The proposed takeover of Axia NetMedia (Axia NetMedia Stock Quote, Chart, News: TSX:AXX) by Partners Group is a fair one for investors, says Paradigm Capital analyst Kevin Krishnaratne.

The proposed takeover of Axia NetMedia (Axia NetMedia Stock Quote, Chart, News: TSX:AXX) by Partners Group is a fair one for investors, says Paradigm Capital analyst Kevin Krishnaratne.

This morning, Axia NetMedia announced its board had agreed to a $272-million takeover by private equity firm Partners Group, a figure that equals $4.25 a share, a a 47-per-cent premium to the volume-weighted average trading price of the company’s shares over the last 60 trading days.

“We have gone through an exhaustive process aimed at enabling the company to realize the full potential of our businesses in North America and France,” said CEO Art Price. “I am extremely proud of what Axia has accomplished and believe that this agreement with Partners Group offers current shareholders a compelling premium and provides Axia the opportunity to more effectively pursue our long-term investment and growth strategy, continue to provide compelling services to our customers, and further enhance our strategic position.”

Krishnaratne, who coincidentally had a $4.25 one-year target on Axia NetMedia, says the deal is a fair one for shareholders. He says it means the company will be able to fund multiple opportunities.

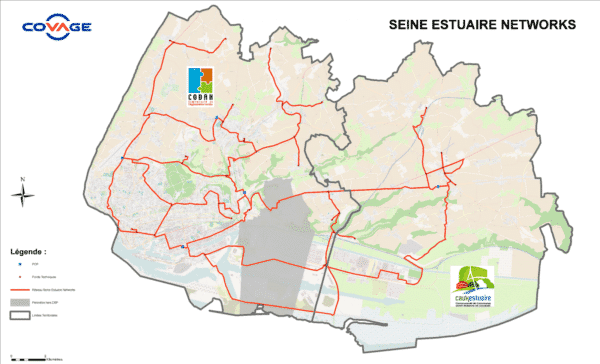

“Under Partners Group, Axia will be provided with the necessary funding to execute on its strategy of being a leading infrastructure fibre player in rural markets, specifically in France where it has a 50% equity ownership stake in Covage,” says Krishnaratne. “Recall that Covage is currently engaged in several fibre bids of various sizes which represent a total pipeline of 3M+ premises. Management has further estimated that there exists another 40-60 bids in the market over coming years and that most of these builds will be awarded in a 2-3 timeframe. The timing for this acquisition is therefore well aligned with fibre opportunities in sight.”

In a research update to clients this morning, Krishnaratne moved his recommendation from “Buy” to “Tender”.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment