With its shares down by half since last October investors in Chinese e-commerce giant Alibaba Group Holding (Alibaba Group Stock Quote, Charts, News, Analysts, Financials NYSE:BABA) are looking for some good news going into the last weeks of 2021. But don’t be surprised if the stock stays mired in multi-year lows, says Paul Harris of Harris Douglas Asset Management, who argues that these days the business climate for companies in China like Alibaba is fraught with a lot of issues.

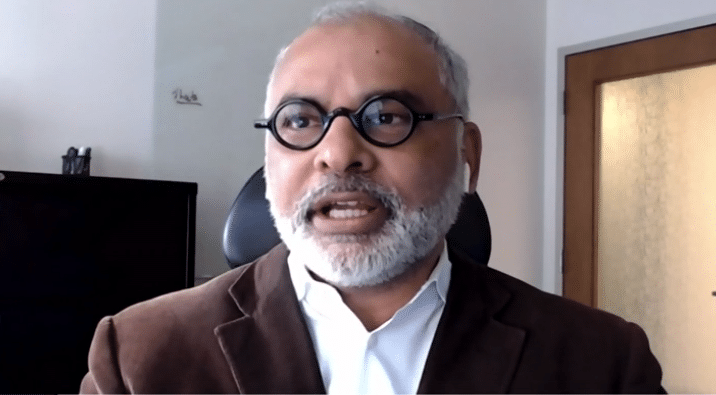

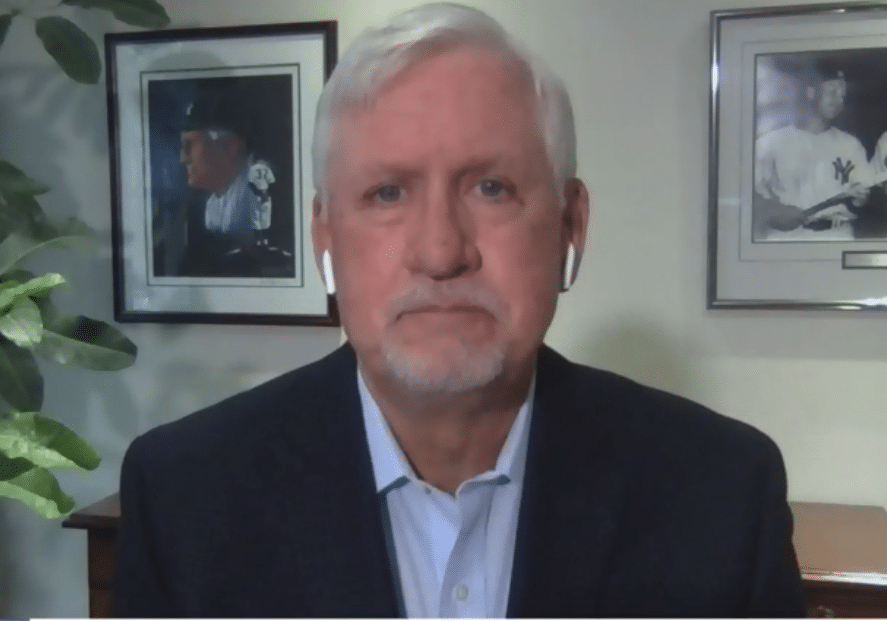

“I don’t own Alibaba but I will say that it’s an interesting company. I think the difficult part of it is that China is really cracking down on a lot of these big tech companies and so that has really hurt many of the Chinese tech companies,” said Harris, speaking on BNN Bloomberg on Tuesday.

“The other issue is a lot of pressure [from] the United States for them to move to GAAP reporting,” Harris said.

The global leader in online and mobile commerce as measured by gross merchandise volume, Alibaba was slapped with a $2.75 billion antitrust fine in April of this year after a months-long investigation by China’s State Administration for Market Regulation (SAMR) which found that Alibaba was guilty of anti-competition practices related to deals with its merchants and pricing strategies.

Then the US Securities Exchange Commission got in on the act by attacking Chinese companies for their accounting practices, which the SEC claims are misleading. Earlier this year, the SEC threatened that Chinese companies had to comply with GAAP-based (generally agreed accounting principles) auditing standards or risk being delisted from US public exchanges.

The SEC has also put pressure on newer Chinese companies hoping to IPO on US exchanges saying they must clearly outline both their legal structures and any risks associated with potential ties to the Chinese government. More recently, the SEC warned investors on risks associated with investing in holding companies which are contractually connected to the actual businesses in China but whose status is at risk due to the fact that the Chinese government could at any time decide that such contracts are invalid, thus threatening investors’ stakes in the holding company.

It’s those types of concerns which have weighed on BABA and other stocks, in Alibaba’s case causing the company to lose over $300 billion in market capitalization in the past year.

Harris says it amounts to a moment of reckoning for Chinese companies listed on foreign exchanges.

“China securities [currently] get a very different regulatory environment if they’re sitting on on US stock exchanges, and I think there’s a feeling that that’s going to change and they may be forced to move to another stock exchange like Hong Kong,” he said.

“So, I think there’s a lot of pressure on these stocks and Alibaba has probably had most of the pressure of late. That’s the big issue. The Chinese government does not want that kind of reporting because the US government and US businesses will get a lot of data about these companies and the Chinese consumer, etc., so it’s … a very difficult issue,” Harris said.

Alibaba Group last announced its financials in August where the company’s June quarter 2021 saw revenue increase 34 per cent year-over-year to approx. US$31.865 billion while income from operations dropped 11 per cent to approx. US$4.778 billion. The company said the lowered earnings were related to strategic investments in products such as its Community Marketplaces and Taobao Deals and Taobao Live. Overall, the company said its active consumer base across the Alibaba Ecosystem reached 1.18 billion people, up 45 million from the previous quarter.

“As we said in last quarter’s results announcement, we are investing our excess profits and additional capital to support our merchants and invest in strategic areas to better serve customers and penetrate into new addressable markets.” said Maggie Wu, Chief Financial Officer of Alibaba Group, in an August 3 press release.

Harris says Alibaba may be a sound investment choice over the long term but turbulence will be in the offing over the shorter term.

“Certainly, Alibaba has strong growth in China — almost all their business is in China — and they’re trying to move into the cloud business. They were in education, they were in entertainment like Amazon and they have a great mobile payment system in Alipay,” Harris said.

“Alipay was supposed to become public and was going to be the one of the largest public offerings in the world, but the Chinese government shut it down the day before it was going to become public and start trading on the Hong Kong stock exchange,” he said. “So, it tells you that it’s a very difficult environment for these companies, and they’ve got to be much more careful about what they can and can’t do with respect to the Chinese government.”

“So, I think China’s a difficult thing. I could certainly see [Alibaba] being a really great long term play, but I think it’s difficult right now to own these stocks,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment