DHX Media (DHX Media Stock Quote, Chart TSX:DHX) performed as expected in its fiscal third quarter, but weaker revenue growth from its WildBrain segment is cause for a forecast revision, says Echelon Wealth Partners analyst Rob Goff, who in an update to clients on Wednesday reiterated his “Speculative Buy” rating but lowered his target price from $3.50 to $3.25.

DHX Media (DHX Media Stock Quote, Chart TSX:DHX) performed as expected in its fiscal third quarter, but weaker revenue growth from its WildBrain segment is cause for a forecast revision, says Echelon Wealth Partners analyst Rob Goff, who in an update to clients on Wednesday reiterated his “Speculative Buy” rating but lowered his target price from $3.50 to $3.25.

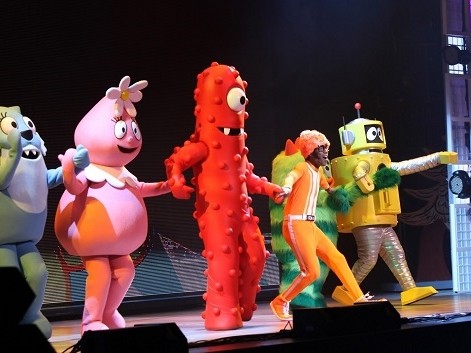

Children’s content company DHX reported its Q3 ended March 31, 2019, on Tuesday, where it generated revenue and EBITDA of $110.0 million and $20.1 million, respectively. Revenue was down 5.6 per cent year-over-year and EBITDA was down roughly 7.4 per cent year-over-year. Those numbers with in-line with Goff’s revenue and EBITDA forecast of $109.0 million and $19.1 million, respectively, and the consensus $110.0 million and $19.7 million.

“While past results leave DHX in a show-me category, we view the shares as attractively valued against our baseline forecasts,” says Goff. “Our aggressive PT target reflects additional upside associated with forecast upgrades about F2020 and beyond, plus the prospects of additional value realization moves.”

Goff says he will be looking for DHX’s new Peanuts partnership with Apple to bring significant cross-division operating gains along with strategic gains where the strength of the partnership draws additional marquee partnerships. Goff says that the Apple deal increased the value of its Peanuts library and will bring about brand rejuvenation through the expected new content to come.

“DHX noted that it has begun production of new Peanuts content under the agreement with Apple. We look for the new content and heightened attention brought on by the new Apple SVOD service to increase consumer product sales and attention to WildBrain. We put the Peanuts production at roughly 20 per cent of the Vancouver studio capacity,” says Goff.

The analyst is now calling for 2019 revenue and Adjusted EBITDA of $428.6 million (was $431.8 million) and $77.5 million (was $78.9 million). His $3.25 target represented a projected 12-month return of 82.5 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment