Editors note: The following special feature is brought to you courtesy Industrial Alliance Securities and analyst Blair Abernethy. It will run in multiple parts over the next two weeks in Cantech Letter. For Part Two click here. For Part Three click here.

In various forms, Artificial Intelligence has been around for decades, but as a sub-sector of the broader technology space AI seems poised to reshape nearly every corner of of our lives, from medicine to law, to the auto industry and beyond.

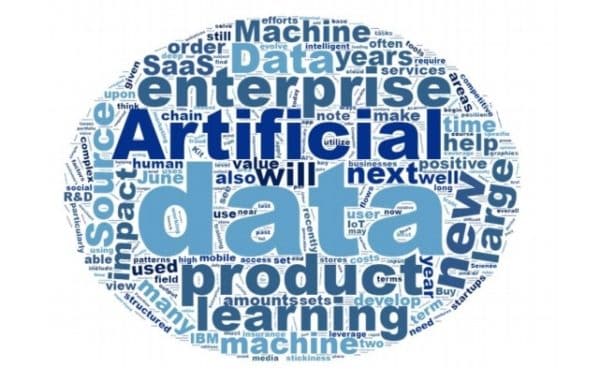

Of course, what concerns most readers of this site is how AI will impact Canadian technology, and this report dives into how it is being employed by names that will be more than familiar to our readers, including names in the broader Cantech universe such as Shopify, Kinaxis, and OpenText.

We thank Industrial Alliance for this comprehensive and report and encourage our readers to examine the disclosures that are provided at the end of this first section.

Introduction

Given the widely reported advances in Artificial Intelligence (“AI”) applications over the past year, we thought that it would be timely to review the enterprise software companies under our coverage in order to gain a better understanding of their current positioning with respect to AI technologies and the potential opportunities and challenges that AI might present for them.

In this report, we provide a brief overview of the current AI technology landscape and discuss ways in which AI could impact, both positively and negatively, the enterprise software industry, including both on-premise and SaaS vendors. We then summarize a review we undertook of the Canadian companies we have under coverage to assess the potential for incorporating AI technologies into their enterprise software product lines.

We believe that several of the companies we cover, including Shopify, Kinaxis, Symbility and ProntoForms, could significantly benefit over the next few years as they incorporate a variety of AI technologies into their respective product stacks. In the long run, we expect AI technologies to become very broadly embedded into enterprise software applications and software, much as business intelligence (“BI”), reporting and analytics features have increasingly been directly incorporated into enterprise applications in the last decade.

What is AI?

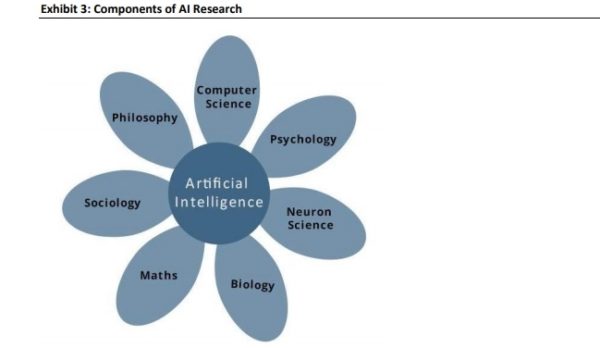

Artificial Intelligence is a broadly applied term that is not easily defined. In 1955, early AI researcher John McCarthy described it as “that of making a machine behave in ways that would be called intelligent if a human were so behaving.” A long-time leading AI textbook by Stuart Russell and Peter Norvig titled “Artificial Intelligence – A Modern Approach” describes AI machines along four dimensions: thinking humanly, acting humanly, thinking rationally, and acting rationally. A recent report on Machine Learning by The Royal Society defined artificial intelligence as “an umbrella term for the science of making machines smart.”

In our opinion, AI should not be looked upon as a distinct technology but rather as a collection of software technologies, techniques, and statistical methodologies that can be applied independently and in combinations to create more “intelligent” software solutions. We view all software as essentially process automation, with AI technology being the next stage in software evolution. In the past, all software was programmed manually. Today, AI approaches, such as Machine Learning, are automating part of the programming task as well. Software with embedded AI technology can be deployed in countless applications for monitoring and/or mining large data sets, predicting outcomes, interacting with and augmenting the work of humans, and directly interacting with other machines (such as computers, sensors, and internet-of-things (“IoT”) with little or no requirement for human interaction.

