As the world’s first company to commercialize a plant-based cannabinoid-derived pharmaceutical, GW Pharmaceuticals (GW Pharmaceuticals Stock Quote, Chart, News NASDAQ:GWPH) stands out as a Top Pick for 2020, according to David M. Kideckel, analyst for AltaCorp Capital, who stayed bullish on the name in a Monday update to clients.

As the world’s first company to commercialize a plant-based cannabinoid-derived pharmaceutical, GW Pharmaceuticals (GW Pharmaceuticals Stock Quote, Chart, News NASDAQ:GWPH) stands out as a Top Pick for 2020, according to David M. Kideckel, analyst for AltaCorp Capital, who stayed bullish on the name in a Monday update to clients.

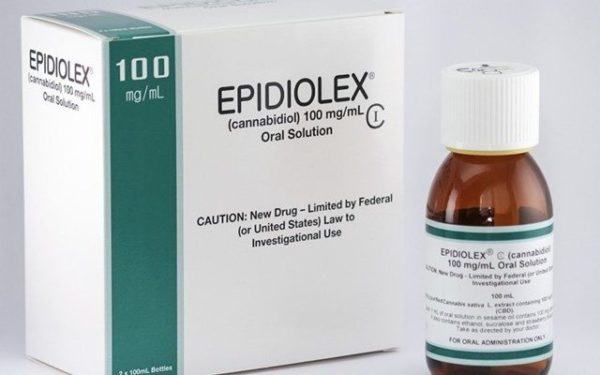

UK-based GW Pharma owns a proprietary cannabinoid product platform and works on discovering, developing and commercializing novel therapeutics, with its lead product Epidiolex marketed for the treatment of seizures associated with Lennox-Gastaut syndrome (LGS) or Dravet syndrome in patients two years of age or older.

GW also has cannabinoid product candidates in Phase 2 trials for autism and schizophrenia. Recently, Kideckel took a tour of the company’s extraction and formulation facilities at its Kent Science Park and came away even more impressed with the GW’s capabilities.

“Put simply, this was the most advanced and sophisticated cannabinoid-based operation we have ever seen, with significant scale and state-of-the-art equipment for extraction and formulation of cannabinoid-derived pharmaceuticals. We believe that these advanced facilities further set the Company apart as the world leader in the cannabinoid-derived pharmaceutical space,” Kideckel wrote.

Altogether, GW has three primary growing sites, an R&D facility and a manufacturing and extraction facility, while as a whole give the company a “robust competitive advantage” in the cannabinoid-derived pharmaceutical space, according to Kideckel.

Further, the analyst says that GW has shown its ability to successfully scale up, from a one-acre, four-tonne production capacity in 1998 to a 67-acre, over 300-tonne capacity by 2017. That plus the company’s successful commercialization of a cannabinoid pharmaceutical in Epidiolex — which was the first to receive US FDA and European Medicines Agency approvals — demonstrate management’s ability to execute on a robust drug development and commercialization process, Kideckel said.

The analyst said near-term catalysts for GW include continued Epidiolex sales growth in the US and Europe, along with advances in the company’s drug development pipeline and the introduction of Nabiximols (Sativex) into the US for a variety of conditions.

Moreover, Kideckel said Epidiolex is just the beginning.

“In our view, the value of GW’s platform can provide upside for long-term investors as it is not captured in our current estimates,” Kideckel wrote. “With Epidiolex becoming a blockbuster drug by FY2023 according to our estimates and the vast clinical trial pipeline in place, we believe GW has significant optionality to unlock long-term value. For these reasons, GW remains our top 2020 pick in cannabinoid-derived pharmaceuticals.”

With the update, Kideckel maintained his “Outperform” rating and $215.00 target price, which at press time represented a projected 12-month return of 113 per cent. (All figures in US dollars.)

GW ended fiscal 2019 with revenue of $311.3 million and an adjusted EBITDA loss of $61.2 million.

Kideckel thinks GW will generate fiscal 2020 revenue and adjusted EBITDA of $501.0 million and negative $18.5 million, respectively, and fiscal 2021 revenue and adjusted EBITDA of $719.9 million and $167.5 million, respectively.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment