That type of narrative works well in some spaces, but other business opportunities are located much further from Farmville.

FLYHT Aerospace Solutions (TSXV: FLY), is a company whose roots go all the way back to the dot-com days, having been founded in 1998. The space the company plays in – it has developed an automated data collection and delivery service for the commercial aviation sector – is widely noted for its red tape and glacial pace of progress.

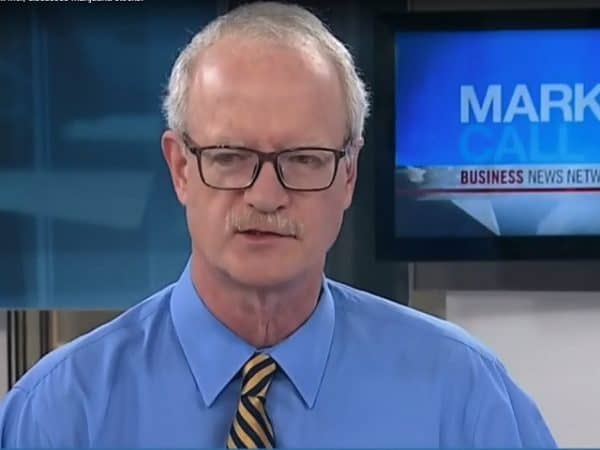

Today, however, the company feels it is close to weaving its way to the finish line, past a regulatory tangle that now represents a significant barrier to entry for would-be competitors. Cantech Letter talked to CEO Bill Tempany about what’s next for FLYHT.

Your technology is called AFIRS™, what does it do?

AFIRS™ is an acronym for Automated Flight Information Reporting System. FLYHT’s real-time data streaming technology is the only solution is that covers the globe. FLYHT has recently developed its next generation technology, which it calls AFIRS™ 228. The upgrade from 220 to the 228 was done as a result of recommendations and input from major airlines and OEMs. The AFIRS™ 228 now possesses the advanced technology that is getting the attention of major players in the industry.

Many people would be surprised to know that 75% of the world does not have radar or radio coverage.

What is the value proposition of AFIRS for airlines?

Many people would be surprised to know that 75% of the world does not have radar or radio coverage. This includes the oceans, deserts and large unpopulated parts of the globe. The AFIRS™ technology is designed to work on any aircraft. The live and real time transmission can interface with and enhance all existing technologies on airplanes today. The continuous monitoring by AFIRS™ sends regular data pings through the Iridium satellite network to the airline’s headquarters. In the case of an emergency, information is immediately sent to the ground, notifying the ground crew of the problem. Also, airlines are beginning to really pay attention to the AFIRS™ fuel savings programs that monitor and recommend take offs and approaches. For example, a recommendation of the position of wing flaps could save airlines millions of dollars a year. From a business perspective, the beauty of FLYHT’s AFIRS™ system is the recurring revenue that is associated. Once an AFIRS™ box is on an aircraft and it is operational, FLYHT collects a range of $500 – $2,500 per month for access to the various AFIRS™ services. The gross margins range from 75% – 85%.

What is the size of the market you are addressing?

If you consider the two major commercial aircraft manufacturers in the world- Boeing and Airbus – they account for approximately 20,000 aircraft. The industry is projecting that number to double by 2030. For business aircraft – Boeing and Airbus – represent approximately 15,000. That number is also projected to double by 2030. Overall I would estimate that there are approximately 40,000 operational aircraft today and approximately 2,000 aircraft are manufactured every year.

It seems to me that there is a big barrier to entry to your market. Can you talk a bit about all the hoops you have had to jump through and how long those have taken?

FLYHT holds patents on its technologies in Canada, United States, Europe, Brazil, China, India and Turkey. Also, STC’s or supplemental type certificates are required to modify an aircraft from its original design. An STC has to be completed for every aircraft type and sometimes variants of a type and are required in multiple jurisdictions such as Transport Canada, FAA, EASA, CAAC to name the main ones. Each STC costs approximately $75,000 and about six months to secure. Right now we have a total of 59 STC’s for our 220 and 228 products. The other road onto an aircraft is with an OEM so the installation is done at the factory for new aircraft. We have a relationship with a major European OEM through our partner, as announced in a September 24, 2012 news release, We expect to be able to announce very soon, the first of a series of contracts that will be a direct result of those relationships.

Investors watching your stock have seen a nice run up recently. For those looking at your stock and trying to gauge a good time to get involved, what are some of the key catalysts they should look for?

There are a number of solid short term business developments we are working on right now. The company is focused on achieving positive cash flow in the fourth quarter of 2013. There are very interesting developments unfolding through our partner channel. And we’ve just announced an “initial” order for 218 aircraft from our partner in China. The AFIRS™ units will be installed by seven different airlines over the course of three years. That is all part of a Chinese government mandate that declares all China based airlines to be equipped with a satellite communication system by 2017. The order for 218 only represents about 10% of the overall Chinese market. Although the Netjets Europe program was temporarily held up, it is now back on track. NetJets has installed 10 AFIRS™ units on its Hawker fleet.FLYHT has been working with the Nigerian Civil Aviation Authority (“NCAA”) on an initiative which would see AIFRS™ units being placed on all of its fleet. They are interested in AFIRS™, because of its ability to stream data in real time from a black box in an emergency scenario as well as a customer safety management system developed for the NCAA to monitor airlines in the country equipped with AFIRS.

_____________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment