Top and bottom lines are growing nicely for flight simulation and training tech company CAE Inc (CAE Inc Stock Quote, Charts, News, Analysts, Financials TSX:CAE), which seems to be a no-brainer of a stock pick due to tailwinds aplenty that should keep this name flying high. That’s the take from Michael Sprung of Sprung Investment Management, who recently nominated CAE as one of his Top Picks for the 12 months ahead.

“Right now, there’s a shortage of pilots and there’s a real need to renew aircraft, and if anybody is going to be training these pilots it’s likely to be CAE participating in it,” said Sprung, speaking on BNN Bloomberg on Wednesday.

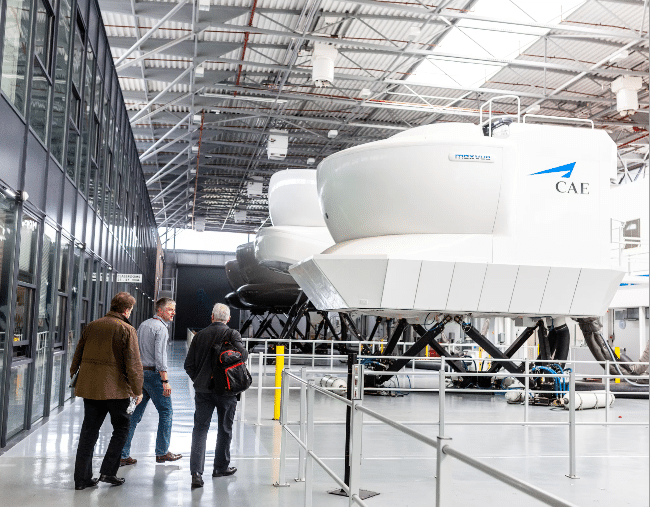

Montreal-based CAE makes flight simulators and has training solutions for both civil aviation and defense, along with training solutions for the healthcare industry. Last month, CAE reported a strong quarter where profits tripled on a year-over-year basis to $78.1 million and revenue grew by 20 per cent to $1.020 billion.

“They’re well positioned on the defense side of the equation, and with the world pressures that are going on now I would expect to see more spending going into defense and pilot training and so on, so I think they’re in a very interesting position,” Sprung said.

Management’s commentary with the recent quarter said while lingering travel restrictions worldwide due to COVID, along with geopolitical concerns and high inflation all continue to be headwinds, the overall secular themes for its civil, defense and healthcare segments look good.

“We continue to expect mid-twenty percent consolidated adjusted segment operating income growth this fiscal year and reiterate our long-term target of a three-year EPS compound growth rate in the mid-twenty percent range,” said President and CEO Marc Parent in a press release.

At the same time, CAE’s share price continues to whipsaw around, with wavering investor confidence in the airline industry being a central factor. CAE immediately plunged at the start of the pandemic from $40 per share to under $20 but it made up most of that ground over the next 12 months, returning to the $38 range for much of 2021. The next year and a bit saw CAE jump around, with the current share price hovering just under $30.

Sprung sees upside ahead, though.

“Their stock has come off recently. It’s under $30. It’s not one that you buy particularly because it’s selling at a low multiple because it’s not at the current time, but I suspect over the next few years we’re going to see some earnings coming in to CAE that are going to cause it to be revalued up,” he said.

“The one thing that’s held them back a little bit is they did have some contracts that were fixed price on some of that training, but as those roll off they get renewed at higher levels. So, I think we’re going to see some positive things from CAE,” Sprung said.

Share

Share Tweet

Tweet Share

Share

Comment