Fans of Kraken Robotics (Kraken Robotics Stock Quote, Charts, News, Analysts, Financials TSXV:PNG) can look forward to a great year from the marine tech company, according to Beacon Securities analyst Gabriel Leung, who delivered an update on Thursday. Leung reiterated a “Buy” rating on the stock and said to look out for management’s 2023 guidance upcoming in the fourth quarter earnings report.

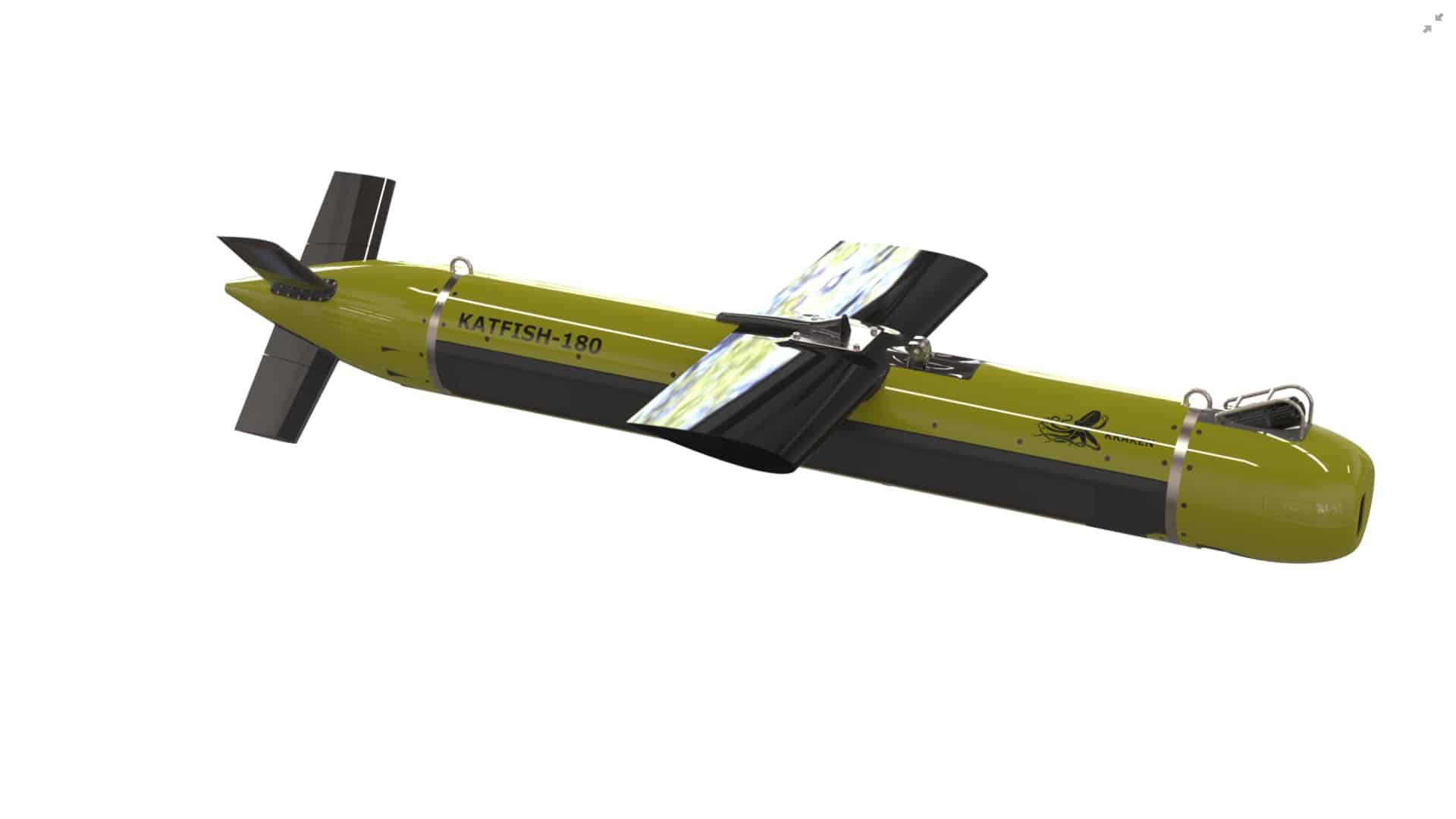

Newfoundland-based Kraken, which offers ultra-high resolution sensors and underwater robotic systems, announced on Thursday preliminary full-2022 revenue of about $40 million, which would represent a 56 per cent year-over-year growth rate, and offered an EBITDA guidance range of $5-$7 million.

In his comments, Kraken President and CEO Greg Reid said he expects strong growth in 2023.

“In the defence market, the macro environment is robust as countries adapt to the new geopolitical norm to monitor and protect seabed assets and we are winning new customers and selling more products and services to existing customers. In the commercial market, we expect continued growth driven by offering services to companies focused on offshore wind and offshore energy,” Reid wrote in a press release.

On the preliminary 2022 numbers, Leung said they were in line with his modelling, which was at $40.6 million in revenue and $5 million in EBITDA. He noted that Kraken ended the year with cash of $8.2 million, up from $5.7 million at the end of the previous quarter, and accounts receivable/contract assets of $13 million. Kraken also has 10 million warrants outstanding, which are exercisable at $0.60 per share and an expiration date of July 26, 2023.

“When combined with our expectation of strong EBITDA growth in CY23 (we are modelling 88 per cent year-over-year EBITDA growth), we believe Kraken remains in a strong financial position to execute on its strong backlog and pipeline of opportunities,” Leung wrote.

Along with his “Buy” rating, Leung maintained a target price of $1.05 per share, which at press time represented a projected one-year return of 78 per cent.

On valuation, Leung has PNG going from an EV/Adjusted EBITDA multiple for 2021 of 55.9x to 25.4x for 2022 and to 13.4x for 2023. EV/Net Revenue moves from 4.9x in 2021 to 3.1x in 2022 and to 2.0x in 2023.

For his forecast, Leung thinks Kraken will go from $40.6 million in revenue for 2022 to $63.0 million for 2023, while adjusted EBITDA is projected to rise from $5.0 million in 2022 to $9.4 million in 2023.

Share

Share Tweet

Tweet Share

Share

Comment