A big contract win for a peer is a good sign for Kraken Robotics (Kraken Robotics Stock Quote, Chart, News, Analysts, Financials TSXV:PNG), says Beacon Securities analyst Gabriel Leung.

On October 12, Huntington Ingalls announced a $347-million contract to provide up to 200 unmanned undersea vehicles to the U.S. Navy’s Lionfish System program.

The analyst explained why the development is a positive for shareholders of PNG.

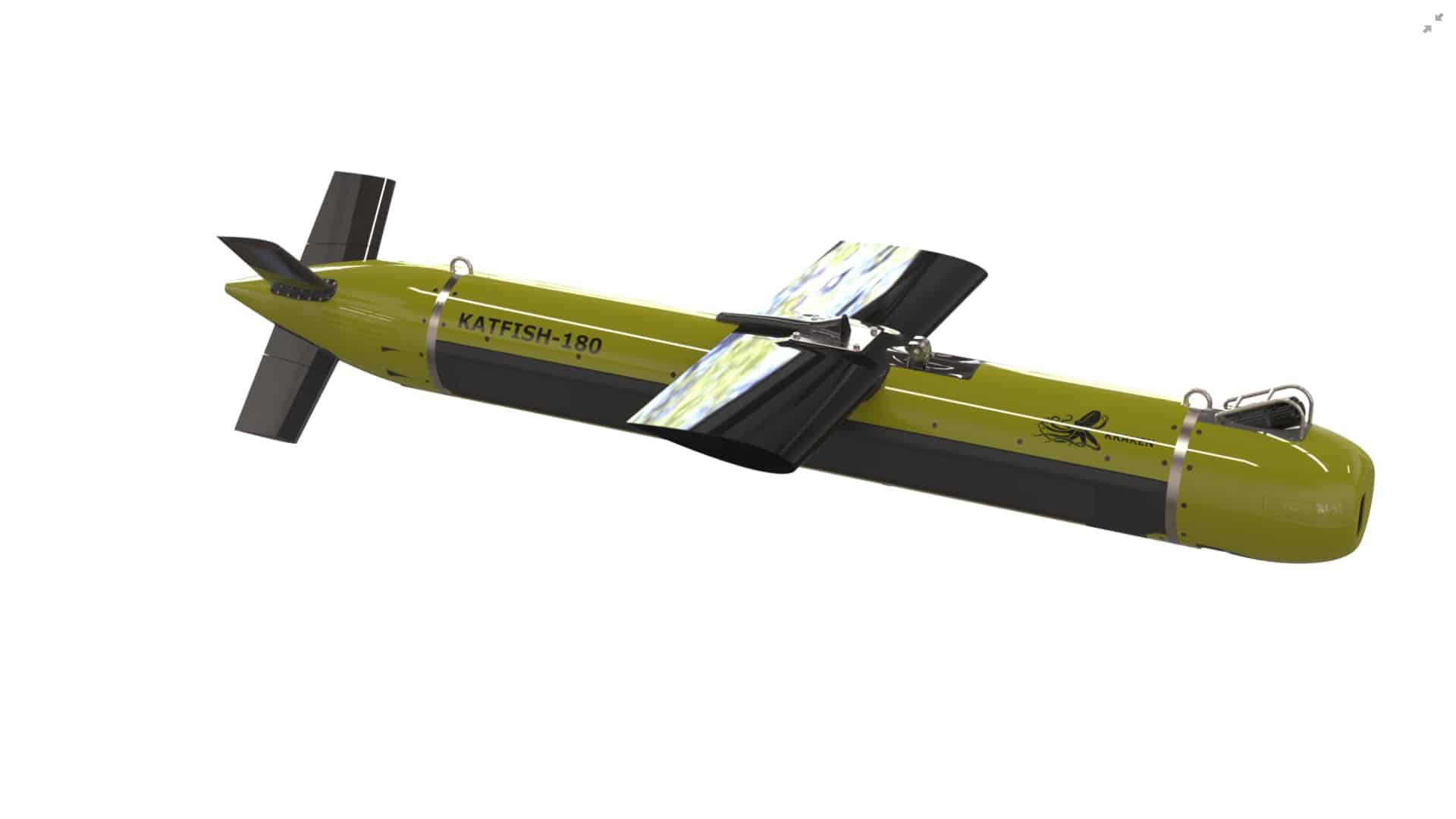

“We view this announcement as being relevant for Kraken given that we believe the REMUS 300 leverages Kraken’s MINSAS (Miniature Interferometric Synthetic Aperture Sonar) sensor systems,” Leung saud. “We would refer investors to Kraken’s recent October 3rd press release around its recent participation at Exercise REPMUS 23 in Portugal and its integration in various UUVs including the REMUS 300. We believe Kraken is already winning deals with HII on upgrade sales on existing vehicles. However, the aforementioned US Navy contract potentially represents a 200-vehicle opportunity over the next five years (in addition to the initial nine vehicle order). We estimate that Kraken’s MINSAS is priced at ~US$250k per unit, which would suggest the initial nine vehicle order could be worth ~US$2.25M to Kraken. Meanwhile, the 200-vehicle opportunity represents another ~US$50M in orders to Kraken over the next five years.”

In a research update to clients October 13, Leung maintained his “Buy” rating and one-year price target of $1.20 on PNG, implying a return of 135 per cent at the time of publication.

Leung thinks Kraken will post Adjusted EBITDA of $17.0-million on revenue of $72.2-million in fiscal 2023.

Share

Share Tweet

Tweet Share

Share

Comment