Clinical stage drug company Bellus Health posted its Q4 results on Thursday, reporting $0.0 million in revenue with a net loss of $2.6 million, which compares to a Q4/17’s $0.0 million in revenue and $1.6 million net loss.

In his comments, President and CEO Roberto Bellini mentioned the progress being made with its chronic cough drug BLU-5937 as well as the company’s closing of $35 million in equity financing.

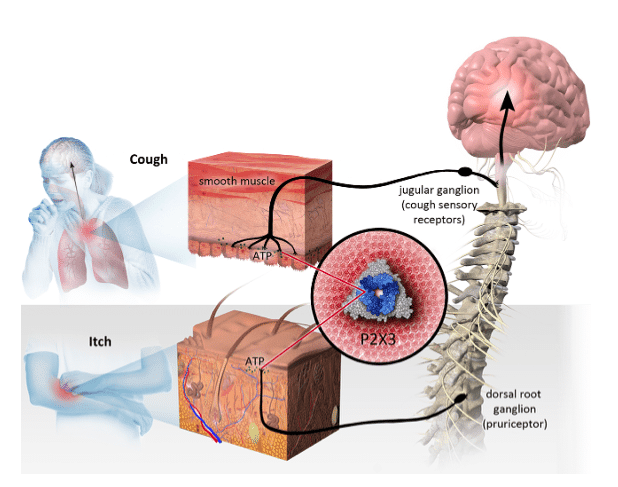

“The positive Phase 1 data reinforces our position that our lead drug candidate BLU-5937 has the potential to be a best-in-class therapeutic for the treatment of chronic cough,” said Roberto Bellini, President and CEO, in a press release. “The $35 million financing completed in December also positions us for another year of important milestones including the start of our Phase 2 study in mid-2019.”

Uddin says the financials at this stage are less important than the clinical progress, with the analyst mentioning in his update to clients on Friday that Bellus had $48.9 million in cash and zero debt as of the end of Q4, which he sees as sufficient to fund corporate operations for more than two years.

The analyst points out that Bellus reported excellent safety results in its Phase I trial with BLU-5937 which showed that it caused fewer taste disturbances than Merck’s MK-7264 based on a trial-to-trial comparison. While Merck is currently in two Phase III trials with MK-7264, Bayer’s BAY1902607 and BAY1817080 are in Phase I and II trials.

“We have conservatively assumed Bellus would out-license BLU-5937 for C$150 millin in upfront and C$450 million in milestones after completing Phase II studies successfully (in 2020),” says Uddin. “However, we would not be surprised that BLU-5937’s decent pre-clinical and Phase I data could help the company forge a deal earlier and/or larger than our assumptions. In June 2016, Merck acquired Afferent for US$1.25 billion (US$500 million in upfront) to obtain MK-7264.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment