largest kids’ networks on YouTube – with unparalleled reach and engagement. I’m pleased to have the opportunity to work with the management team, employees and our many valued partners and customers to deliver leading content and brands for audiences worldwide,” wrote Ellenbogen in the company’s announcement on August 29.

Goff says that the company’s realigned focus will take a little longer than expected to bear fruit, hence the target cut. At the same time, the analyst says that growing competition in the OTTP environment has upped the value of premium content with exclusivity premiums compensate for a shift from multiple, non-exclusive sales.

“We have lowered our aggressive $3.25 PT to $2.50 reflecting heightened uncertainty at WildBrain given recent YouTube changes and the consideration that DHX’s focus on premium production over mass production may take longer to surface value as OTTP providers spend more, but it’s a case of spending more on fewer signature titles with an increasing bifurcation of content values,” Goff writes.

“We lowered our F2020 EBITDA by $4.8 million to $84.0M million leaving us in line with the consensus. Our EBITDA reduction would equate to $0.35 per share at 10.0x’s EV/EBITDA. We are further cautious that pressures at YouTube around youth advertising could see near-term pressures on WildBrain as it repositions,” he writes.

Ahead of DHX’s fourth quarter report due on September 23, Goff says that he is looking for quarterly EBITDA to rise from $16.0 million a year ago to $18.1 million (the consensus is for $18.0 million).

“We see DHX benefitting from its ownership of marquee properties with Peanuts at the top of the list. However, we suspect lower profile titles have seen value erosion. The expansion of OTTP budgets overall reflects the aggressive pricing on premium product. Industry veterans are likely to watch for the new CEO to push for prospective library write- downs clearing the decks with a forward view,” Goff writes.

The analyst is calling for full 2019 revenue of $428.6 million and adjusted EBITDA of $77.5 million. His $2.50 per share target price reflects EV/EBITDA valuations at 9.6x/8.8x for his fiscal 2019 EV and fiscal 2020 EBITDA and represents a projected 12-month return of 48.3 per cent at the time of publication.