The end of Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart, News: TSX:ONC, Nasdaq:ONCY) phase two meetings with the FDA have derisked the story, says Canaccord Genuity analyst Neil Maruoka.

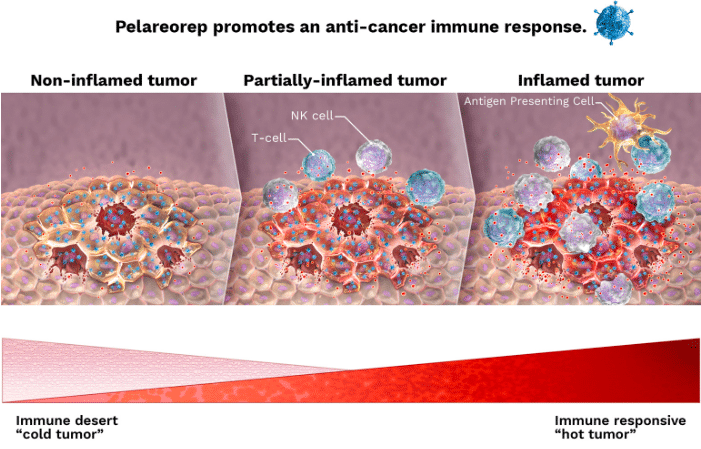

This morning, Oncolytics Biotech announced it had completed the successful end of its phase two meeting with the FDA for Reolysin in combination with paclitaxel, for the treatment of hormone receptor positive, HER2 receptor negative (HR+/HER2-) metastatic breast cancer (mBC) patients.

“The FDA’s feedback and positive end of phase 2 meeting outcome support our proposed target patient population of HR positive/HER2 negative metastatic breast cancer patients for our registration study,” said CEO Matt Coffey. “With statistically significant and clinically compelling overall survival data, fast-track designation and now clear guidance from the FDA, we are focused on finalizing the adaptive study design that will include approximately 400 patients with a predetermined interim analysis. Importantly, the FDA provided guidance that if the study achieves its primary end point, then it will be the only study required for BLA approval. The design of the study and this FDA guidance will also continue to drive our partnering process.”

Maruoka says this is a significant development.

“We believe this is a very positive step toward the potential approval of Reolysin, as the FDA has now provided clarity on the path forward, significantly reducing clinical and regulatory risk, in our view,” the analyst says. “The Agency has confirmed that Reolysin can move forward in a single pivotal Phase III study, which we believe will significantly shorten the development timelines for this drug. Further, the FDA supports evaluation in HR+/HER2- metastatic breast cancer (mBC) patients, which was a population that responded very well in the recent Phase II study; we believe a trial in these patients also lowers clinical risk. Finally, the FDA guided that a positive result on the primary endpoint in the Phase III study will support approval; we believe this suggests that Oncolytics could pursue a Special Protocol assessment, which would further reduce regulatory risk. Final details of the Phase III protocol will be developed in the context of a potential partnership. We view the company’s described clinical plan as a good strategy, but one that will likely require additional resources or a biotech/pharma partnership to complete. We would nonetheless remain buyers of Oncolytics, as the company has re-emerged with greater focus and a sharper strategy to advance its lead product.”

In a research update to clients today, Maruoka maintained his “Buy” rating on Oncolytics Biotech, but raised his one-year price target on the stock from $1.50 to $2.50, implying a return of 346.4 per cent at the time of publication.

Maruoka thinks Oncolytics Biotech will generate EBITDA of negative $16.8-million on zero revenue in fiscal 2017. He expects those numbers will improve to an EBITDA loss of $13.1-million on zero revenue the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment