Canada’s 10 Fastest Growing Tech Stocks

If you are trying to measure how fast a company is growing it is, without doubt, best to take a long view. Revenues can be lumpy and unpredictable, especially for smaller companies that are just getting a foothold in the market. Cantech Letter’s own Quant Snapshots look at three year annualized growth. But just for fun, wouldn’t it be interesting to see who has grown the most in just one year? Some of the companies below will fail to meet the promise of the exceptional gain they just posted. Others will use it as a stepping stone towards becoming our new market leaders. This list is comprised of companies listed on the TSX and TSXV Technology, Life Sciences and Cleantech Index whose most recently reported annual revenues grew the most, percentage wise, from the prior year. We have excluded all companies who did not post at least $1 million in revenue in that prior year. This leaves one notable exception that deserves mention here: Theratechnologies (TSX:TH) grew from virtually nothing in 2008 ($210,000) to more than $17 million in revenues for fiscal 2009.

1. Cardiome (TSX:COM)

2008 Revenue: $1.55 million

2009 Revenue: $52.99 million

Increase: +3318%

It’s been a long road for Vancouver based Cardiome, but the very recent success of the company is important. Important enough, in fact, that it may be a shot in the arm to the whole BC biotech industry, which desperately needed a company to run the table and bring a major treatment from infancy to commercialization. The huge leap in revenues for Cardiome are milestone payments from Merck, and are associated with Cardiome’s drug ververnakalant, which is designed to treat atrial fibrillation, or an abnormal heart rhythm. In December of last year ververnakalant met an important phase 3 end point, triggering a milestone payment. The exciting thing for Cardiome investors is that the $50 million leap in revenues is dwarfed by the potential of all milestone payments from Merck, which could mean more than half a billion in revenue. Next up for Cardiome is the expected market approval of vernakalant IV in Europe. That decision is expected in September, and would trigger a second round of milestone payments.

2. Enablence Technologies (TSXV:ENA)

2008 Revenue: $3.15 million

2009 Revenue: $45.24 million

Increase: 1336%

Download a Blue-Ray movie in thirty seconds? That day is coming, maybe faster than you think. Just before Christmas of last year Ottawa’s Enablence made a deal with Intel to build photo diodes for a new project called LightPeak. Light Peak is Intel’s code-name for a new high-speed optical cable technology designed to connect electronic devices to each other in a peripheral bus. It’s intended as a single universal replacement for current buses such as USB, FireWire, and HDMI. And it’s fast. LightPeak has the capability to deliver high bandwidth, starting at 10 Gigabytes per second with the potential ability to scale to 100 Gigabytes per second.

3. Route 1 (TSXV:ROI)

2008 Revenue: $1.17 million

2009 Revenue: $5.21 million

Increase: $345.3%

It may seem odd, but last year’s swine-flu scare was a catalyst that helped Toronto’s Route 1 sell more software. Route 1, whose TruOFFICE™ service allows remote users to securely access their digital resources from anywhere, furthered its relationship with the Netherlands Ministry of Foreign Affairs, who were concerned about the burgeoning pandemics effect on productivity and wanted to allow their employees to work from home. Route 1 narrowly missed profitability last year, but expects to hit the mark later in 2010, when they expect to hit 22,500 active TruOffice subscribers.

4. Innergex Renewable (TSX:INE) Increase:+336.8%

2008: Revenue: $5.87 million

2009 Revenue: $25.64 million

Over the past few years lot of Cleantech deals that sailed high on promise have crashed on the cold shores of reality. Innergex looks like one of those that will emerge from the rubble. Based in Longueuil, QC, The Company develops, owns and operates run-of-river hydroelectric facilities and wind projects. Innergex now operates seventeen facilities that generate 325 megawatts of power. The Company’s balance sheet benefited greatly from three important projects that came online within fiscal 2009. These three projects are part of seven Innergex hopes to bring online before 2012. The Company expects these additional projects to bring their total power generation to 529 megawatts.

5. GLG Lifetech (TSX:GLG)

2008 Revenue: $9.89 million

2009 Revenue: $41.88 million

Increase: 323.5%

Making things sweet is big business. The global market for sweeteners is estimated to be approximately $58 billion. Sugar still dominates with more than 90% of the market, but other sweeteners are starting to chip away at that share. Vancouver’s GLG Lifetech produces no calorie sweeteners derived from the South American herb Stevia. According to market research firm Mintel, stevia recently surpassed saccharin and aspartame in terms of dollar sales. The European Food Safety Alliance last year joined the US in ruling that Stevia is safe for food and GLG may be perfectly positioned to benefit: The Company’s press releases roll reads like the United Nations; GLG has signed recent deals in South America, Australia, China and India.

6. Cantronic Systems (TSXV:CTS)

2009 Revenue: $3.74 million

2010 Revenue: $15.71 million

Increase: 320%

Infrared Thermal Imaging. Night vision. Thermal tactical binoculars. Cantronic’s product list reads like the tools at the disposal of James Bond, but the Coquitlam, BC based company isn’t trying to stop Goldfinger from robbing Fort Knox. Instead, Cantronic’s technology solutions are being used, increasingly, to solve real world problems. The Company’s FeverScan M3000D dual-vision thermal imaging camera

system, for instance, have been installed in various airports and key

locations in Greece and Iraq for swine flu screening. Next up for Cantronic is to continue an aggressive move into China, a market Cantronic President and CEO James Zahn says is fragmented and will be the Company’s most important for growth.

7. DragonWave (TSX:DWI)

2009 Revenue: $42 million

2010 Revenue: $165.85 million

Increase: 294.9%

You downloaded an app on your iPhone 3G today. Or pinged a friend using your Blackberry Bold. Or PVR’d a movie. Our appetite for wireless data has become unquenchable. And Ottawa’s DragonWave is at the gate, taking a toll. Dragonwave’s products provide wireless microwave transmission of broadband voice, video and data, which has become cheaper and easier than fiber. The Company’s primary clients are service providers. Well, more to the the point, Clearwire. DragonWave suffered its first real setback in more than a year when its recent fourth quarter results showed that 87 percent of the company’s revenue in the quarter came from Clearwire. Still, the resulting analysts cuts were not that deep for a stock that had risen so sharply. Many believe that as large carriers like AT&T and Verizon roll out into suburban and rural areas, where microwave equipment has natural advantages over fiber, DragonWave will have little trouble achieving a more healthy diversity to its client base.

8. Nuvo Research (TSX:NRI)

2008 Revenue: $10.52 million

2009 Revenue: $38.35 million

Increase: +264.5%

Like Cardiome, Mississauga’s Nuvo Research, which has developed an osteoarthritis pain-killing cream that is absorbed through the skin, saw its revenues leap on a milestone payment. Upon receiving FDA approval, Nuvo received $15-million payment from its marketing partner, Covidien. Ultimately The Company received $27.3-million in a single quarter when licensing payments were added to the mix. Nuvo management has taken the approval to market of Pennsaid, the commercial name of the treatment, as a opportunity to diversify; last December they shuffled management around to put more resources behind the development of its autoimmune drug platform.

9. Bennett Environmental (TSX:BEV)

2008 Revenue: $8.29 million

2009 Revenue: $28.06 million

Increase: 238.5%

Oakville’s Bennett Environmental is a bit of a turn-around story. In early 2004, shares of Bennett, which uses thermal oxidation technology to remediate contaminated soil and contaminated construction debris, were going for more than $27. Mired in a 2004 class action lawsuit launched on behalf of company investors over alleged misrepresentation of the company’s financial health, the stock fell to pennies in late 2008. The stock languished until late 2009, when it was clear that The Company’s fiscal health was rapidly improving; revenues grew from under $11 million in 2006 to over $28 million in 2009.

10. H20 Innovation (TSXV:HEO)

2008 Revenue: $10,813,536

2009 Revenue: $31,215,790

Increase: +189%

Until 2008, H20 Innovation was a company enjoying steady but unspectacular growth in its water treatment business. Clearly, that wasn’t enough for The Company’s management team, led by Frederic Dugre. Early in 2009, H20 took initiatives to not only grow, but to diversify the company from merely being a manufacturer of water treatment systems and equipment into one that covered the complete life cycle of membrane filtration and biological waste water treatment systems. The acquisition of Professional Water Technologies, a California based company that builds membrane pre-treatment and maintenance solutions for industrial, municipal and commercial applications was perhaps the biggest move. But acquisitions were part of the story of H20’s growth; a surprising 61% of H20’s growth in Q4 2009 was organic.

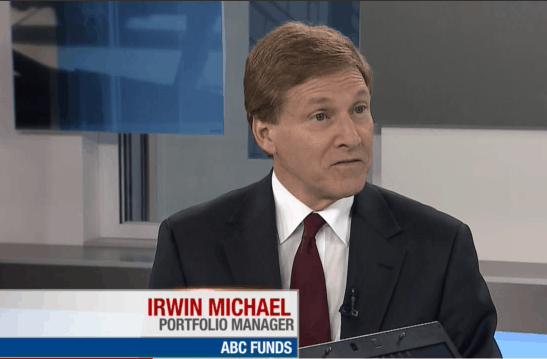

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.