At its core, a typical AI solution has an algorithm, which is a set of rules that a computer program follows in order to solve a problem, make a recommendation, or decide upon a course of action. AI algorithms are not necessarily “fixed” in nature, but typically evolve and improve as the system gains more experience with the data, or the input data itself (such as customer behaviour and buying patterns) evolves over time.

There are a variety of sub-disciplines in AI technology research, all of which are continuing to advance and rapidly evolve. Some examples of AI technology subfields include, but are not limited to, the following

•Deep learning (using neural networks with hidden layers);

•Machine learning (supervised, reinforcement, and unsupervised approaches);

•Machine vision (and image processing);

•Expert systems (knowledge-based systems);

•Recommendation engines;

•Natural language generation;

•Natural language processing;

•Predictive analytics and prescriptive analytics;

•Autonomous software agents (aka “bots”);

•Autonomous vehicles; and

•Robotics

Stay Tuned for Part Two in this series “Why is AI (Finally) Happening Now?”

Disclosures:

Company related disclosures:

Issuer Company Ticker Applicable Disclosures

Constellation Software Inc. CSU-T 7, 9

Shopify Inc. SHOP-N 7, 9

OpenText Inc. OTEX-Q 7, 9

Kinaxis Inc. KXS-T 7, 9

Descartes Systems Group Inc. DSGX-Q 7, 9

Absolute Software Inc. ABT-T 7, 9

BSM Technologies Inc. GPS-T 7, 9

Symbility Solutions Inc. SY-V 7, 9

ProntoForms Corp. PFM-V 1, 3, 7, 9

Redline Communications Inc. RDL-T 7, 9

See legend of Disclosures on next page.

General Disclosures

Please note that Industrial Alliance Securities Inc. (‘iA Securities’) merged with MGI Securities Inc. on April 1, 2014 and continued their operations as

Industrial Alliance Securities Inc. As a result, the enclosed disclosures may relate to either Industrial Alliance Securities Inc. or to MGI Securities Inc.

for the period prior to April 1, 2014. All appropriate disclosure will be included until no longer needed.

The information and opinions contained in this report were prepared by iA Securities. iA Securities is controlled by Industrial Alliance Insurance &

Financial Services Inc. (‘Industrial’). Industrial is a TSX Exchange listed company (IAG-T) and as such, iA Securities is an affiliate of Industrial. The

opinions, estimates and projections contained in this report are those of iA Securities as of the date of this report and are subject to change without

notice. iA Securities endeavours to ensure that the contents have been compiled or derived from sources that we believe to be reliable and contain

information and opinions that are accurate and complete. However, iA Securities makes no representations or warranty, express or implied, in

respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from

any use of, or reliance on, this report or its contents. Information may be available to iA Securities that is not reflected in this report. This report is

not to be construed as an offer or solicitation to buy or sell any security. The reader should not rely solely on this report in evaluating whether or not

to buy or sell securities of the subject company.

Definitions

“Research Analyst” means any partner, director, officer, employee or agent of iA Securities who is held out to the public as a research analyst or

whose responsibilities to iA Securities include the preparation of any written report for distribution to clients or prospective clients of iA Securities

which includes a recommendation with respect to a security.

“Research Report” means any written or electronic communication that iA Securities has distributed or will distribute to its clients or the general

public, which contains an analyst’s recommendation concerning the purchase, sale or holding of a security (but shall exclude all government debt

and government guaranteed debt).

Conflicts of Interest

The research analyst and or associates who prepared this report are compensated based upon (among other factors) the overall profitability of iA

Securities, which may include the profitability of investment banking and related services. In the normal course of its business, iA Securities may

provide financial advisory services for the issuers mentioned in this report. iA Securities may buy from or sell to customers the securities of issuers

mentioned in this report on a principal basis.

