Buy Oncolytics Biotech for a 331 per cent return, Echelon Wealth says

Echelon Wealth Partners analyst Doug Loe thinks cancer biologics company Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart TSX:ONC) is still trading at a major discount to its industry peers. In a research note to clients on Monday, Loe reiterated his “Speculative Buy” rating and $11.00 target for ONC.

Echelon Wealth Partners analyst Doug Loe thinks cancer biologics company Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart TSX:ONC) is still trading at a major discount to its industry peers. In a research note to clients on Monday, Loe reiterated his “Speculative Buy” rating and $11.00 target for ONC.

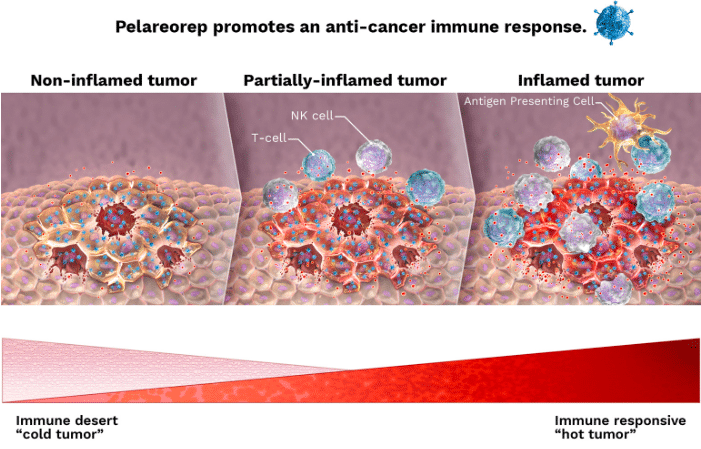

On Monday, Calgary-based Oncolytics announced that it has enrolled its first patient in its previously-announced 36-patient AWARE-1 breast cancer trial testing the company’s flagship oncolytic reovirus formulation, Reolysin/pelareorep.

Loe says that while starting the trial doesn’t by itself move the needle on his investment thesis, completing the AWARE-1 trial has become a “company-defined antecedent” to commencing pivotal Phase III testing. Thus, timely completion puts ONC on a more defined path, the analyst says.

“As we have described before, ONC shares are trading at a substantial discount to valuations ascribed to at-the-time private oncolytic virus development peer firms on acquisition by more mature oncology-focused drug developers,” says Loe.

“Recent examples include: Amgen/BioVex’s herpes virus-based Imlygic (BioVex’s take-out valuation was US$1 billion, of which US$425 million was upfront cash), or Merck/Viralytics’ coxsackievirus A1-based Catavak (take-out value US$394 million), and Boehringer Ingelheim/ViraTherapeutics’ vesicular stomatitis virus-based VSV-GP (take-out value US$244 million),” he says.

Loe expects ONC to have zero revenue over the years 2019 to 2022, with EBITDA losses of $25.5 million, $26.5 million, $22.5 million and $18.6 million, respectively. He see the company starting to generate revenue by 2023, where he forecasts royalty revenue from Reolysin of $16.8 million and EBITDA of negative $0.7 million. For 2024, he sees $95.7 million in revenue and $78.8 million in EBITDA.

Loe’s $11.00 target represented a projected 12-month return of 331 per cent at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.