Oncolytics Biotech’s REOLYSIN Inches Closer to Reality

Investors know progress in biotech can be painfully slow. Oncolytics Biotech (TSX:ONC) can trace its history all the way back to the early 1990’s and discoveries made in the Department of Microbiology and Infectious Diseases at the University of Calgary. The company has since poured ten of millions of dollars into the development of a cancer treatment based around a formulation of reovirus, a family of viruses that can affect the gastrointestinal system and have shown to have oncolytic, or cancer killing properties.

2011 was a year in which some investors lost patience with Oncolytics Biotech; shares of the company began the year at $6.73 and ended it at $4. But recent evidence suggest Oncolytics is beginning to make significant headway. The company’s lead offering, REOLYSIN, recently reached a phase two primary endpoint, and passed it with flying colors.

In combination with Gemzar, a nucleoside used in chemotherapy and marketed by Eli Lilly, eight of thirteen patients enrolled in the REOLYSIN study showed stability for twelve weeks or more.

This follows on the heels of a Phase Two non-small cell lung cancer study Oncolytics presented at last July’s World Conference on Lung Cancer. Interim results there revealed that twenty-one of twenty-two patients that had been treated with REOLYSIN in combination with chemotherapy drugs carboplatin and paclitaxel, showed a clinical benefit.

___

This story is brought to you by Verisante (TSX:VRS). The Canadian Cancer Society named Verisante Core a Top 10 Cancer Breakthrough of 2011. Click here for more information.

____

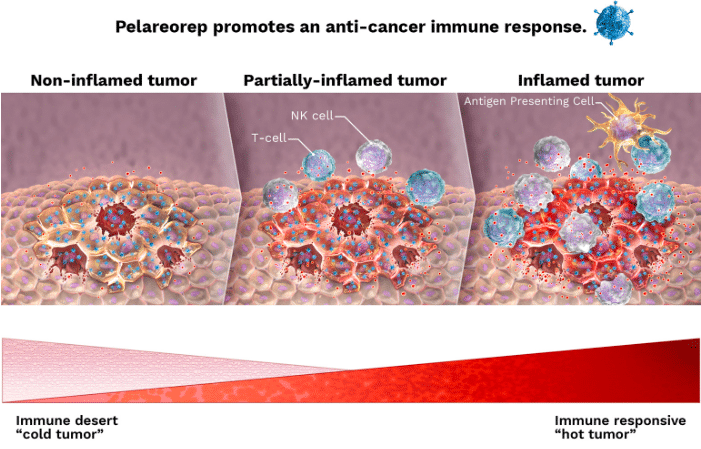

REOLYSIN is a proprietary form of human reovirus developed by Oncolytics. Reovirus is found naturally in mammalian respiratory and bowel systems. We’re all exposed to it, but the vast majority of us do not show any symptoms. Decades ago, researchers began to suspect that reovirus showed potential as a cancer therapeutic because it reproduced well in cancer cell lines, specifically in those cells that display and activated Ras pathway, a characteristic that could play a role in two-thirds of all human cancers. Oncolytics Biotech has become a world leader in the area, with over 280 patents to date.

Bringing REOLYSIN to market is proving to be an expensive proposition. In its recent Q3, Oncolytics estimated it would spend about $24 million in 2011. But the company is well financed, with cash and short-term investments of more than $42 million.

Pancreatic cancer is the the fourth most common form of the disease. Pancreatic is a particularly aggressive Cancer; the five-year rate of survival for the most common form of pancreatic cancer, Adenocarcinoma of the pancreas, is less than 5%.

Share of Oncolytics Biotech closed Friday up 3.6% to $4.27.

____

______

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.