Google and its parent company Alphabet (Alphabet Stock Quote, Chart: NASDAQ:GOOGL) isn’t just a good tech play, says analyst Jamie Murray of the Murray Wealth Group — the company’s fundamentals speak to an all-around solid investment for years to come.

Google and its parent company Alphabet (Alphabet Stock Quote, Chart: NASDAQ:GOOGL) isn’t just a good tech play, says analyst Jamie Murray of the Murray Wealth Group — the company’s fundamentals speak to an all-around solid investment for years to come.

“We definitely like it,” says Murray, Head of Research at Murray Wealth, to BNN Bloomberg . “Great revenue growth for a company of its size, it has that durable 20 per cent per year, it’s what you can expect from Alphabet.”

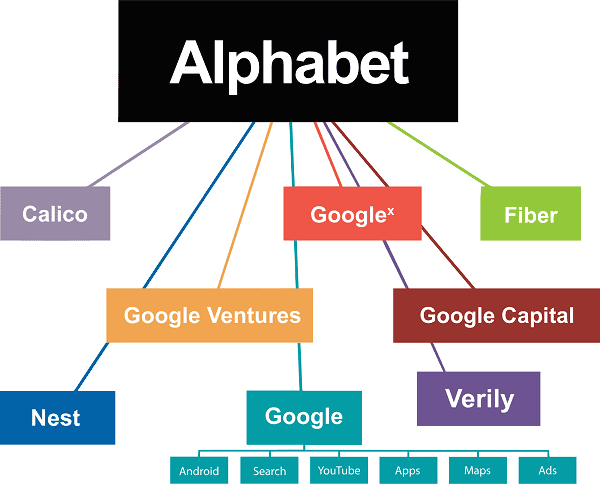

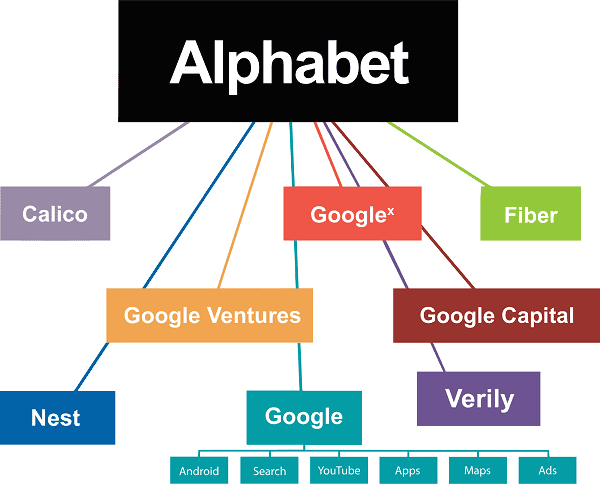

Last week, Alphabet and fellow FAANG stock Facebook were shifted out of the technology category of the S&P Dow Jones Indices and pushed over to the newly created Communications-Services sector where they’ll join Amazon and Netflix, all industry-leading giants whose weighty market capitalizations overshadow all but a few other public companies.

With a market cap of $840 billion, Alphabet’s share price has appreciated by 15 per cent so far this year, less than FAANG members Amazon and Apple but handily beating the S&P 500 Index’s year to date of 9.85 per cent.

Murray says that part of Alphabet’s future growth will depend upon the fruits of side projects like its pioneering research into autonomous vehicles.

“It’s moving into all of these new technology initiatives,” says Murray. “The Waymo self-driving car unit is potentially the next big thing out of Google that will take years to play out but if they get it right, it could be worth hundreds of billions of dollars and Google is right there at the forefront of that technology.”

For its last earnings report in July, Alphabet posted strong consensus beats both on revenue, where it generated $32.66 billion versus the expected $32.17 billion, and on adjusted earnings per share, where it reported $11.75 billion versus the Street’s $9.59 billion (all figures in US dollars).

“It’s trading at around a 25x, 26x P/E for 20 per cent EPS growth that you’ve gotten for the last ten years and that you’ll probably get for the next ten years,” says Murray. “We’d definitely be buying Google here.”

Disclosure: Jayson MacLean owns shares of Alphabet.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment