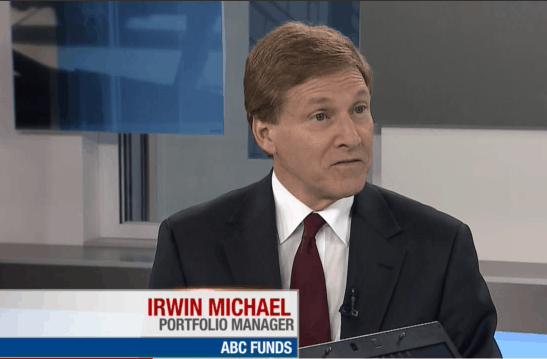

Fund manager Irwin Michael, whose ABC Funds owns seven-million shares of Oakville’s Bennett Environmental, says his confidence in the company has not wavered. He points out that Bennett has no debt and is sitting on $1.60 in cash, and has no debt. Irwin Michael, Portfolio Manager at ABC Funds appeared on BNN’s Market Call June 22nd to talk value stocks with host Michael Hainsworth.

Michael, who describes himself as a deep value investor, says equities are getting cheaper because of “irrational and emotional activities” in the marketplace.

The fund manager points out that individual stocks, however, are doing quite well, with better earnings and increased dividends. He calls what is happening in Europe a “crisis of confidence” more than anything else. Irwin says he believes that when the market does turns, value plays will lead the way out.

On pick he likes is Bennett Environmental (TSX:BEV), which is down 27% from when he made the stock a top pick in July of last year on BNN.

_____________________________

This story is brought to you by Cantech Letter sponsor BIOX (TSX:BX). The largest producer of biodiesel in Canada, BIOX’s proprietary production process has the capability to use a variety of feedstock, including recycled vegetable oils, agricultural seed oils, yellow greases and tallow. For more information CLICK HERE.

______________________________

Michael says his belief in the value of Bennett has not wavered. He points out that the company has no debt and is sitting on $1.60 in cash. When host Hainsworth offered that the street has, by and large, abandoned the company, Michael said he regarded that as a good sign, because it has become a contrarian investment.

Oakville-based Bennett Environmental is a turnaround story with baggage. In early 2004, shares of the company, which uses thermal oxidation technology to remediate contaminated soil and contaminated construction debris, were going for more than $27. Mired in a 2004 class action lawsuit launched on behalf of investors over alleged misrepresentation of the company’s financial health, the stock fell to pennies in late 2008. Bennett languished until late 2009, when it was clear that its business was rapidly improving; revenues grew from under $11 million in 2006 to over $28 million in 2009.

Bennett’s stock leveled off, but the company was mired in controversy. Late last year Robert Griffiths, the company’s former vice-president of U.S. sales, received fifty months in a US jail for his role in a plot to win $43-million worth of government contracts through bribes. 2011 was a transition year for Bennett, as it reported no revenue because its core Saint Ambroise facility remained closed in order to accumulate soil inventory.

As of March 31st, ABC Funds owned seven-million shares of Bennett, two million in its ABC North American Deep-Value Fund, two million in its ABC Dirt Cheap Stock Fund, 1.75-million share in its ABC fully managed fund, and 1.25-million in its ABC American Value fund

Shares of Bennett Environmental closed Friday up 1.9% to $1.65.

___________________________________

__________________________________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment