Hot Stocks: The top peforming TSX Techs for the week ended July 22nd

Wondering who’s hot? Cantech Letter breaks down the The Top Performing TSX Techs for the week of July 18th to July 22nd. This survey includes any stock listed on the TSX Technology, Cleantech and Life Sciences indexes with a minimum share price of $.10 cents as of July 18th, 2011. The number in brackets is the stock’s overall TSX rank.

1. (1) Zarlink Semiconductor (TSX:ZL) 60.9%

Price on July 15th: $2.33

Price on July 22nd: $3.75

On Wednesday, Zarlink, which been an Ottawa stalwart for decades, announced it had received and rejected an unsolicited bid from Irvine, California based Microsemi (NASD:MSCC). While the board’s decision to pass, it said, was unanimous, shares of Zarlink rocketed on Wednesday, closing up 50% to $3.60 as more than twenty-six million shares changed hands. The real reason may have been the open ended language of the denial in its official press release, which certainly didn’t close any doors on the proposal. But that subtle opening clearly wasn’t enough rope for Microsemi. After being rebuked by the board twice, it is now appealing directly to the shareholders of Zarlink. In a letter to Zarlink’s board, Microsemi’s CEO James Peterson, said “Your continued refusal to discuss our proposal compels us to directly inform your shareholders of our attractive proposal,”

2. (4) Tranzeo Wireless Technologies Inc. (TSX:TZT) 33.3%

Price on July 15th: $.15

Price on July 22nd: $.20

Wireless network equipment maker Tranzeo, whose shares have been in an eighteen month freefall attracted some bottom fishers this past week, reaching $.22 cents. But that’s a long way from the company’s recent high of $1.67 in late-March of last year.

3. (24) Espial Group (TSX:ESP) 17.7%

Price on July 15th: $.85

Price on July 22nd: $1

Perennial money loser Espial, which is a supplier of IPTV television software has become extremely lightly traded, the twelve trades that drove the company up late last week were its first in nine business days. Bargain hunters looking at the Ottawa company may have taken notice that its market cap of $14 million is only a shade more than the $10 million it has in the bank.

4. (26) Afexa Life Sciences (TSX:FXA) 17.4%

Price on July 15th: $.46

Price on July 22nd: $.54

Edmonton based Afexa continued a modest but steady upward run when it announced that Paladin Labs (TSX:PLB) would invest just under $6 million into the maker of Cold-FX. The news may be helping investors to forget about the uncertainty around the company’s management situation, as Jack Moffatt, the man who steered the company since a 2008 shakeup, will not be back and the company has not yet found a replacement.

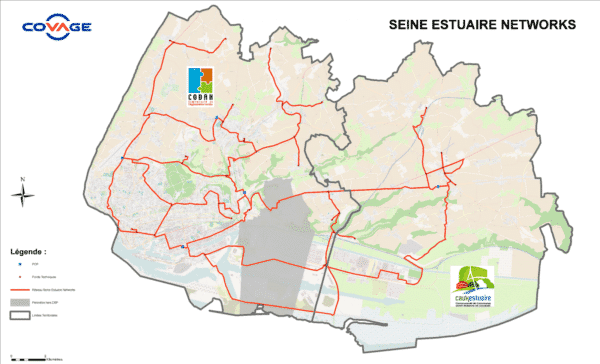

5. (30) Axia NetMedia (TSX:AXX) 16.4%

Price on July 15th: $1.10

Price on July 22nd: $1.28

Calgary’s Axia Netmedia, which provides broadband internet services and has built a 3700 km fibre infrastructure in France, has had a tough go of things of late. Shares of Axia fell from nearly $7 in mid-2007 to current levels, and haven’t really recovered. The Company, however, has grown its revenue from $50.9 million to over $68 million in that same time frame.

__________________________________________________________________________

__________________________________________________________________________

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.