A management shuffle at Sernova Corp (Sernova Corp Stock Quote, Chart, News, Analysts, Financials TSX:SVA) isn’t dampening analyst Andre Uddin’s enthusiasm for the stock.

On September 5, Sernova announced the appointment of Cynthia Pussinen as CEO. The company also announced that Dr. Philip Toleikis will serve as Chief Technology Officer.

“Sernova has demonstrated tremendous growth over the past several years as it has transitioned from a research company to one that is moving towards commercialization of a product for the treatment of multiple chronic diseases including our flagship program for Type 1 Diabetes (T1D). As a united Board, we feel now is the time to bring in an industry leader with extensive experience with large pharmaceutical companies as well as entrepreneurial biotech and advanced therapeutics focused companies,” said board chairman Brett Whalen. “The skills that Ms. Pussinen brings to our company include over 25 years of global experience shepherding new therapies from development through commercialization across multiple conditions with sales measured in the billions.”

Uddin says this moves strengthens the company’s offensive line.

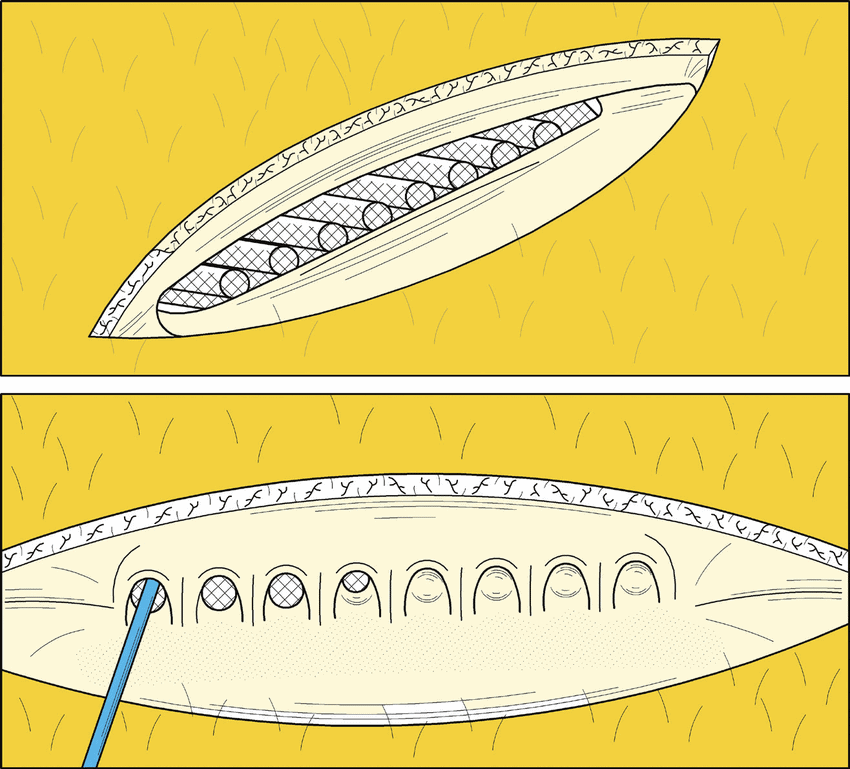

“Today, Sernova announced that its Board of Directors has appointed Cynthia Pussinen as Chief Executive Officer and she also has joined the board,” the analyst noted. “Dr. Philip Toleikis, who has led the company since 2009 as President and CEO will now serve as Chief Technology Officer and he will remain on the board. Ms. Pussinen’s previous position, was the Chief Technical Officer for Spark Therapeutics, Inc., a gene therapy company which is now a member of the Roche Group. Prior to joining Spark in 2021, Ms. Pussinen’s leadership roles include 6 years with Ipsen Biomeasure and Ipsen Biosciences, U.S. R&D focused subsidiaries of Ipsen, where she served as President and CEO. We spoke to Ms. Pussinen today and asked her what her key priorities would be for SVA, it included: (i) getting SVA’s promising treatments to market to better serve patients (ii) looking for additional partnerships (iii) building a US presence (iv) listing on NASDAQ in 2024 (v) continuing to improve SVA’s cell pouch technology and (vi) look at treating other potential diseases.”

In a research update to clients September 5, Uddin maintained his “Speculative Buy” rating and one-year price target of $3.50 on Sernova, implying a return of 311.8 per cent at the time of publication.

Share

Share Tweet

Tweet Share

Share

Comment