A big contract win has Beacon Securities analyst Gabriel Leung tipping his hat to Kraken Robotics (Kraken Robotics Stock Quote, Charts, News, Analysts, Financials TSXV:PNG). Leung delivered a corporate update on Wednesday where he maintained a “Buy” rating on Kraken while raising his target price from $0.90 to $1.05 per share, saying that in piling up significant wins Kraken is solidifying its place in the marine tech space.

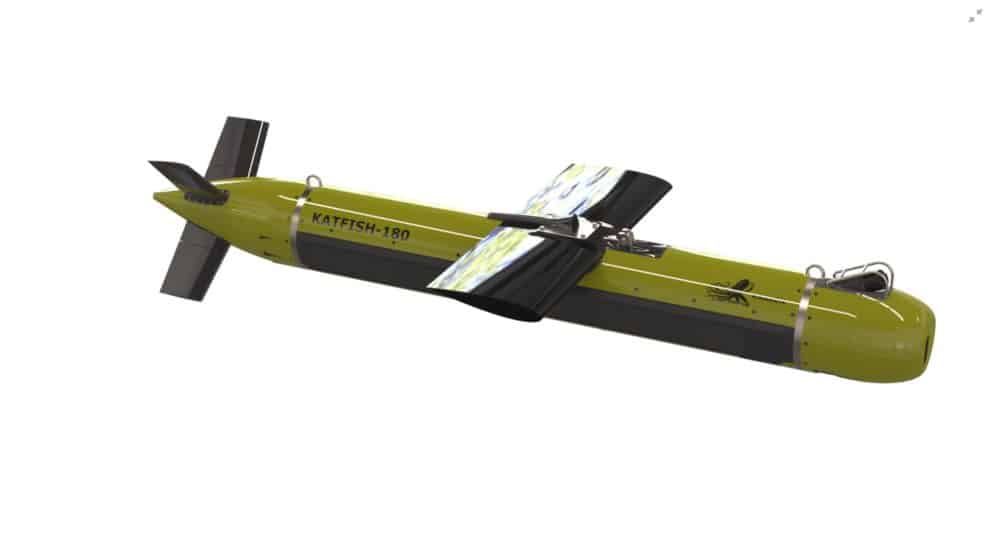

St John, Newfoundland-based Kraken Robotics, which has ultra-high resolution, software-centric sensors and underwater robotic systems, saw its share price rise more than nine per cent on Wednesday after the company announced a contract with His Majesty’s Royal Canadian Navy to provide Remote Mine-hunting and Disposal Systems for the Department of National Defence (DND).

Kraken said the contract features an estimated 24-month acquisition program followed by an initial five-year Integrated Logistics Support (ILS) program. If all options are selected, the total value will be over $50 million, including about $40 million for the acquisition and about $10 million for the ILS program.

“For Kraken, this program is building upon the success we have had supplying underwater sensors, platforms, and services to a number of NATO navies including the US, UK, Australia, Denmark, Poland, and others,” said Karl Kenny, President and CEO, in a press release.

“Kraken has deployed our SAS solutions on the family of HII AUVs across several countries, so we are looking forward to bringing that field-proven capability to the Royal Canadian Navy,” he said.

With the announcement, Leung has added the contract to his forecasts, assuming a ~$10/~$30 million revenue split in 2023 and 2024. The result is a full 2023 revenue estimate of $63.0 million compared to a projected $40.6 million in 2022. On Adjusted EBITDA, the analyst is expecting $5.0 million in 2022 and moving to $9.4 million in 2023.

On valuation, Leung has Kraken’s EV/Net Revenue going from 5.0x in 2021 to 3.2x in 2022 and to 2.0x in 2023. The result is Leung’s target raise to $1.05 per share, which is based on 3.5x 2023’s EV/Sales. At press time, Leung’s new target represented a projected one-year return of 75 per cent.

Leung called the contract another bullish win for Kraken and referenced the company’s sensor and systems sales to Denmark, Poland, the US, the UK and Australia as well as recent transactions including a $14 million subsea battery order which could see follow-on orders.

“We believe these notable wins highlight the depth of Kraken’s product platform and increasingly prominent position within the marine technology sector (which could ultimately lead to its take- out by a larger commercial or defence contractor),” Leung wrote.

Share

Share Tweet

Tweet Share

Share

Comment