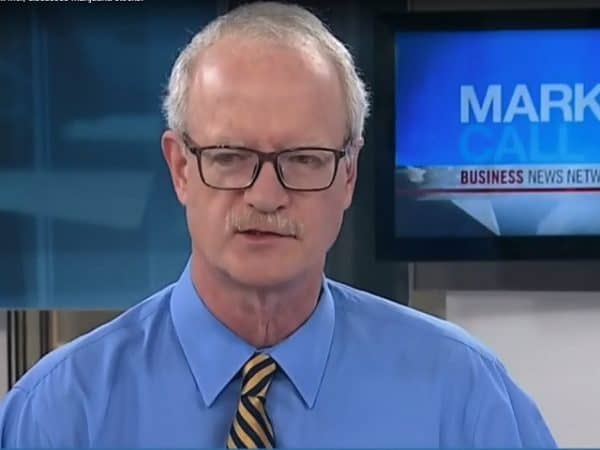

FLYHT Aerospace is having trouble getting off the ground, Hap Sneddon says

Since completing a ten-for-one share consolidation last July, aerospace communications company FLYHT Aerospace Solutions (FLYHT Aerospace Solutions Stock Quote, Chart, News: TSXV:FLY) has seen its share price take a tumble.

The news from a technical perspective is less than rosy, says Hap Sneddon, President and Chief Portfolio Manager at CastleMoore Inc., who argues that the stock which currently trades in the $1.20 range will have trouble getting back over the $1.50 mark.

Calgary-based FLYHT, which provides equipment to enable aircraft to live stream their flight data, reported its first quarter 2018 financials last month, posting revenue of $3.32 million, a 12.3 per cent drop from Q1/17, with EBITDA of negative $487,000, which compared to EBITDA of positive $224,000 in the same quarter of 2017.

At the time, CEO Thomas R. Schmutz, emphasized the company’s hardware division and the role played by its Automated Flight Information Reporting System (AFIRS) in eventually leading to higher SaaS sales.

“FLYHT is very pleased with the increasing AFIRS Hardware sales, which increased 46 per cent over the same quarter last year,” stated Schmutz in a press release. “We believe this trend of increasing hardware sales will yield increasing Software as a Service revenues over time as the equipment is installed and the software services are enabled. As expected, Licensing revenues for the quarter were down significantly from last year, but were consistent with the forecast we have received.”

The company recently received a Canadian Patent for its emergency situation data streaming tech called FLYHTStream, which FLYHT believes will garner widespread adoption in the commercial air transport sector.

Last July, with its share price languishing in the 20 cent range, FLYHT announced a ten-for-one share consolidation, something the company said would help both its stock performance and financial reporting.

At the time, the company was boasting four consecutive quarters of profit and produced positive cash flow, but over the ensuing 11 months, the stock’s performance has been disappointing, losing more than half its value.

Speaking to BNN Bloomberg, Sneddon points out the potential negatives of a reverse stock split.

“Reverse consolidation tends to have a negative impact. By and large, it means the company is having problems and it needs to get some more equity financing going. If it’s got a low share price, it doesn’t go so well — for institutions, $5.00 is a cut mark for investing.”

Technically, Sneddon sees problems as well.

“Obviously, there’s a fundamental story for it to drop more than 50 per cent since the beginning of 2017,” he says. “It kept trying to go through that level of three bucks [in early 2017] but could not do it. Forces get exhausted and away they go.”

Looking at the three-year chart, Sneddon says, “There’s a break here at $1.50, with a lot of touch points there, so I would think that the first place that we’re going to have a problem is at the $1.50 level.”