COVID-19 may continue to put pressure on sales for GW Pharmaceuticals (GW Pharmaceuticals Stock Quote, Chart, News NASDAQ:GWPH) but the company’s just-released quarterly results were still a positive, according to ATB Capital Markets analyst David Kideckel, who reviewed the numbers in an update to clients on Tuesday.

COVID-19 may continue to put pressure on sales for GW Pharmaceuticals (GW Pharmaceuticals Stock Quote, Chart, News NASDAQ:GWPH) but the company’s just-released quarterly results were still a positive, according to ATB Capital Markets analyst David Kideckel, who reviewed the numbers in an update to clients on Tuesday.

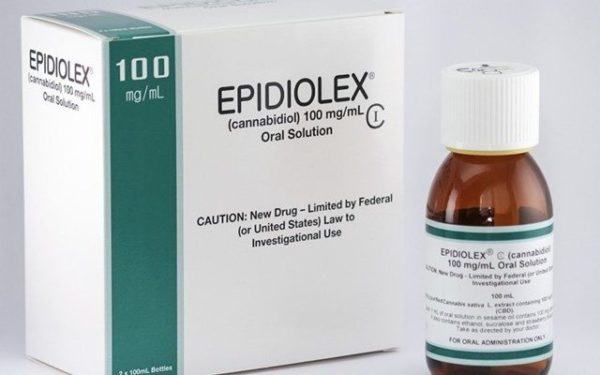

GW Pharmaceuticals is a UK-based cannabinoid company focused on developing and commercializing novel therapeutics including via its lead product Epidiolex, which has so far been approved for the treatment of seizures related to Lennox-Gastaut syndrome (LGS) and Dravet syndrome and for Tuberous Sclerosis Complex (TSC) in the US. The company also has a number of clinical trials underway including Phase 3 trials for Epidiolex for Rett Syndrome and nabiximols for MS Spasticity, along with Phase 2 trials for CBDV for epilepsy and autism spectrum disorders.

GW Pharma reported on Tuesday third quarter results featuring total revenue of $137.1 million compared to $91.0 million a year earlier and a net loss of $12.2 million compared with a loss of $13.8 million a year earlier. The company ended the quarter on September 30 with $480.3 million in cash and equivalents. (All figures in US dollars.)

“We are pleased to report strong revenue growth in the third quarter despite the challenges presented by COVID-19,” said Justin Gover, CEO, in a press release. “Epidiolex meets a serious unmet need within the field of epilepsy and we expect the product to demonstrate continued strong growth in the months and years ahead. The recent expanded indication for the treatment of seizures associated with TSC has been very well received by patients, clinicians and payers.”

On the quarterly numbers, Kideckel was calling for revenue of $123.6 million (the consensus was $127.1 million) compared to the realized $136.8 million and for a net income loss of $11.2 million compared to the realized loss of $12.2 million (consensus loss of $19.1 million).

Kideckel has accordingly revised his estimates for GW Pharma, taking into consideration both COVID-19-related sales headwinds and expected increased operating expenses as the company steps up its R&D and SG&A via advancing its clinical pipeline and sales efforts, both of which Kideckel said are healthy signs of a growing biotech company.

“We view the results as positive as net sales from Epidiolex (known as Epidyolex in Europe) increased ahead of our and consensus expectations. We believe this demonstrates that GW is executing well under the uncertain COVID-19 environment,” Kideckel wrote.

“While this is positive, we believe the pandemic may continue to impact the engagement of sales teams with healthcare professionals, which is especially important for launching drugs such as Epidyolex. Therefore, we maintain our near-term cautious view over GW’s sales ramp. Over the long-term, we maintain our constructive stance supported by the Company’s cash position, clinical trial pipeline, and the still largely untapped market for Epidiolex/Epidyolex,” he said.

Highlights over the quarter for GW included having Epidiolex approved in Australia for the treatment of seizures associated with LGS and Dravet syndrome as well as receiving a label expansion in the US on the drug to include the treatment of seizures associated with TSC, with a similar expansion now under review by the European Medicines Agency.

“We believe that increased market penetration and label expansion will continue to drive strong Epidiolex sales growth, albeit dampened over the near-term due to COVID-19,” Kideckel said.

With the update, the analyst has maintained his “Outperform” rating but dropped his one-year target from $190.00 to $170.00, which at press time represented a projected total return of 57 per cent.

Looking ahead, Kideckel thinks GW Pharma will generate full 2020 revenue and adjusted EBITDA of $516.1 million and $5.3 million, respectively, and 2021 revenue and adjusted EBITDA of $662.7 million and $27.3 million, respectively.

The analyst said that while at the moment his figures only consider Epidiolex sales the company has a robust clinical trial pipeline, with notables including a New Drug Application scheduled for the FDA by mid-2021 for nabiximols, currently in a Phase 3 trial, along with a newly-announced planned Phase 3 trial in orphan epilepsy syndrome, which would be fast-track eligible by the FDA, according to Kideckel.

GW Pharma’s share price had been down for the year up until the release of the Q3 numbers, after which the stock has now pushed into positive territory for 2020.

On the Phase 3 nabiximols trial in the United States for MS-associated spasticity, announced on Monday, GW Pharmaceuticals said in a press release that positive results have come from three previous European Phase 3 studies which showed that the drug was well-tolerated an provided continued reductions in patient-reported spasticity.

“We are excited that the U.S. Phase 3 clinical program evaluating nabiximols in Multiple Sclerosis spasticity is now recruiting patients, after a delay due to COVID-19,” said Gover in the press release. “Given the rigorous studies already conducted on the medicine outside of the U.S., and positive discussions with the FDA, we believe that we have a clear path to an NDA submission, potentially as soon as next year, and a significant second product opportunity for GW in the US.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment