Following the company’s third quarter results, RBC analyst James McGarragle remains bullish on CAE (CAE Stock Quote, Chart, News, Analysts, Financials TSX:CAE).

On February 14, CAE reported its Q3, 2024 results. The company posted Operating Income of $121.6-million on revenue of $1.09-billion, a topline that was up 13 per cent over the same period a year prior.

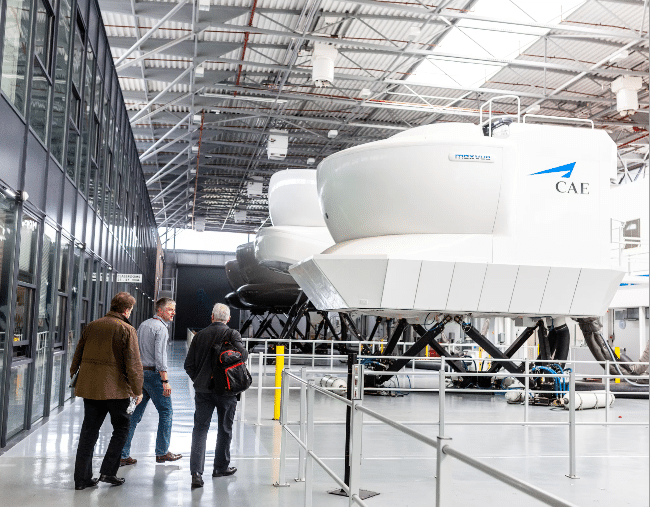

“Our performance in the third quarter reflects strong underlying demand for our civil market solutions, and points to the ongoing progress to transform our defence business. We also generated strong free cash flow, enabling us to bolster our financial position in line with our leverage targets,” CEO Marc Parent said. “Further securing CAE’s future, we booked nearly $1.3-billion in total order intake during the quarter, for an $11.7-billion backlog. In civil, orders were $845-million, for a 1.36 times book-to-sales ratio, including 20 full-flight simulator orders, new training partnerships with marquee airlines such as Air France KLM Group and over $300-million of business jet training orders. We have considerable headroom for growth in the civil aviation market, and our continued positive momentum underscores the strong demand for CAE’s highly differentiated training and flight services solutions, and our ability to win share within this large secular growth market. In defence, performance was consistent with our expectations at this point on the path toward being able to generate higher margins. We continued to replenish our backlog with more profitable work and sought to further accelerate the retirement of outstanding program risks, mainly associated with certain legacy defence contracts that we entered into pre-COVID and have been most-impacted by economic headwinds.”

As reported by the Globe and Mail, the CAE results were met with a selloff the analyst feels was unwarranted.

“Focus from [Wednesday’s] results (and driver of the share price weakness in our view) was commentary on the Defense outlook, which represented downside versus prior street expectations,” McGarragle wrote. “While this should not be ignored, we remind investors Defense only represents 15 per cent of CAE’s business. Commentary on Civil (the other 85 per cent) suggests a robust demand and solid margin outlook. We value the Civil segment at $28 (12 times EV/ EBITDA multiple), which implies a negative $2.50 is being assigned to Defense, which we see as unwarranted.”

While he says the company’s Defense segment is basically being assigned no value and therefore only can deliver upside, the analyst said its Civil segment is poised to deliver.

““We believe CAE’s Civil segment is well positioned to benefit from long-term secular tailwinds,” he said. “Our view is that the Civil segment will grow at a pace that meaningfully exceeds the overall economy at an organic growth rate that we peg at a mid- to high-single-digit range out to 2030. Key drivers of this growth are: i) a near to medium-term recovery in passenger travel; ii) favourable pilot demographics; and iii) specific to the Defense segment, increased spending by NATO members driven by Russia’s invasion of Ukraine. CAE is an industry leader in the Civil Aviation Training market and we note that CAE operates the world’s largest civil aviation training network, which we believe acts as a significant barrier to entry as well as a key differentiator. Our view is that this favourably positions CAE to capitalize on meaningful Civil tailwinds going forward.

McGarragle today maintained his “Outperform” rating and target of $34.00 on CAE

Share

Share Tweet

Tweet Share

Share

Comment