GW Pharmaceuticals is a world leader in cannabinoid-derived pharmaceuticals: Beacon Securities

He’s the only Canadian analyst currently covering the stock, but Beacon Securities analyst David Kideckel thinks more investors should be looking at UK-based GW Pharmaceuticals (Nasdaq ADR:GWPH),

He’s the only Canadian analyst currently covering the stock, but Beacon Securities analyst David Kideckel thinks more investors should be looking at UK-based GW Pharmaceuticals (Nasdaq ADR:GWPH),

On Tuesday, GWPH reported its Q3, 2018 results. The company lost £136.7-million on revenue of £10.7 million, a topline that was up 75.4 per cent over the same period last year.

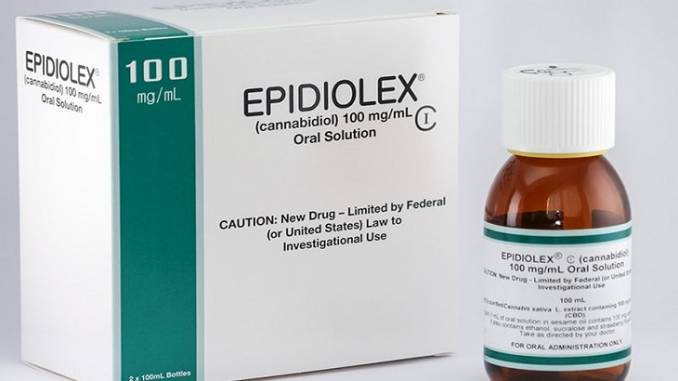

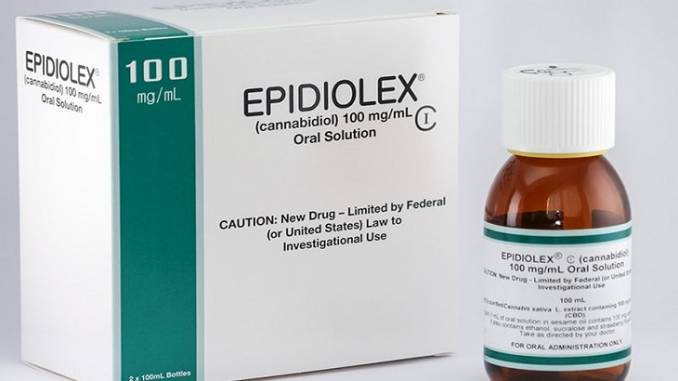

“The recent FDA approval of Epidiolex represents a major medical advance for patients with Lennox-Gastaut Syndrome and Dravet syndrome,” CEO Justin Gover said. “We anticipate rescheduling to be completed within 90 days of FDA approval and for product launch to take place in the Fall. In preparation for launch, we have now completed the hiring of our U.S. sales organization and are engaged with patient organizations, physicians and managed care organizations/payors. This approval has been a transformative event for GW, not only opening a new chapter as a commercial-stage company, but also validating and reinforcing our world leadership in cannabinoid science, and the potential of our product pipeline.”

Kideckel says the approval of Epidiolex is a milestone event for GW Pharma, validating its science and underscoring the potential of its product pipeline. He believes the company is now in a clear leadership role.

“We believe that GW continues to blaze a trail in the field of cannabinoid-derived pharmaceuticals,” the analyst says. “As the world leader in this space, the company continues to outpace its competitors and show the market why it is the world leader in plant-derived pharmaceuticals generated from the cannabis plant. The company remains on track to Epidiolex commercialization and we are confident that the DEA will re/deschedule a part of this drug and/or its components in the coming weeks/months. As the only firm in Canada to cover this company, we eagerly await its and the DEA’s next steps as GW continues to dominate the space in cannabinoid-derived pharmaceuticals.”

In a research update to clients today, Kideckel maintained his “Buy” rating and one-year price target of (US) $200 on GW Pharmaceuticals, implying a return of 55 per cent at the time of publication.

The analyst thinks GW will post and EBITDA loss of (US) $207.9-million on revenue of $3.6-million in fiscal 2018. He expects those numbers will improve to EBITDA of negative $159.9-million on a topline of $64.3-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.