If you want telecom you go to Ottawa. If you want oil and gas technology, go to Alberta. When it comes to biotech, Quebec is Canada’s undisputed champion.

Quebec ranks fourth in North America in terms of the number of biotech firms, and all of the world’s top ten pharmaceutical companies all have operations there.

Montreal is home to the The Biotechnology Research Institute, Canada’s largest biotechnology R&D facility, but biotech’s reach in Quebec is not limited to its largest city. A biotech hub in tiny Saint-Hyacinthe, for instance, has had more than half a billion invested into it and was recently named best emerging research/science park in North America.

Dozens of Quebec biotechs have chosen to go public, Cantech Letter counts down the five we find the most interesting today, ranked by market cap.

1. AEterna Zentaris (TSX:AEZ)

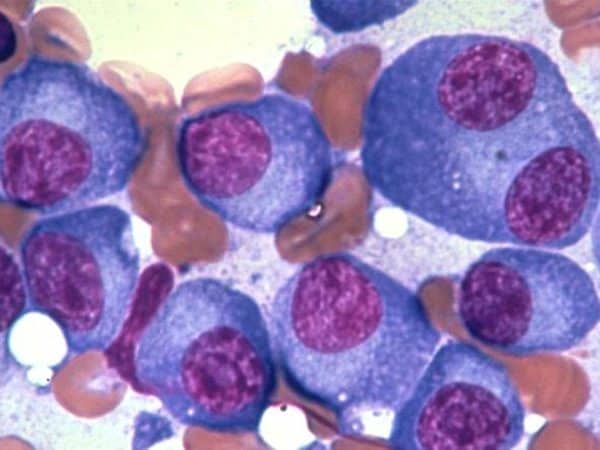

After a tough few years, 2011 showed signs of hope for shareholders of AEterna Zentaris. In July, nearly eight years after initially filing, the company’s cancer therapy candidate, Perifosine, was granted a patent by the European Patent Office. By the end of that month, the Quebec-based oncology/endocrinology drug maker had completed recruiting 465 patients for its perifosine phase 3 trial for refractory advanced colorectal cancer. And by October, two articles reporting positive phase one and two results perifosine had been published in the October, 2011 on-line issue of the Journal of Clinical Oncology.

AEterna Zentaris has a lot riding on perifosine, a drug with multiple niche applications in cancer treatment. While the company has received encouraging news in the forms of FDA fast tracking and orphan status (for the treatment of neuroblastoma) some investors may have mistakenly believed the treatment itself only has niche potential, after all The FDA’s orphan drug status is reserved for new treatments that are being developed for diseases or conditions that affect fewer than 200,000 people in the United States. But the sum total of all opportunities for perifosine is quite large. According to Global Industry Analysts, the global market for Multiple Myeloma Therapeutics is forecast to reach US$6.4 billion by the year 2017.

2. Medicago (TSX:MDG)

Set Medicago’s stock chart against newspaper headlines and you’ll get an idea of what they’re up to. The Company’s shares peaked in late 2009 as swine flu panic ripped through North America, and trailed off after the most dire of predictions failed to materialize. Medicago develops plant based vaccines to combat new strains of influenza. In 2010, The U.S. Department of Defense awarded the company a $21 million grant from to build a facility that can mass-produce its influenza vaccines. While clearing regulatory hurdles is a time consuming process for any biotech, Medicago is all about speed. The company uses tobacco leaves to produce pandemic and seasonal influenza VLP vaccines. One of the real benefits to this solution, compared to traditional egg-based or cell based production is speed; a vaccine can be produced for testing a month or less after the identification of a new strain.

In Genevea last year a panel of scientific experts, headed by Dr. Harvey Fineberg, cleared the World Health Organization of any misconduct in the way they handled the swine flu pandemic of 2009. The panel however, concluded that the WHO was rendered ineffective by the lack of available medicine. “Vaccines were produced as fast as technology would have permitted. said Fineberg “But they came only months after the initial outbreak. The availability of drugs to combat influenza as with many viruses are still very limited.” Giant Philip Morris, for one, thinks Medicago will emerge a winner in the space.Through its Philip Morris Investments BV, it has arranged to invest $22.5 million in Medicago.

3. Diagnocure (TSX:CUR)

Sainte-Foy’s Diagnocure, which was founded in 1994, thinks molecular diagnostics tests, which can detect irregular gene or protein activity patterns associated with cancer, might one day lead to a breakthrough. After Health Canada granted regulatory approval for its Progensa PCA3 in August, Diagnocure set about working its way through the tangle of FDA approval and is now preparing its Progensa PCA3 assay in the first half of 2012. Diagnocure management says the markets they are addressing are growing rapidly; more than 30 percent per year, reaching US$4 billion by 2014.

4. Intelgenx (TSXV:IGX)

If you’ve ever tried to choke down a series of pills while laid up in a hospital bed, you know it can be inconvenient. Quebec’s IntelGenx has a solution for that and for a host of other ineffificiences related to current drug delivery methods. You’re probably already somewhat familiar with IntelGenx Quick Release Wafer Technology, it’s based upon the edible film technology used for breath enhancement strips. Convenience, however, isn’t the only reason Intelgenx is on the rise. Oral controlled-release drug delivery technologies have the ability to improve the performance of a wide variety of existing pharmaceutical compounds. Traditional drug tablets without controlled-release, blood levels of the drug tend to rise quickly after administration, reach a peak and then drop fairly rapidly, thus requiring frequent dosing. Side effects may also occur at the high peak blood levels experienced. Next up for Intelgenx is the building a product pipeline around the technology. Last June, the company signed an agreement with Israel’s RedHill Biopharma to co-develop and license its anti-psychotic oral thin film.

5. Noveko (TSX:EKO)

Shares of Montreal’s Noveko soared during the swine flu scare of 2009, when its antimicrobial surgical masks were flying off the shelves, but struggled after the World Health organization declared that the H1N1 virus had run its course. When the threat of the swine flu fizzled out, so did shares of Noveko. The company, however, actually holds patents holds patents for a variety of antimicrobial products including hand sanitizers, surgical masks and respirators. Noveko management is excited by the potential of providing filters to commercial buildings and office towers, such as the ones they recently installed at the Movenpick Hotel in Geneva, and at several office towers in Montreal.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment