Google parent company Alphabet has “absurd” growth: investor

Antitrust concerns continue to swirl around Google and its parent company Alphabet (Alphabet Stock Quote, Chart, News NASDAQ:GOOGL), the latest being reports that a group of US states will be investigating Big Tech’s impact on competition.

Antitrust concerns continue to swirl around Google and its parent company Alphabet (Alphabet Stock Quote, Chart, News NASDAQ:GOOGL), the latest being reports that a group of US states will be investigating Big Tech’s impact on competition.

But with the fallout likely years away, investors should be concentrating on the here and now, says portfolio manager Jamie Murray, where Google stands as not only a revenue-generating workhorse but a cheap stock pickup as well.

It’s been an eventful 2019 for Alphabet, which spent much of January to May trying to recapture ground that the stock lost over the fourth quarter of last year, only to lose it again during May and June.

The stock has been dogged by general worries across the tech sector over looming trade tariffs and, more pointedly in Google’s case, investor caution brought on by the threat that someday, somehow, Alphabet might be forced into a breakup.

News broke in early June that both the US Department of Justice and the Federal Trade Commission would be conducting separate antitrust investigations, with the DOJ taking on Apple and Google while the FTC would be looking into Facebook and Amazon. Concerns have swirled for years that the tech giants have become too powerful and thus potentially damaging to consumers and competition, with Google having already been fined billions by the European Union over its manipulation of the online advertising space.

“There’s still great growth in this company, mid-teens to 20 per cent a year on the revenue side, which is really absurd for a company as large and mature as Google…”

Now adding to the pressure on the federal level, as reported in the Wall Street Journal on Tuesday, a group of state attorneys are reportedly investigating the tech industry’s big players, with “up to 20 or more” states involved. Texas Republican attorney general Ken Paxton stated, “the real concerns consumers across the country have with big tech companies stifling competition on the Internet.”

But with the outcome of these cases and their impact, if any, on companies like Alphabet still only a future possibility, investors should be focusing on Google’s strong growth prospects, Murray says.

“It’s our largest holding in our global growth fund,” says Murray, portfolio manager at the Murray Wealth Group to BNN Bloomberg on Monday. “I was on [BNN Bloomberg] six weeks ago when it was one of our Top Picks, and nothing has changed except that the stock has done a little better after their last results.”

“We saw some investigations opened up in the whole tech sector. That had been an overhang for most of 2018 so we actually view it somewhat positively now that that’s out in the market. People can sort of move past it.”

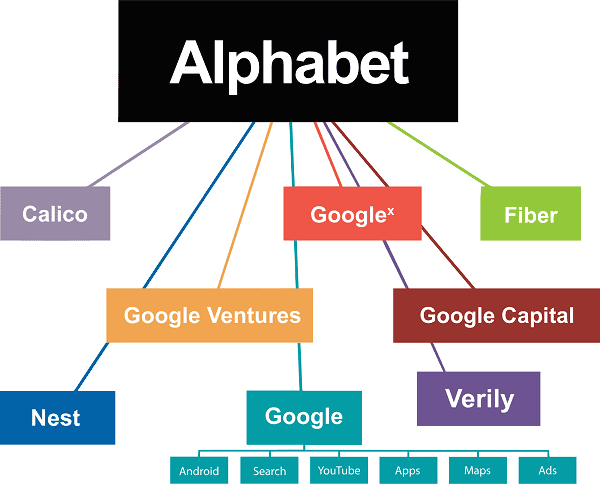

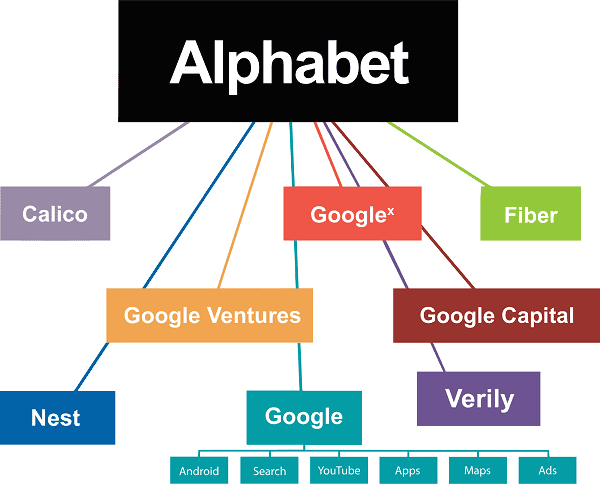

“There’s still great growth in this company, mid-teens to 20 per cent a year on the revenue side, which is really absurd for a company as large and mature as Google — their properties, Google, Google Maps, YouTube, they’re ten, 15, 20 years old and so to be able to sustain this growth is pretty impressive,” he says.

Alphabet’s share price jumped at the end of July with the company’s second quarter results which beat analysts’ expectations for both revenue and earnings. Alphabet reported a top line of $38.94 billion versus the consensus expectation of $38.15 billion and earnings of $14.21 per share versus the expected $11.30 per share. (All figures in US dollars.)

“They still have great margins and the cash on the balance sheet is just going to keep growing. They’re already at $100 million-plus, and that’s going to grow by $5 million a year. $40 billion in free cash flow in 2021. It’s not very expensive at all,” says Murray. “It trades cheaper than most consumer product companies like Pepsi but it grows five times as fast as they do.”

Murray says that with there may be a benefit to having the antitrust cases against Alphabet started and out in the open, as now those worries are likely already baked into the company’s share price.

“We saw some investigations opened up in the whole tech sector. That had been an overhang for most of 2018 so we actually view it somewhat positively now that that’s out in the market. People can sort of move past it,” he says. “And it’ll be five-plus years before there’ll be any outcome from those.”