Alibaba’s stock looks like a buy, this portfolio manager says

Shareholders of Alibaba Group Holding (Quote, Chart NYSE:BABA) have been waiting patiently for the Chinese tech giant to break out of its year-long funk, wondering when the range-bound stock will rise above its resistance level.

Shareholders of Alibaba Group Holding (Quote, Chart NYSE:BABA) have been waiting patiently for the Chinese tech giant to break out of its year-long funk, wondering when the range-bound stock will rise above its resistance level.

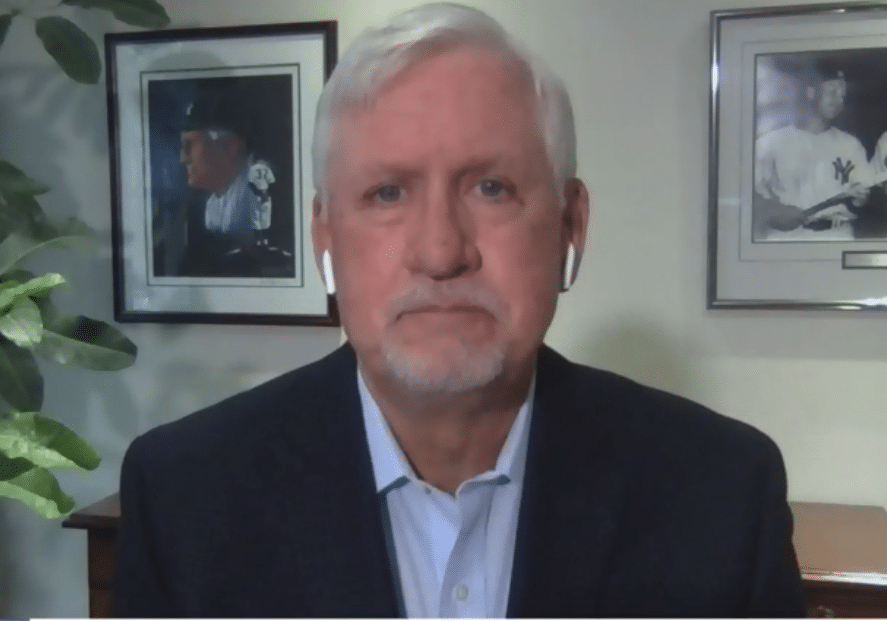

That remains to be seen, says technical analyst Keith Richards of ValueTrend Wealth Management, but now might just be the time for investors to jump in.

It’s back to the drawing board for Chinese tech giant Alibaba, which opened trading on Monday at $177.10 per share, only chump change better than the $176.40 where it started the year off and significantly lower than the $211.70 high it reached in early June. (All figures in US dollars.)

A number of issues have been dogging the stock this year, first with Alibaba being lumped into the broader tech selloff in March and April and since then it’s been hit by fears surrounding the growing trade dispute between the United States and China.

Mixed results in its quarterly earnings released last Thursday didn’t help, as the compa-ny’s revenue matched analysts’ expectations while its earnings did not, leading to a two per cent drop in the stock.

Richards says that although Alibaba’s share price looks range-bound, there’s good rea-son to be optimistic.

“Alibaba is pretty much the market in China if you want to gain access to that market,” says Richards, portfolio manager at ValueTrend, to BNN Bloomberg. “[The stock] has basically been consolidating for a while. A lot of worries around the trade wars and trade agreements, that might be playing into it. But basically, it’s trading range-bound and it has been since the latter part of 2017.”

“At this point, I don’t see any breakdown,” he says. “You can see that the lows are higher and the highs are flat, so this is a consolidation. You could probably safely be picking it up near the bottom of the trading range, which looks to be somewhere around current prices.”

Last week’s first quarter fiscal 2019 financials showed a 61 per cent year-over-year in-crease in revenue at $11.8 billion, while EPS of $1.18 per share came in slightly lower than the expected $1.20 per share. As well, Alibaba’s fiscal Q1 net income of $1.27 bil-lion represented a 40.8 per cent year-over-year decline.