Axia NetMedia (Axia NetMedia Stock Quote, Chart, News: TSX:AXX) is a uniquely positioned pure‐play broadband telco, says Paradigm Capital analyst Kevin Krishnaratne.

Axia NetMedia (Axia NetMedia Stock Quote, Chart, News: TSX:AXX) is a uniquely positioned pure‐play broadband telco, says Paradigm Capital analyst Kevin Krishnaratne.

In a research report to clients today, Krishnaratne initiated coverage of Axia NetMedia with a “Buy” rating and a one year target price of $4.25, implying a return of 36% (including dividend) at the time of publication.

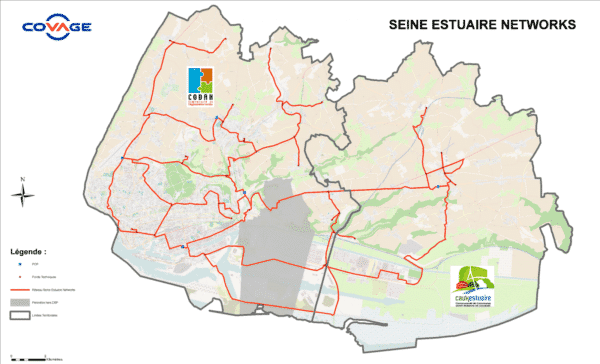

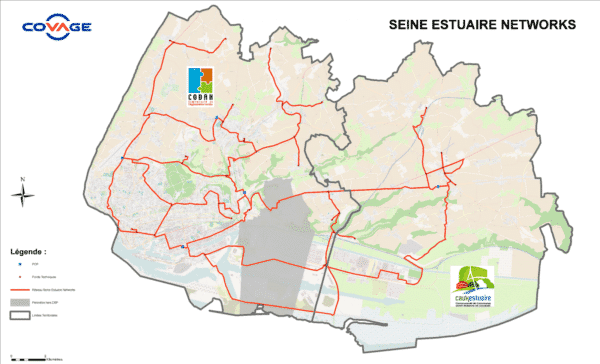

Krishnaratne says he likes that Axia NetMedia plans to sell to the private sector, noting that is has traditionally only sold to government clients. The analyst says the company’s current stock price also does not reflect the opportunity it has in France, where he believes there is a total market potential of more than two-million homes. In January, the company announced that its subsidiary Covage was awarded an agreement to partner with local governments to deploy a Fibre-to-the-Home (FTTH) network to 319,000 homes in Seine-et-Marne, France.

“100% leveraged to broadband, Axia stands apart from other Canadian telcos with a model that fully embraces the notion of viewing broadband as the pipe with which to drive a multitude of apps,” says Krishnaratne. “Additionally, Axia’s interest in Covage gives investors a way to gain exposure to an international telco with strong growth prospects supported by a government mandate focused on bridging the digital divide in France.”

Calgary-based Axia designs and builds fibre based internet and data networks, often to remote communities. The company’s operations largely take place in North America and in France, where its subsidiary Covage is partnered with the locally owned and operated VINCI Networks.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment