The stock stayed in limbo for years and then started losing altitude over the past twelve months, leaving those investors who stuck around clinging to the notion that the company’s blackbox streaming technology is close to hitting it big. Arrow Capital Management’s Alex Ruus knows the feeling and he argues that FLYHT’s breakthrough could be just around the corner.

On Tuesday, Calgary-based FLYHT Aerospace reported positive results from a flight-test of its Automated Flight Information Reporting System (AFIRS) on a Boeing ecoDemonstrator aircraft. The company says that the results — a collaboration between FLYHT, Boeing and Embraer — show for the first time that data from an aircraft’s flight data recorder has been streamed over a satellite network for the duration of a flight.

“We are extremely proud to have the opportunity to collaborate with Boeing and Embraer on the ecoDemonstrator program,” says CEO Thomas R. Schmutz. “This is another example of how we continue to demonstrate the value of FLYHT’s patented real-time aircraft data streaming. In this instance we validated its usefulness for distressed flight situations and support of the ICAO objectives for the Global Aeronautical Distress and Safety System mandate, or GADSS.”

The news caused a jump in FLYHT’s share price, which has risen 11 per cent in trading since the announcement. The stock is still down 29 per cent for the year and down 48 per cent since a ten-for-one share consolidation last July. But Ruus says that the company’s troubles aren’t surprising claims that the AFIRS delays say more about the airline industry than anything else.

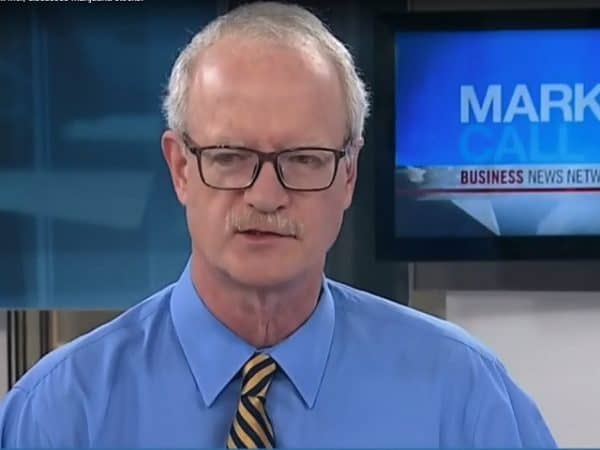

“The issue with FLYHT has been that it’s trying to sell into the airline market and airlines are notoriously difficult to sell into. They’re mass organizations that operate like the governments,” says Ruus to BNN Bloomberg. “There are a lot of ways that airlines could actually save money through deploying this, unfortunately, only a few airlines have jumped in so far, but we think that at some point that it’s going to really take off.”

“It seems like the largest growth is coming out of China now that the Chinese are putting in stricter regulations because it gives the government a better grip on where everything is in the air,” he says. “We think there are probably going to be some big breakthroughs in the next year, but I would have said that a year ago and it’s been disappointing so far.”

Last month, FLYHT reported its second quarter financials which featured a three per cent year-over-year decline in revenue at $3.1 million and an EBITDA of negative $562,000, which compares to last year’s Q2 EBITDA of negative $656,000. The company’s topline broke down to its SaaS sales at $1.1 million, AFIRS hardware sales of $854,000 and licensing of $1.1 million.

Ruus advises FLY shareholders to keep the faith. “The CEO just bought stock in the market this summer, so that’s a good sign,” he says. “I talk to him pretty well every quarter and he’s really excited about where things are going and thinks that there’s a lot of upside here. So far, it’s been disappointing but we like it and we’d be buyers here.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment