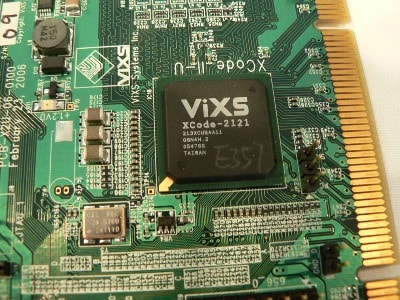

ViXS Systems has the right product at the right time, says Stifel Nicolaus

Stifel Nicolaus analyst Blair Abernethy says ViXS Systems (ViXS Systems Stock Quote, Chart, News: TSX:VXS) has transitioned its business and is well positioned to benefit from changing video viewing trends of consumers.

On July 15th, Toronto-based ViXS Systems, which was formed more than a dozen years ago, began trading on the TSX. In April, the company announced it would go public through an amalgamation agreement with a capital pool company. Weeks later, it completed a $57.4 million financing, led by GMP Securities.

Abernethy says ViXS once focused on standalone transcoding, primarily for Asian markets, but has since diversified its business to capitalize on trends that are driving the video content business, which has become increasingly complex. He points out that the company already has several design wins in place that he believes will enable it to triple its revenue by fiscal 2015. He also points to a $700-million pipeline of opportunities the company has on deck in the next year as evidence that it is keeping up with technology shifts in the industry.

In a research update to clients this morning, Abernethy initiated coverage of ViXS Systems with a BUY rating and 12-month target price of $5.25.

Abernethy says ViXS simply has the right product at the right time. He says content providers and over-the-top services are struggling with the methods by which consumers are accessing content, and the present infrastructure is not up to task. He says there are complex engineering challenges that come about because of the fragmentation of the sources and uses of video, and ViXS is tackling these head on.

The Stifel Nicolaus analyst says the competitive landscape is very much in ViXS’ favour. He notes that chip sets can take as long as four years to develop, and many incumbents were not able to keep up with technology that has been changing rapidly. Abernethy says the result is that ViXS finds itself in a small field of leaders that also includes Broadcom and Entropic.

Shares of ViXS Systems closed today even at $3.87.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.