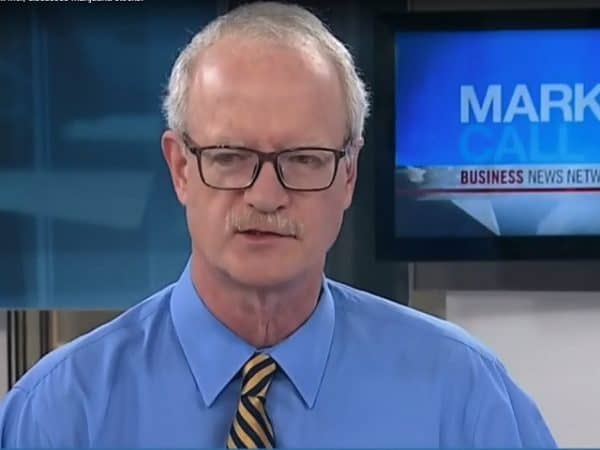

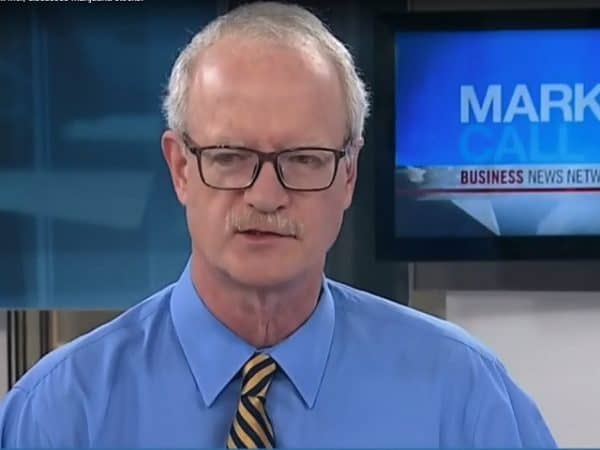

“You look at the heartbreak from the recent plane crash and it becomes a process of, ‘Let’s get the diggers out to find the flight recorder, let’s send it to France and let’s see if we can actually analyze it.’ This is stupid — there’s an existing system that’s rock-solid, has millions of hours of flight on it and has already been proven by existing large customers,” says McWhirter, in conversation with BNN Bloomberg on Monday.

Makers of satellite-connected communications technology, Calgary-based Flyht has seen its share price slide from an initial $2.70 in mid-2017 to a low of $1.00 by the close of 2018. The stock has performed better so far in 2019, currently trading up 51 per cent year-to-date.

Last fall, the company made a pair of notable announcements, one being positive results from flight-tests of its Automated Flight Information Reporting System with Boeing and Brazillian aerospace company Embraer and the other being the purchase of Colorado-based satellite communications company Panasonic Avionics.

McWhirter says the Panasonic acquisition is a positive but that the real prize will come when more airlines choose to adopt Flyht’s technology.

“The purchase was a huge advantage for the company and it gives them an existing client base, as well. But it’s not really what’s going to put the match to the gasoline,” he says. “China has said that by the end of 2019 or 2020 by the latest, all the planes that are operating in China must have satellite-based voice communication, and Flyht is the only company that offers this.”

“We think that the near-term opportunity is in China, and if it turns out that they get the wins that are possible then I think you’ll see the stock easily lift between now and the end of the calendar year,” he says.

“I don’t own the stock, yet I’ve owned it in the past and sold it when it was around $2.25-$2.50. Now that it’s approximately half of that, the opportunities are probably nearer and better and I think it’s probably time to be revisiting and purchasing the stock,” he says.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment