Alibaba is a treacherous stock to own, Gordon Reid says

This year has been a disaster for shareholders of Chinese e-commerce giant Alibaba (Alibaba Stock Quote, Charts, News, Analysts, Financials NYSE:BABA) as the stock has dropped by more than half amid growing tensions between the United States and China that threaten the status of Chinese companies on American public markets.

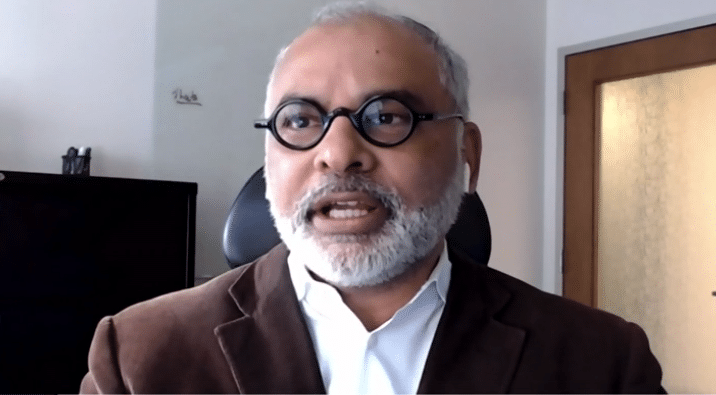

What’s it mean for investors who are already down a bunch on Alibaba? Portfolio manager Gordon Reid advises to take the loss, get out and put your money somewhere safer.

“If you’re in something that you’re uncomfortable with and you’re underwater, what you want to think about is tomorrow and the future. The past is the past, you can’t change that,” said Reid, president and CEO of Goodreid Investment Counsel, who spoke on BNN Bloomberg on Thursday.

“If you have a loss, all you want to do is take the money that is now represented in that investment and do the best with it that you can going forward. If that happens to be an Alibaba, then stay there, but if it’s not then move. [But] I would say in response, Alibaba is a treacherous stock these days,” Reid said.

Alibaba, which has e-commerce, retail, tech and AI interests and owns the Chinese retail platforms Taobao and Tmall, was once heralded as the best among the bunch of e-commerce companies and in 2014 set the record for the largest IPO ever on the New York Stock Exchange. The world had opened up to Chinese businesses over the past couple of decades and companies like Tencent and Alibaba seemed poised for greatness. Investors took to BABA, which generated over a 200 per cent return from its public listing date to a high point hit last fall.

But the stock has since fallen on hard times, dropping from just over $300 last November to now around the $120 mark, with a struggling Chinese economy and regulatory pressure from Beijing having impacted the company.

For its latest quarter, delivered last month, Alibaba’s revenue grew by 29 per cent year-over-year to 200 billion yuan (about US$31.4 billion) with EPS up 38 per cent to 12.20 yuan. But EBITDA dropped by 27 per cent year-over-year for the quarter and revenue for its customer management segment grew by only three per cent amid rising competition in the e-commerce space in China. As well, management lowered its full-year guidance on stalled consumer demand.

“This quarter, Alibaba continued to firmly invest into our three strategic pillars of domestic consumption, globalization, and cloud computing to establish solid foundations for our long-term goal of sustainable growth in the future,” said Daniel Zhang, Chairman and CEO, in a November 18 press release. “Our global annual active consumers across the Alibaba Ecosystem reached approximately 1.24 billion, with a quarterly net increase of 62 million consumers, and we are on track to achieve our longer-term target of serving two billion consumers globally.”

Alibaba and other Chinese companies have been under further pressure from US regulators over the extent to which the Chinese government has controls over their respective business interests, with the US Securities and Exchange Commission (SEC) announcing earlier this month rules around the Holding Foreign Companies Accountable Act (HFCAA) passed last year. The HFCAA gives the SEC the right to delist companies who don’t consent to audit requests by a US oversight board, something that has occurred repeatedly in the case of Chinese-owned companies.

The end result could very well be the delisting of names like Alibaba from American exchanges, some of whom have already created a dual listing in Hong Kong.

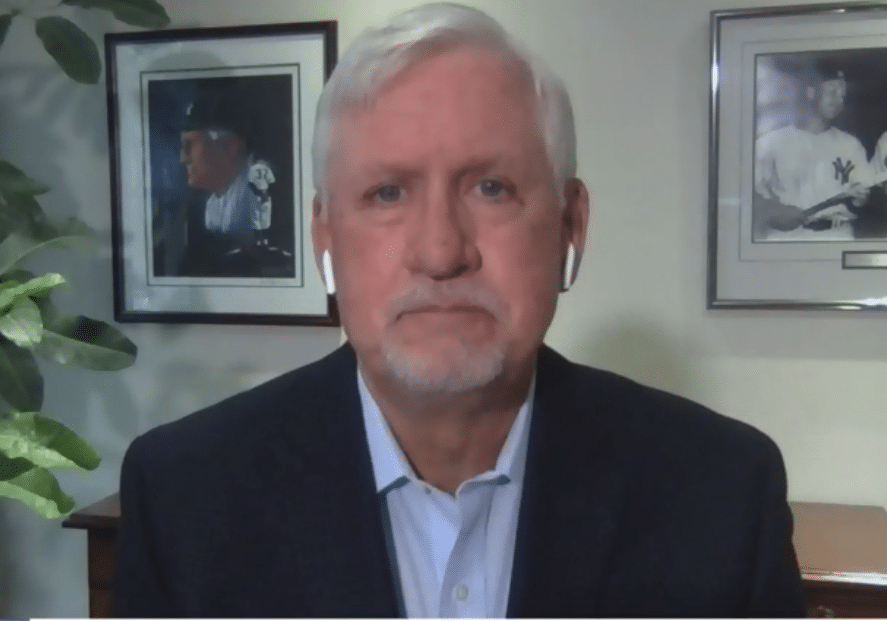

“I think for a lot of Chinese companies listed in U.S. markets, it’s essentially game over,” David Loevinger, managing director for emerging markets sovereign research at TCW Group, who spoke to CNBC earlier this week. “This is an issue that’s been hanging out there for 20 years — we haven’t been able to solve it.”

Loevinger said it could be within the next two years that “most Chinese companies” listed on US exchanges will have been delisted.

For Reid, the contingencies and uncertainties make investing in Chinese companies like Alibaba too much of a gamble right now.

“Alibaba is under the influence of the Chinese government. [The Chinese government] have been heavy-handed with regard to their internet companies and, more specifically, I think to capitalism in general. They want to let groups, companies and people who have succeeded in the Chinese market know who’s boss, and that’s a dangerous thing for shareholders because it’s an authoritarian regime and you just don’t know what’s going to happen. That’s where the rumours of the delisting come,” Reid said.

“I have long been very wary of Alibaba and anything that is Chinese listed and continue to feel that way. So, we would not be an investor in Alibaba,” he said.