With lithium prices continuing to break records, the risk-reward thesis on Critical Elements Lithium (Critical Elements Lithium Stock Quote, Charts, News, Analysts, Financials TSXV:CRE) never looked better. That’s according to Beacon Securities analyst Ahmad Shaath, who delivered a recent update to clients where he reiterated a “Buy” rating on the stock.

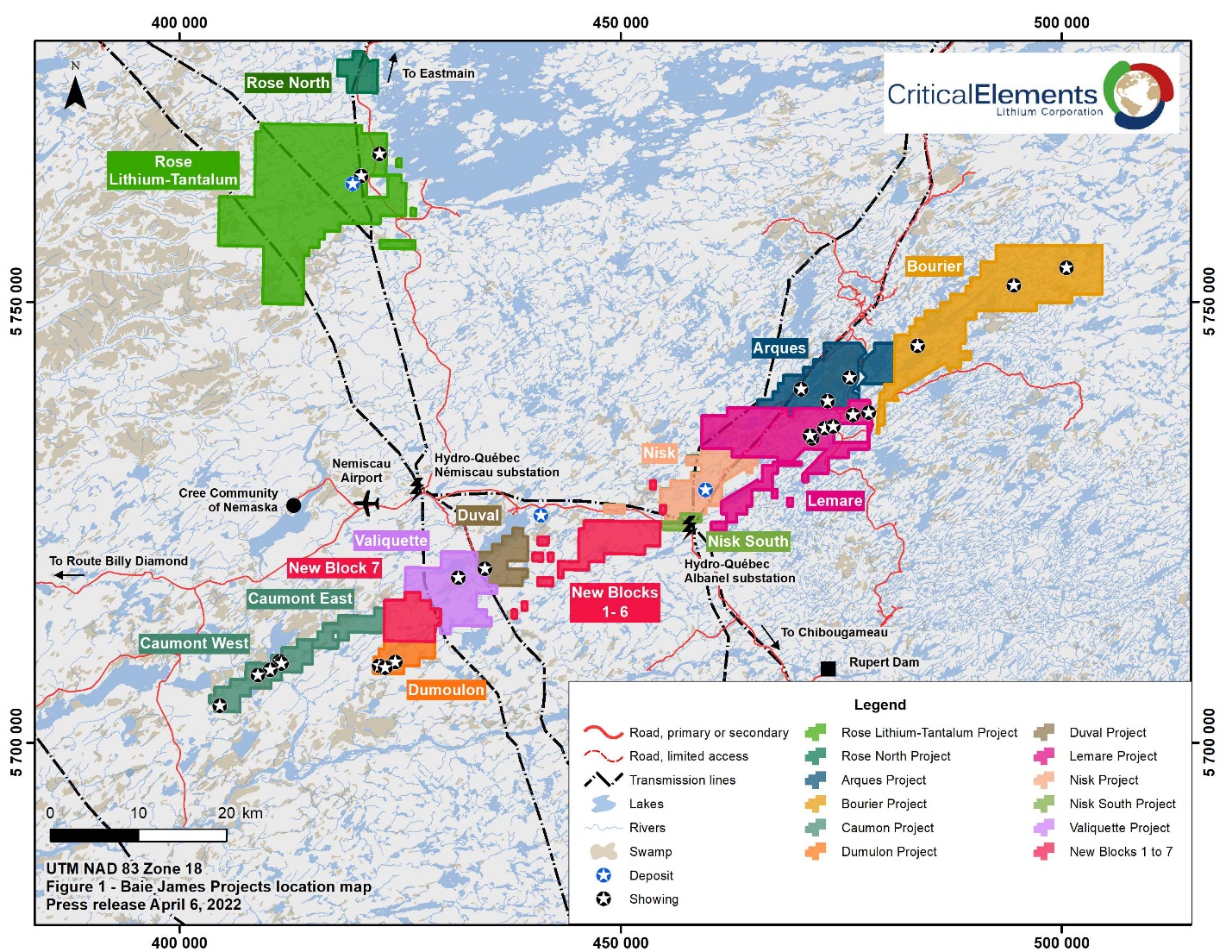

Shaath said there are sector tailwinds behind lithium production and that government push for production is currently at unprecedented levels, all good news for Montreal-based Critical Elements Lithium, which has a land portfolio of 700 sq km and a wholly-owned, feasibility-stage project called Rose Lithium-Tantalum to help supply high purity lithium for the electric vehicle (EV) and energy storage markets.

In his October 20 update, Shaath pointed to two recent key events for investors to take in, first, in the Biden Administration’s award of US$2.8 billion in grants to boost US production of EV batteries and the minerals used to build them. He noted that a significant share of the grant was given to mining companies, including juniors in the sector, with Albemarle (lithium miner) receiving US$150 million, Piedmont (lithium) receiving US$142 million, Talon Metals (nickel) receiving US$115 million and Syrah (graphite) receiving US$220 million.

Shaath also pointed to the Canadian federal government’s investment of $222 million in Rio Tinto to support the company’s decarbonization efforts in its Quebec-based facilities, with the investment targeted at the processing of critical minerals and aimed at helping Rio to develop new processing technologies for EV-related materials, including new technologies to process lithium.

Lithium prices are at their highest ever with prices in China recently hitting US$74,475 per tonne, essentially double what they were at the start of 2022. Lithium hydroxide prices are up almost 150 per cent at about US$74,000.

Earlier this year, Critical Elements conducted a successful pilot plant testing at Rose for the conversion of spodumene concentrate (lithium ore) into battery-grade lithium hydroxide using a thermal leaching process, after which the company conducted a feasibility study with positive results in June. That study showed an average production of 173,317 tonnes of chemical grade 5.5 per cent spodumene concentrate, 51,369 tonnes of technical grade 6.0 per cent spodumene concentrate and 441 tonnes of tantalum concentrate, with an expected life of the mine of 17 years, an average gross margin of 68.3 per cent and an after-tax NPV of US$1.915 billion.

On Critical Elements’ potential, Shaath spoke of the fact that its Rose Project is currently under 100 per cent ownership, with no strategic partners to date.

“We view this positively as it leaves uncapped upside to investors. This is part of the company’s stated strategy as management is targeting to have partners that are willing to share the risk with its investors through a meaningful investment (most likely on the equity side),” Shaath said.

Critical Elements has seen its share price rise over the past three months, going from about $1.35 per share to now $1.70, but Shaath sees more upside. With his “Buy” rating, he maintained a $4.50 target price on CRE, which at press time represented a projected one-year return of 168 per cent.

“We also point out to the upside potential to our Net Asset Value Per Share (NAVPS) estimate given the continued strength in lithium prices. Our current NAVPS estimate of $4.47 is based on LOM realized ASP of US$2,784, with our short-term forecast (CY22-CY25) aiming to capture our expectations of continued supply deficit (US$3,000/tonne and US$4,950/tonne for SC5.0 and SC6.0, respectively) still at a significant discount to current prices,” Shaath wrote.

“Our long-term price assumption of ~US$2,500 represent a conservative view given the massive supply deficit in the industry which continues to drag on longer than expected. As an example, factoring LOM realized ASP of just above ~ US$3,200/tonne (+50 per cent versus our model) yields a NAVPS of ~$9.00 and at current spot prices our NAVPS estimate is ~$27.00. Thus, at current price of $1.68 per share, the risk-reward formula never looked more attractive for CRE shares,” he said.

Share

Share Tweet

Tweet Share

Share

Comment