Echelon Wealth Partners analyst Rob Goff likes the new financing carried out by children’s TV and entertainment company DHX Media (DHX Media Stock Quote, Chart, News TSX:DHX), saying the leeway for growth created by the share offering outweighs the share dilution created.

Echelon Wealth Partners analyst Rob Goff likes the new financing carried out by children’s TV and entertainment company DHX Media (DHX Media Stock Quote, Chart, News TSX:DHX), saying the leeway for growth created by the share offering outweighs the share dilution created.

In an update to clients on Thursday, Goff reiterated his “Speculative Buy” rating while raising his target price from $2.50 to $2.70 per share.

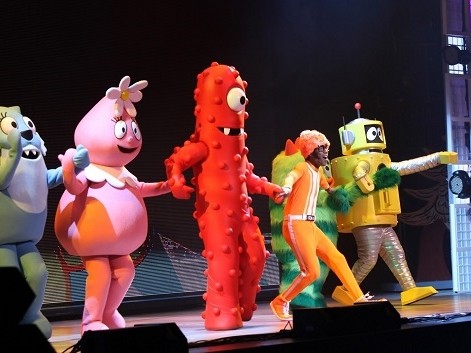

Halifax-based DHX Media, which is changing its corporate name to WildBrain, on Wednesday announced it is offering rights to eligible holders of its common voting shares and variable voting shares as of October 18, 2019. The company says that it will use the proceeds from the $60-million rights offering to repay $50 million of a term loan with $10 million available to invest in growth assets.

Goff says the financing gives DHX greater financial flexibility and allow it to grow its YouTube business through WildBrain, while at the same time highlighting the strong backing of its largest investor through Fine Capital, which has agreed to acquire any voting shares not taken up by holders of the rights.

The financing may also help make DHX more attractive to potential buyers, Goff says.

“We see it as a smart move with the benefits of improved financial flexibility and the availability of funds for investment trumping the modest dilution in our SOTPs valuation. Investors considering the potential implications this may have on takeover scenarios should note the flexibility this brings to the company. We see it amongst mining companies where funds are raised to demonstrate an ability to advance projects as a leverage point with would-be suitors,” says Goff.

All things being equal, the analyst says that the additional shares effectively dilute his sum-of-the-parts valuation by $0.27 to $0.51 per share, bringing it to a range of $2.44 to $3.44 per share. But Goff says that he’s comfortable in moving his valuation ahead by 0.75x to a range of 10.25 to 11.50, seeing as the $10-million will be going towards investment and that the financing gives the company greater flexibility.

“We believe our Peanuts and WildBrain valuations in particular leave upside. In addition, the strength and quality of the proprietary production and PSF suggest we are potentially conservative. While the value of DHX Television may attract scrutiny, the properties are estimated to generate FCF of $20 to $25 million annually,” he writes.

Goff thinks that DHX will generate fiscal 2020 (year end June 30) revenue and adjusted EBITDA of $443.2 million and $84.9 million, respectively. His revised $2.70 target represents a projected return of 21.6 per cent at the time of publication.

DHX Media last reported its quarterly earnings on September 23, where its fiscal fourth quarter 2019 featured revenue rising 12 per cent year-over-year to $108.8 million, with its WildBrain segment experiencing 25 per cent growth to $17.9 million.

Adjusted EBITDA for the Q4 grew to $20.2 million compared to $16.0 million a year earlier. For the year, DHX’s revenue grew from $434.4 million to $439.8 million, while adjusted EBITDA went from $97.5 million to $79.6 million.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment