After reporting fourth quarter earnings, GW Pharmaceuticals (GW Pharmaceuticals Stock Quote, Chart, News NASDAQ:GWPH) has received a target reduction from AltaCorp Capital analyst David M. Kideckel, who in an update to clients on Tuesday stayed bullish on the company nonetheless.

After reporting fourth quarter earnings, GW Pharmaceuticals (GW Pharmaceuticals Stock Quote, Chart, News NASDAQ:GWPH) has received a target reduction from AltaCorp Capital analyst David M. Kideckel, who in an update to clients on Tuesday stayed bullish on the company nonetheless.

UK-based cannabinoid pharma company GW Pharmaceuticals released its Q4 and full-year 2019 results on Tuesday, showing quarterly revenue of $109.1 million, up from just $6.7 million a year earlier, and a net loss of $24.9 million compared to a loss of $71.9 million for Q4 2018.

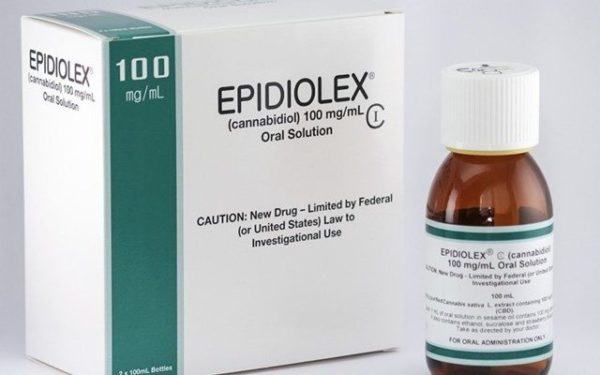

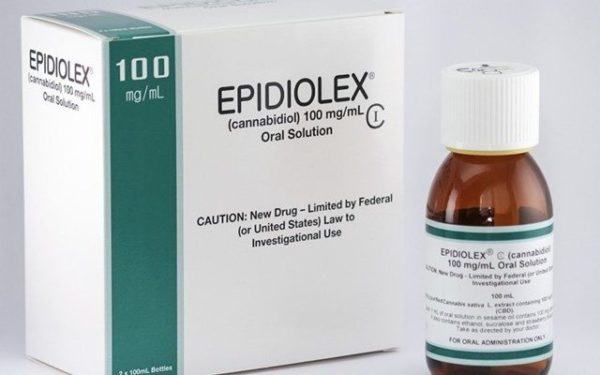

Quarterly net sales of lead product Epidiolex, used for the treatment of seizures associated with Lennox-Gastaut syndrome or Dravet syndrome, were $104.5 million. (All figures in US dollars.)

CEO Justin Gover called 2019 a transformative year for GW, which launched Epidolex in the United States and gained approval in Europe.

“We also expect 2020 to be an important year for our growing and developing product pipeline beyond Epidiolex as we build on our world leadership in cannabinoid science,” said Gover in a press release. “We are focused on advancing nabiximols in the US in several indications and clinical programs with other potential products whilst continuing to bring Epidiolex to more patients in the US and Europe.”

GW’s $109.1-million top line came in better than both the consensus expectation of $104.6 million and Kideckel’s own $96.0-million estimate, while the $24.9-million net loss was greater than the consensus $16.5 million and Kideckel’s $14.0-million estimate.

The analyst sees GW’s near-term outlook to be dependent on continued Epidiolex sales growth in the US along with its successful commercialization in Europe.

“As we have highlighted before, so far, Epidiolex has experienced meaningful sales growth in the US, with more than 3,000 physicians prescribing the drug since launch.

Over the near term, we expect GW to continue to drive growth by targeting a total addressable market of ~6,000 physicians in the US, capturing more patients in the long-term care segment, expanding payor coverage, and expanding the label indication for Epidiolex to Tuberous Sclerosis Complex (TSC), once/if approved by the US Foods and Drug Administration,” Kideckel wrote.

Going forward, the analyst says GW has a robust drug development pipeline and is progressing through several clinical trials. He expects GW to file the TSC Supplemental New Drug Application with the FDA in the first half of this year, with approval expected by mid-2020. The company should also be filing the TSC European submission over the first half of this year.

“In our view, expanding the Epidiolex label indication to TSC in the US and Europe can provide a significant catalyst for GW. Several other catalysts may materialize as GW progresses through its robust pipeline, which includes its Rett Syndrome clinical trial, its Sativex program in the US, the development of CBDV (cannabidivarin) to treat Autism-related disorders, and a Neonatal Hypoxic-Ischemic Encephalopathy (NHIE) intravenous CBD program,” Kideckel wrote.

The analyst has lowered his revenue estimates for GW based on lower patient growth due to patient withdrawal rates, which is standard course for any pharmaceutical, Kideckel said, and not due to GW’s specific earnings results. The analyst is now calling for fiscal 2020 revenue and adjusted EBITDA of $501.0 million and negative $18.5 million, respectively.

With the update report, Kideckel maintained his “Outperform” rating but reducing his price target from $230.00 to $215.00, which at press time represented a projected 12-month return of 84 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment