Paradigm lowers target on Oncolytics, but says stock is still a buy

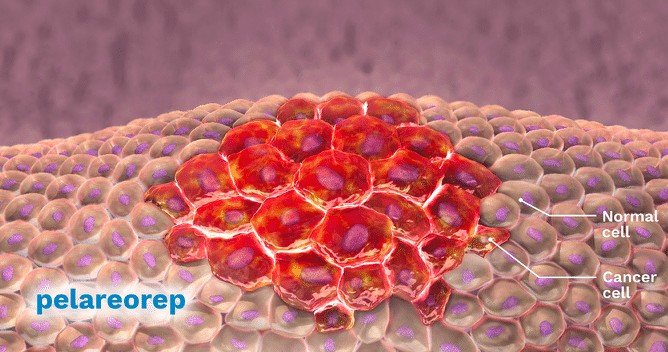

The results from Oncolytics’ (Oncolytics Stock Quote, Chart, News: TSX:ONC) U.S. Phase Two pancreatic cancer study were “mixed” says Paradigm Capital analyst Alan Ridgeway, but the company’s lead product REOLYSIN still has a multi-billion dollar market opportunity and several near term catalysts.

The results from Oncolytics’ (Oncolytics Stock Quote, Chart, News: TSX:ONC) U.S. Phase Two pancreatic cancer study were “mixed” says Paradigm Capital analyst Alan Ridgeway, but the company’s lead product REOLYSIN still has a multi-billion dollar market opportunity and several near term catalysts.

Yesterday, Oncolytics released patient data from its U.S. randomized Phase Two Pancreatic Cancer Study. The market response was sharply negative, with shares of the company on the TSX falling nearly 36% to $.90.

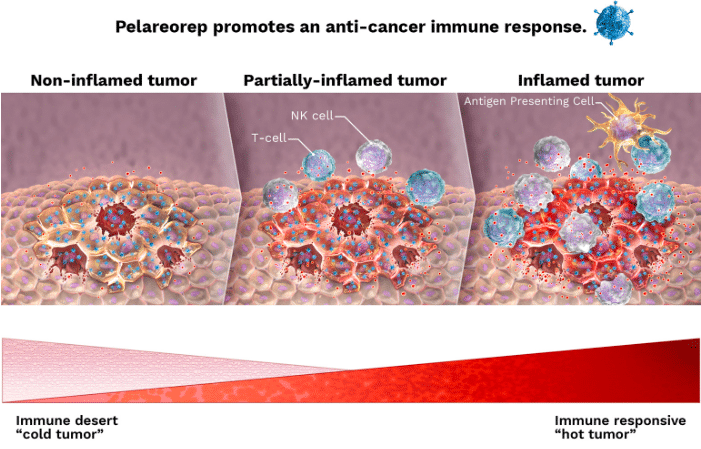

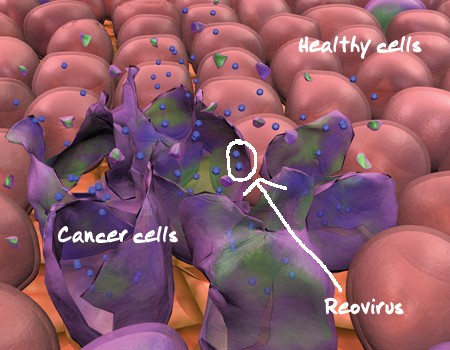

“This is the first randomized clinical evidence that screening patients for their KRAS status could influence their clinical outcomes when treated with a drug regime that includes Reolysin,” said Dr. Alan Tuchman, senior vice-president, medical and clinical affairs, and chief medical officer of Oncolytics. “These findings support previous evidence of Reolysin being active in cancer cells with an activated RAS pathway and warrants confirmation of KRAS status as a potential predictive biomarker in future studies.”

Ridgeway says that while the study failed to reach its primary endpoint, it did extend the understanding REOLYSIN’s mechanism of action. What’s more, says the analyst, it provides further evidence that the treatment has activity as a therapeutic, and underscores the importance of pre-screening patients to select for likely responders.

In a research update to clients yesterday, Ridgeway revised his outlook on Oncolytics. The analyst says he is pushing his launch expectation for REOLYSIN to 2018 and now believes the treatment has a 50% chance in ovarian and pancreatic cancer, a 25% chance in RAS/EGFR NSCLC, and a 25% chance of success in treating squamous cell lung cancer. Ridgeway maintained his “Buy” rating on Oncolytics, but lowered his target from $10.00 to $8.00, implying a return of 471% at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.