Critical Elements Lithium (Critical Elements Lithium Stock Quote, Chart, News, Analysts, Financials TSX:CRE) is a Canadian lithium explorer.

The stock, which has a one-year high of $3.035 and a low of $1.32 has been on something of a tear of late, moving from a low of $1.35 to a close of $1.87 on September 15.

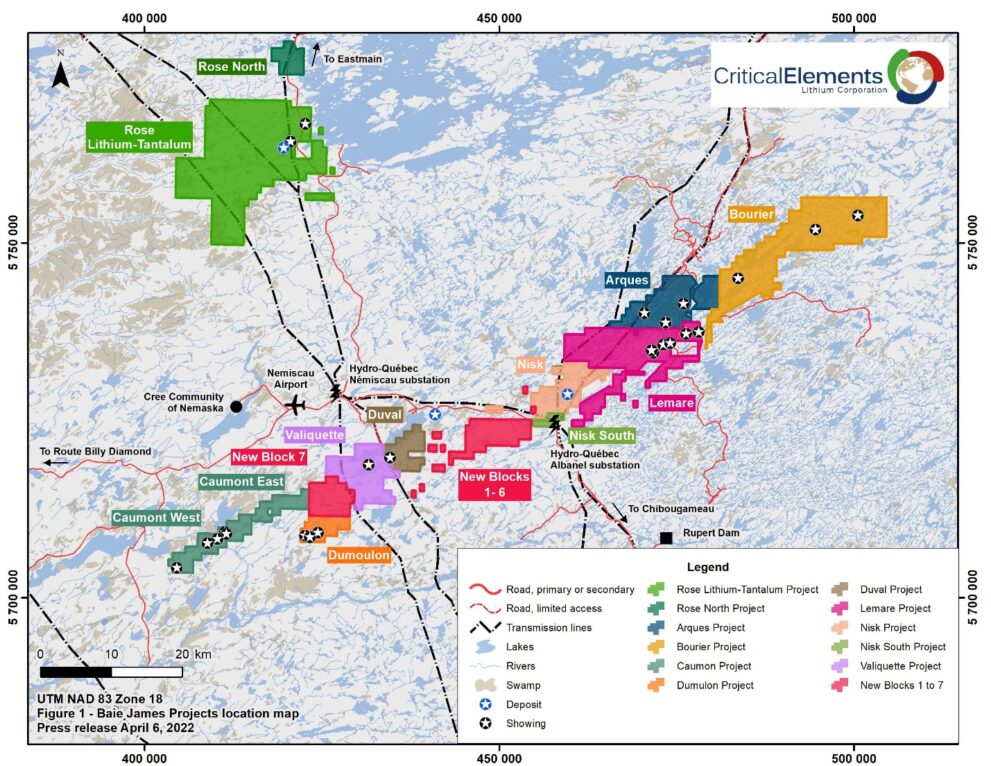

The company, which owns the Rose lithium project in Quebec, says it aims to become a major supplier of lithium for the electric vehicle market.

In August, the company announced the results of a feasibility study on the Rose project, which found that the Net Present value of the project was (US) $2.2-billion.

“We are very pleased to announce the results of the new definitive feasibility study at Rose to provide the updated economics of the project,” CEO Jean-Sebastien Lavallee said. “The study reaffirms the substantial value of Rose — amongst the backdrop of higher input costs and the decision to build our own 500-worker camp — to establish Critical Elements as a reliable, high-quality supplier of lithium. Thank you to our engineers, management team and local stakeholders for their diligent efforts and our shareholders for their continuous support.”

Is CRE Stock a buy right now?

On September 6, 2023, in a research update to clients, Industrial Alliance Securities analyst Sehaj Anand reiterated his “Speculative Buy” rating and one-year price target of $4.20 on CRE stock, implying a return of 177.4 per cent at the time of publication.

The analyst, commenting on positive results from a prospecting program that began in June of 2023 on its Nemaska belt property portfolio, said CRE enjoys a special place not only in Canada’s lithium future, but the world’s.

“Our thesis remains intact as Rose remains one of the very few permitted, construction-ready lithium projects in the world, strategically located within the James Bay region, which has recently become a hot spot for lithium with several major lithium players operating in the region,” he wrote. “As the Company remains focused on advancing its flagship Rose project, we believe that the market is also focused on the upcoming strategic partner and project financing package announcement, a significant catalyst for the stock. On an EV/t LCE basis, CRE trades at US$344/t M&I LCE, a discount compared to peers at US$382/t LCE>”

The analyst thinks there is money to be made in the short term and in the long term on CRE.

“As the Company advances the Rose project towards construction and subsequently production, we expect the stock to rerate to close the valuation gap,” he argued. “In Exhibit 4, we have also included several lithium producers to show the stock’s long-term re-rate potential as the Rose project undergoes construction and eventually production. Potential upcoming catalysts include: 1) Strategic partnership and project financing package expected in the near term; 2) Construction commencement expected in H1/C24; and 3) Assay results from the exploration program and Lemare maiden mineral resource.”

Share

Share Tweet

Tweet Share

Share

Comment