Critical Elements Lithium Corp (Critical Elements Lithium Stock Quote, Charts, News, Analysts, Financials TSXV:CRE) got the nod from iA Capital Markets analyst Sehaj Anand on Wednesday, with Ananda saying the stock deserves a Top Pick rating for the third quarter on the back of its high-purity lithium deposit in Quebec’s James Bay Area and multiple upcoming catalysts for the stock.

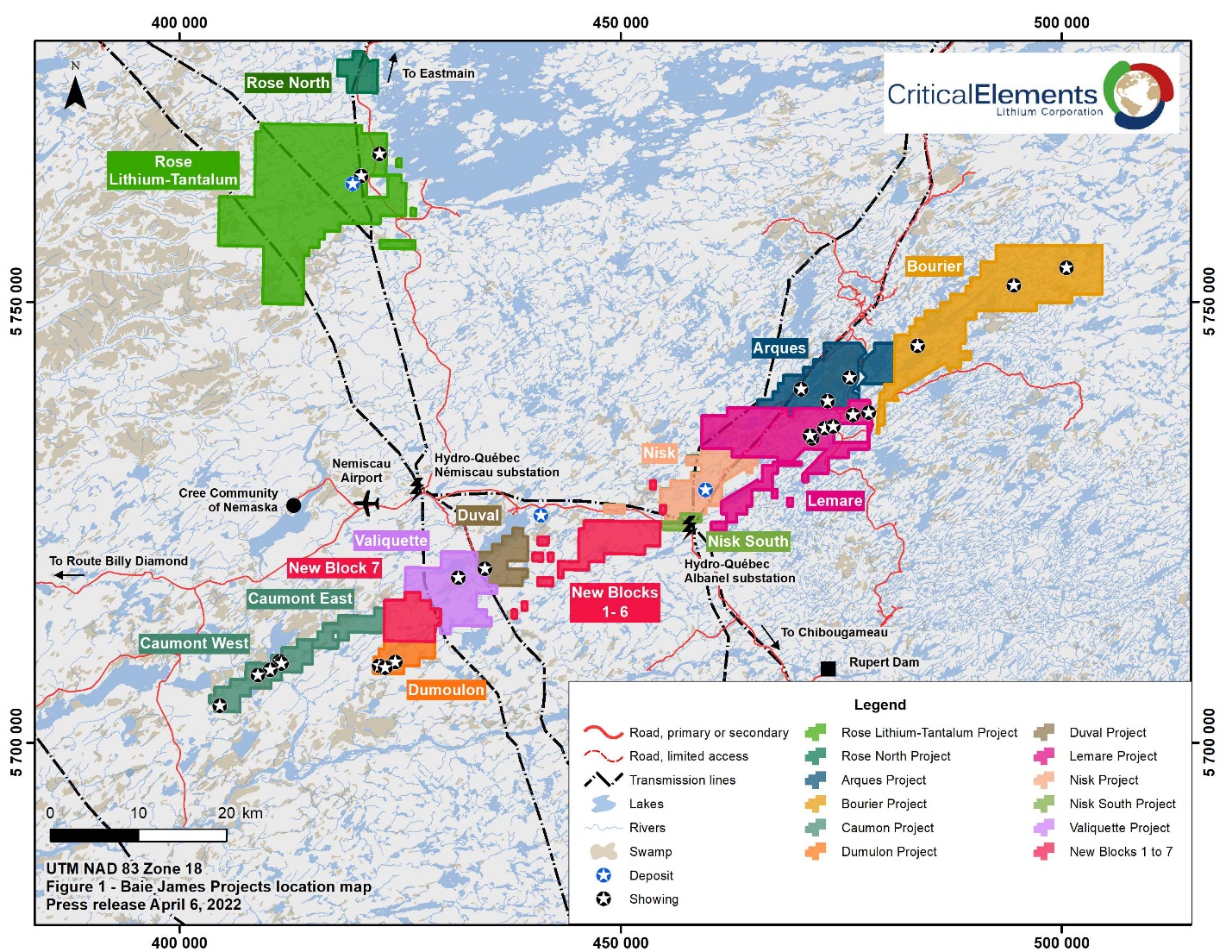

Critical Elements Lithium is a lithium spodumene developer with a flagship project, the Rose Lithium-Tantalum, at James Bay. The stock had an amazing run from sub-$0.50 territory in 2020 to the high-$2.00 range by earlier this year but shares have pulled back from there to now around $1.80. Currently, CRE sports a year-to-date return of negative 14 per cent.

Anand said the relatively poor performance so far in 2023 relates to a number of factors: weak lithium prices in the first quarter, time slippage in a strategic partnership and a project financing package and speculations around a near-term equity financing.

All that has created a “very attractive” entry point for investors into one of the few construction-ready, permitted lithium projects in North America, according to Anand, who said construction is expected to begin at Rose over the second half of the current year.

“Rose is a high purity deposit, i.e., it has low iron oxide and mica content that allows CRE to produce technical-grade SC (used in glass/ceramics), which garners premium pricing (~120 per cent premium: iA est.) compared to battery-grade SC,” Anand wrote.

Anand further commented that CRE could be a takeout target, with a number of major lithium players now operating in the hot James Bay region, including Livent, Allkem and Sayona.

The analyst said investors should be on the lookout for catalysts in strategic partnership and offtake agreements expected in the near term, a project financing package expected in the second half of the year, construction at Rose and assay results from the exploration program and Lemare maiden mineral resource.

Anand said Critical Elements is currently trading at a premium compared to other relatively earlier-stage peers such as Snow Lake Resources and Frontier Lithium but also at a discount compared to advanced and similar-stage peers like RockTech Lithium and Liontown Resources.

“As the Company advances the Rose project towards construction and subsequently production, we expect the stock to re-rate to close the valuation gap. In Exhibit 1, we have also included several lithium producers to show the long-term re-rate potential for the stock as the Rose project undergoes construction and eventually production,” Anand wrote.

With the update, Anand reiterated a “Speculative Buy” rating and $5.00 target on CRE, which at press time represented a projected one-year return of 213 per cent.

Share

Share Tweet

Tweet Share

Share

Comment