DHX Media has double-digit upside, Echelon Wealth says

DHX Media (DHX Media Stock Quote, Chart TSX:DHX) gets a price target raise from analyst Rob Goff of Echelon Wealth Partners, who sees the company’s recent quarterly results as indication of better prospects for organic growth.

DHX Media (DHX Media Stock Quote, Chart TSX:DHX) gets a price target raise from analyst Rob Goff of Echelon Wealth Partners, who sees the company’s recent quarterly results as indication of better prospects for organic growth.

Halifax-based DHX was up 3.53 per cent in trading on Wednesday as investors reacted to the company’s fiscal first quarter 2019 financials, which featured revenue of $104.0 million, a 5.5 year-over-year increase, and adjusted EBITDA of $17.3 million, down from $22.8 million last Q1.

The company conducted a strategic review this year while suspending its dividend, part of a number of moves meant to solidify the company, said CEO Michael Donovan.

“We are pleased with the progress we are making to solidify our operations, upgrade our management team and reduce our leverage,” said Donovan in the quarterly press release. “We are making the necessary investments for sustainable organic growth. While it is still early days, our pipeline of business on the content and consumer products side is starting to build, laying the foundation for improving results in the quarters and years ahead.”

Goff says that DHX came in with revenue and EBITDA beats over its Q1: the $104.0 million beat Goff’s and the Street’s $98.0 million and $98.5 million, respectively, while the $17.3 million EBITDA beat Goff’s and the consensus’ $16.5 million and $16.2 million, respectively.

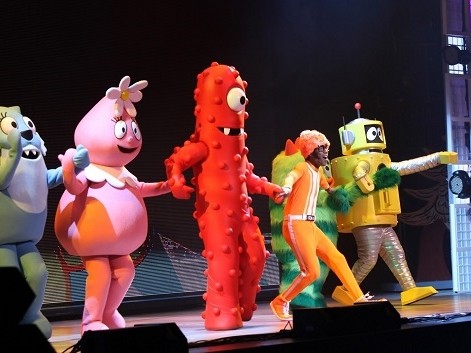

Goff notes that DHX’s WildBrain results proved solid for the quarter, gaining 49 per cent year-over-year while non-WildBrain distribution revenues declined by 29 per cent year-over-year.

“We take the view that results reflect a baseline from which to build organic growth on a more stable trend line with the potential for upside about new production including Peanuts and with the potential for significant moves to form strategic partnerships to empower monetization of brands and library content,” says Goff in a client update on Wednesday.

The analyst said that the introduction of new Peanuts content, something DHX said that it’s working on, would constitute a catalyst for the stock.

Goff rates DHX a “Speculative Buy” with a 12-month target of $3.40 (previously $2.85), which represents a projected return of 20 per cent at the time of publication.