Technology Sector

Blair Abernethy, CFA August 17, 2017 Page | 27

Analyst’s Certification

Each iA Securities research analyst whose name appears on the front page of this research report hereby certifies that (i) the recommendations and

opinions expressed in the research report accurately reflect the research analyst’s personal views about the issuer and securities that are the subject

of this report and all other companies and securities mentioned in this report that are covered by such research analyst and (ii) no part of the research

analyst’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed by such research analyst

in this report.

Analyst’s Ethics

As a condition of employment, analysts are required to adhere to the Code of Ethics and Standards of Professional Conduct of the CFA Institute

(formerly Association for Investment Management and Research ‘AIMR’).

Analyst Trading

iA Securities permits analysts to own and trade in the securities and or the derivatives of the issuer under their research coverage, subject to the

following restrictions. No trades can be executed in anticipation of coverage for a period of 30 days prior to the issuance of the report and 5 days

after the dissemination of the report to our clients. For a change in recommendation, no trading is allowed for a period of 24 hours after the

dissemination of such information to our clients. A transaction against an analyst’s recommendation can only be executed for a reason unrelated to

the outlook of the stock for the issuer and with the prior approval of the Director of Research and the Chief Compliance Officer.

Research Dissemination Policy

iA Securities makes its research available in electronic and printed formats and makes every effort to disseminate research simultaneously to all

eligible clients. Research is available to our institutional clients via Bloomberg and First Call as well as through our sales representatives via email,

fax or regular mail. Electronic versions are distributed in PDF format. Additionally, the research is only intended to be distributed in jurisdictions

where iA Securities is licensed.

For Canadian Residents: This report has been approved by iA Securities which accepts responsibility for this report and its dissemination in Canada.

Canadian clients wishing to effect transactions in any such issuer discussed should do so through a qualified salesperson of iA Securities in their

particular jurisdiction.

For US Residents: iA Securities is not a U.S. broker-dealer and therefore is not governed by U.S. laws, rules or regulations applicable to U.S. brokerdealers.

Consequently, the persons responsible for the content of this publication are not licensed in the U.S. as research analysts in accordance with

applicable rules promulgated by the U.S. self-regulatory organizations. Any U.S. institutional investor wishing to effect trades in any security referred

to herein should contact iA Securities (USA) Inc., a U.S. broker-dealer affiliate of iA Securities.

Disclosure Legend

1. Within the last 12 months, iA Securities has received compensation for investment banking services or has provided investment banking

services with respect to the securities of the issuer.

2. iA Securities expects to receive or intends to seek compensation for investment banking services from the issuer covered in this report within

the next three months.

3. In the past 12 months, iA Securities has managed or co-managed a public offering of securities for the issuer.

4. iA Securities makes a market in the securities of the issuer.

5. iA Securities beneficially owned 1% or more of the common equity (including derivatives exercisable or convertible within 60 days) of the

issuer as of the month end preceding this report.

6. The iA Securities research analyst(s), who cover the issuer discussed, members of the research analyst’s household, research associate(s) or

other individual(s) involved directly or indirectly in producing this report:

a. have a long position in its common equity securities.

b. have a short position in its common equity securities.

7. The analyst has visited the issuer’s head office. No payment or reimbursement was received from the issuer for the associated travel costs.

8. In the past 12 months, the issuer is (or has been) a client of iA Securities and received non-banking and non-securities related services for

which iA Securities received or expects to receive compensation.

9. In the past 12 months, neither iA Securities, its officers or directors, nor any analyst involved in the preparation of this report have provided

services to the issuer for remuneration other than normal course investment advisory or trade execution services.

10. An officer or director of iA Securities, outside of the Equity Research Department, or a member of his/her household is an officer or director

of the issuer or acts in an advisory capacity to the issuer.

11. The analyst has relied in the preparation of the recommendation on material provided by a third party which will be disclosed on request.

Copyright

All rights reserved. All material presented in this document may not be reproduced in whole or in part, or further published or distributed or referred

to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express

written consent of iA Securities Inc.

iA Securities is a member of the Investment Industry Regulatory Organization of Canada (‘IIROC’) and the Canadian Investor Protection Fund (‘CIPF’).

iA Securities is a business name and trademark of Industrial Alliance Securities Inc.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment