US-based cannabis company Acreage Holdings (Acreage Holdings Stock Quote, Chart CSE:ACRG.U) should see improvement to its top and bottom lines, as the company continues to open up more retail shops across the US, according to Beacon Securities analyst Russell Stanley.

US-based cannabis company Acreage Holdings (Acreage Holdings Stock Quote, Chart CSE:ACRG.U) should see improvement to its top and bottom lines, as the company continues to open up more retail shops across the US, according to Beacon Securities analyst Russell Stanley.

In a note to clients Thursday, Stanley reiterated his “Buy” rating and $40.00 target price, representing a projected 12-month return of 103 per cent at the time of publication.

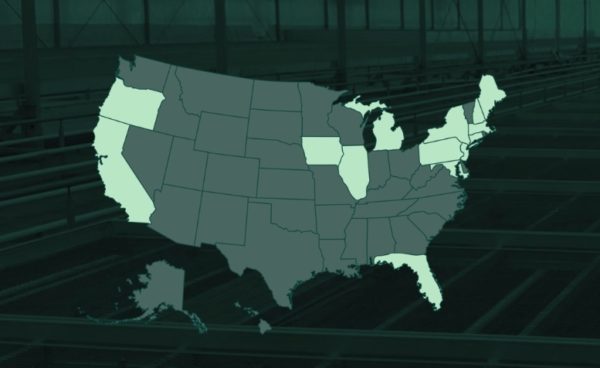

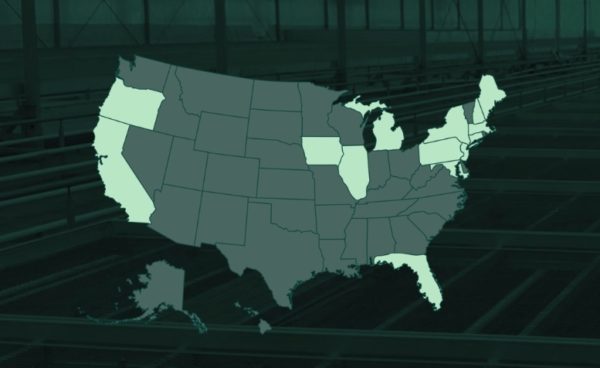

On Thursday morning, Acreage Holdings announced the opening of three new shops under its The Botanist brand of dispensaries in New York and Ohio, with another one likely to be opening in North Dakota tomorrow. The company now owns or has management services agreements in place for 24 dispensaries across 12 states, a result that Stanley takes as a positive.

“We view these developments positively as they reflect continued build out of the retail network, which should translate into strong revenue/EBITDA improvement,” Stanley states.

The analyst says that Acreage is now trading at approximately 13x his 2020 EBITDA estimate of $158 million, which is slightly below the $160 million consensus. (All figures in US dollars.) That makes for a 45 per cent discount to its broad peer group and a 67 per cent discount to its larger market cap peers.

Stanley sees potential catalysts in further progress on legalization at both the state and federal level, the company’s upcoming Q4/18 results (on March 12) as well as additional buildout updates and M&A activity.

The analyst predicts that Acreage will generate fiscal 2018 Adjusted EBITDA of negative $13 million on revenue of $69 million, fiscal 2019 Adj. EBITDA of $60 million on revenue of $272 million and fiscal 2020 Adjusted EBITDA of $158 million on a top line of $533 million.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment